Dream Industrial and CPP Investments Launch $3B Industrial Powerhouse

Dream Industrial REIT partners with CPP Investments, selling an $805M portfolio to launch a new joint venture targeting $3B in Canadian industrial assets.

Dream Industrial and CPP Investments Launch $3B Industrial Powerhouse

TORONTO, ON – December 17, 2025 – Dream Industrial REIT (TSX: DIR.UN) has unveiled a major strategic partnership with Canada Pension Plan Investment Board (CPP Investments), creating a new joint venture poised to invest up to $3 billion in the Canadian industrial real estate market. The deal, which significantly scales DIR’s private capital business, is anchored by the sale of a 12-asset portfolio from DIR to the new entity for $805 million.

This transaction serves as a powerful validation of Canada's industrial property sector, signaling robust confidence from one of the world's largest institutional investors.

A Strategic Infusion of Capital and Confidence

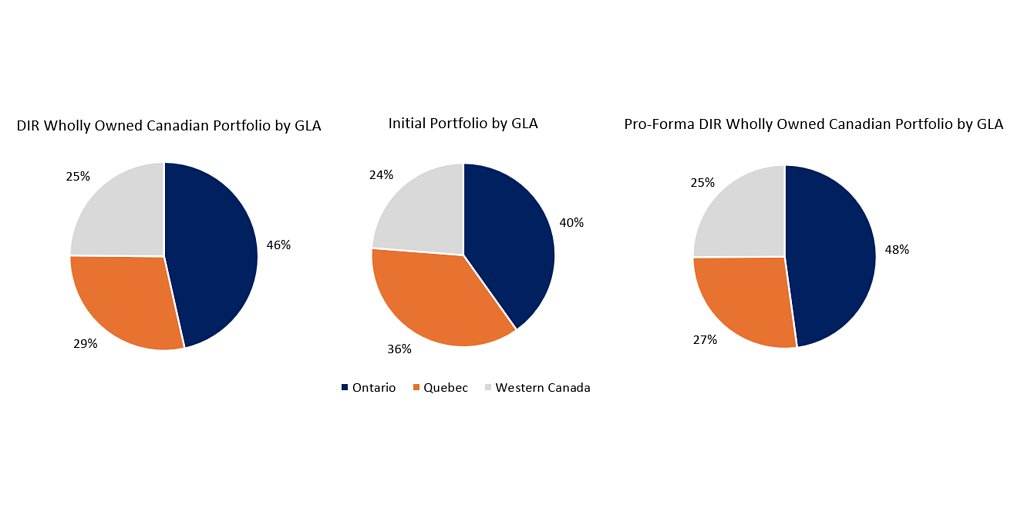

The newly formed joint venture will be owned 90% by CPP Investments and 10% by Dream Industrial REIT. As its first act, the venture is acquiring an initial portfolio of 12 industrial properties from DIR, totaling 3.6 million square feet across key markets in Ontario, Quebec, and Alberta. The $805 million purchase price is slightly above the portfolio's current IFRS value, a detail that underscores the strength of the private transaction market for high-quality industrial assets.

“This transaction is a testament to the quality of our assets, the strength of our platform, and the opportunities in the Canadian industrial market,” said Alexander Sannikov, Chief Executive Officer of Dream Industrial REIT. “With this transaction and joint venture with CPP Investments, we are reinforcing the intrinsic value of our assets, growing our private capital partnerships business, and unlocking an additional avenue for portfolio growth.”

The initial portfolio is a cross-section of DIR’s Canadian holdings, with 37% of its gross leasable area in the Greater Toronto Area, 36% in Montreal, and 24% in Calgary. The partnership is not stopping there; both parties have allocated a combined $1.1 billion in equity capital, with the goal of acquiring up to $3 billion in additional Canadian industrial assets over time.

