Advisors Brace for 2026 as Confidence Hits Record Low

- RIA Economic Outlook Index: 53 (lowest since Q1 2024)

- Inflation Skepticism: Only 42% of RIAs believe inflation will stay below 3% in the next 12 months (down from 69% last quarter)

- Market Volatility Concerns: 23% of RIAs are extremely or very concerned about a major equity market downturn (up from 16% in Q3 2025)

Experts conclude that financial advisors are recalibrating expectations for 2026, balancing heightened volatility concerns with disciplined long-term strategies while prioritizing client guidance amid economic and political uncertainty.

Advisors Brace for 2026 as Confidence Hits Record Low

TOPEKA, Kan. – January 13, 2026 – A palpable sense of caution is spreading through the financial advisory community as it looks ahead to the rest of 2026. Confidence among Registered Investment Advisors (RIAs) has fallen to its lowest level in two years, driven by a potent mix of persistent inflation fears, anticipated market volatility, and deep uncertainty surrounding U.S. economic policy.

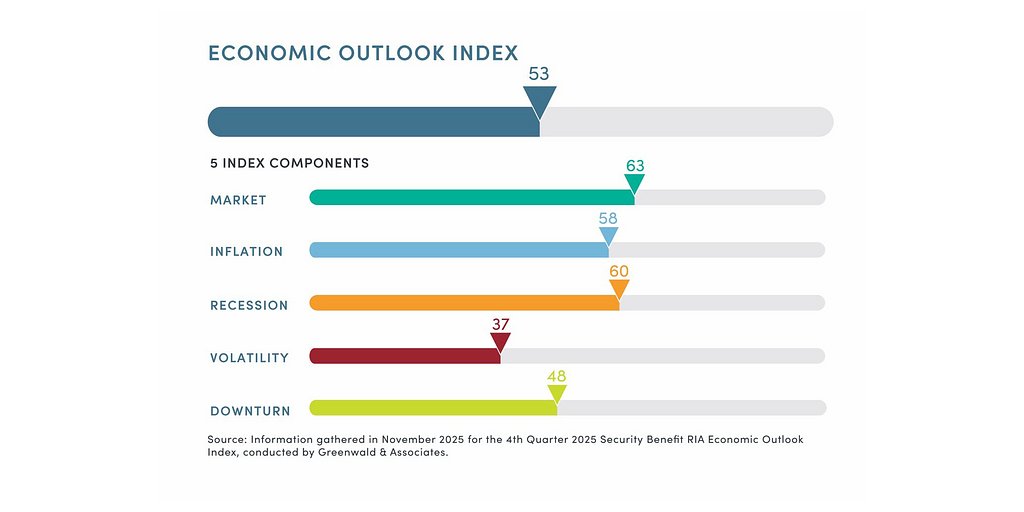

According to the latest RIA Economic Outlook Index, a quarterly survey from retirement market leader Security Benefit and Greenwald Research, advisor sentiment has dropped to a reading of 53. The index, which measures optimism on a scale of 0 to 100, is now at its lowest point since it was first introduced in the first quarter of 2024, signaling a significant recalibration of expectations for the economic landscape.

“Advisors are clearly recalibrating expectations as they head into 2026, but this isn’t a retreat from the market,” noted Mike Reidy, National Sales Manager for the RIA Channel at Security Benefit, in the report's release. “RIAs are balancing heightened volatility concerns with disciplined portfolio strategies, staying focused on long-term goals while helping clients navigate a more uncertain environment.”

The Anatomy of Advisor Anxiety

Digging into the data reveals that inflation remains a primary source of concern, with advisors growing more skeptical that price pressures will be tamed. Despite the latest Personal Consumption Expenditures (PCE) Price Index showing inflation hovering around 2.7%, the survey found a sharp decline in optimism. Just 42% of RIAs now believe inflation will stay below 3% over the next twelve months, a dramatic drop from the 69% who held that belief in the previous quarter.

This advisor pessimism stands in contrast to some institutional forecasts. Projections from the Federal Reserve and the Congressional Budget Office for 2026 place inflation between 2.4% and 2.7%, suggesting that the professionals managing client portfolios are bracing for a stickier inflation scenario than government bodies anticipate. This divergence highlights a growing risk-off sentiment among those on the front lines of wealth management.

Compounding these fears is the specter of market volatility. Half of all advisors surveyed now expect stock market turbulence to be higher over the next year than it was in 2024, an increase from 42% last quarter. More telling is the rise in acute concern: nearly one-quarter (23%) of RIAs report being extremely or very concerned about a major equity market downturn, up from just 16% in the third quarter. This growing focus on downside risk is prompting a strategic shift in how advisors are positioning portfolios for the year ahead.

Policy and Politics Cloud the Crystal Ball

Adding another layer of complexity is the uncertain impact of the political environment on the economy. Advisors are starkly divided on the potential effects of the Trump administration's policies in 2026. While a slight majority (54%) believe the administration will have a positive overall impact on the U.S. economy, a substantial minority of one-third (33%) expect a negative outcome. This lack of consensus underscores the difficulty of forecasting in the current political climate.

Concerns become more focused when advisors consider specific policy levers. Nearly half of RIAs (45%) anticipate that trade and tariff policies will have a negative effect on equity markets in the coming year, compared to only 26% who see a positive effect. This apprehension aligns with analyses from economic think tanks like the Peterson Institute for International Economics, which have historically warned that widespread tariffs can lead to higher consumer prices, disrupted global supply chains, and retaliatory measures that dampen economic growth. The survey suggests that advisors are taking these potential headwinds seriously as they evaluate market risk.

Interestingly, advisors appear less concerned about longer-term fiscal issues, at least for now. Only 20% of RIAs stated that the size of the federal debt is likely to negatively impact the economy in 2026, indicating that near-term market drivers like trade policy and inflation are weighing more heavily on their immediate outlook.

The New Playbook: From Caution to Action

In response to this cautious outlook, RIAs are not pulling back from the market entirely but are instead adjusting their strategic playbook. The survey reveals a clear pivot toward global diversification and a renewed focus on existing clients. A third of advisors (34%) reported increasing their allocations to international equities during the fourth quarter, a classic move to spread risk and seek growth opportunities outside a potentially volatile domestic market.

Perhaps the most significant strategic shift is in business focus. When asked about their primary objective for the first half of 2026, nearly half of RIAs (46%) said they will prioritize deepening relationships with existing clients. This far outpaced the 29% who named new client acquisition as their top priority. This inward focus suggests that advisors see their primary role in the current environment as one of guidance and reassurance, helping clients navigate anxiety and stick to their long-term plans rather than chasing new assets.

This client-centric approach is also reflected in how advisors are deploying defensive strategies. The move toward protection is measured and selective. The survey found that just one in ten RIAs increased their allocation to annuities with guaranteed lifetime income during the quarter. While not a widespread rush, it points to a deliberate consideration of products designed to provide contractual guarantees and mitigate the impact of market downturns, particularly for clients at or near retirement.

As the retirement industry grapples with helping an aging population navigate financial uncertainty, the concerns and strategic shifts highlighted in the report are significant. The findings paint a picture of a profession on high alert, one that is proactively managing risk, emphasizing client communication