Operationally, a subsidiary of Dream Unlimited Corp. will act as the asset manager for the joint venture, while a subsidiary of DIR will handle property management, capital expenditures, and leasing services at market rates, creating a new, scalable fee-generating stream for the REIT.

Unlocking Value and Rewarding Unitholders

For Dream Industrial REIT, the deal represents a significant capital recycling event that is expected to unlock substantial value for its unitholders. The REIT anticipates receiving over $730 million in net proceeds from the transaction. A significant portion of this capital, between $100 million and $200 million, is earmarked for unit buybacks under its existing normal-course issuer bid program.

This buyback is particularly notable given the current market dynamics. As of the last closing price on December 16, 2025, the REIT’s units traded at a more than 37% discount to their September 30, 2025, IFRS Net Asset Value (NAV) of $16.74 per unit. The aggressive buyback signals strong conviction from management that its units are undervalued. Further bolstering this return of capital to unitholders, DIR announced it will suspend its Distribution Reinvestment and Unit Purchase Plan (DRIP) effective with the January 15, 2026 distribution.

The transaction is projected to be immediately accretive to DIR’s diluted Funds From Operations (FFO) per unit, with an expected increase in the low to mid-single-digit percentage range on a leverage-neutral basis once proceeds are deployed.

“Over the past several years, our FFO payout ratio has improved to the mid-60% range and our retained cash flows have grown, driven by strong organic growth and multiple growth levers embedded within the business,” noted Lenis Quan, Chief Financial Officer of Dream Industrial REIT. “We expect the Transaction to be accretive to FFO and cash flow while maintaining our credit metrics and balance sheet flexibility.”

The 'Value-Add' Playbook for Industrial Real Estate

The joint venture’s acquisition strategy will be centered on a 'value-add' approach. It will actively target properties with existing vacancy, near-term lease rollovers, or opportunities for significant capital investment, intensification, and redevelopment. This strategy is designed to actively create value rather than passively hold stabilized assets.

The initial portfolio itself provides a template for this approach. With a weighted average lease term of approximately three years and an average rent of around $11 per square foot, the properties offer a near-term opportunity to capitalize on rental rate growth by re-leasing space at higher market rates. The transaction is expected to slightly increase DIR’s overall portfolio occupancy, from 94.3% to 94.5% on an in-place and committed basis, while maintaining its significant mark-to-market potential.

By focusing on assets that require repositioning or modernization, the joint venture aims to transform them into modern, efficient industrial spaces that meet the evolving demands of logistics and supply chain tenants, particularly in crucial 'last-mile' urban locations.

A Broadening Horizon for Dream Industrial

While the partnership with CPP Investments marks a major new initiative, it complements DIR’s existing strategy for its wholly-owned portfolio. The REIT remains focused on acquiring and developing modern, infill industrial assets in its target markets. This dual-track approach—combining direct ownership with a growing private capital business—provides the REIT with diversified capital sources and greater flexibility to pursue growth across different points in the economic cycle.

“Our growth strategy for the wholly owned portfolio in Canada remains focused on acquiring and developing newer vintage, small and mid-bay infill assets with strong occupancy, embedded lease escalators and built-in mark-to-market potential,” stated Bruce Traversy, Chief Investment Officer of Dream Industrial REIT. He also pointed to opportunities abroad, adding, “In the near-term, we are also looking to increase our exposure in Western Europe, where we see attractive going-in cap rates, lower capital values and strong outlook for rental growth in core infill locations.”

This global ambition is already in motion. In 2025 alone, the Trust has closed on over $115 million in acquisitions. It is currently in negotiations on over $600 million of additional acquisitions across Europe and Canada. Additionally, the Trust is pursuing multiple intensification projects on its existing sites and is adding further scale to its renewable energy pipeline at target yields on cost of 7% to 10%.

📝 This article is still being updated

Are you a relevant expert who could contribute your opinion or insights to this article? We'd love to hear from you. We will give you full credit for your contribution.

Contribute Your Expertise →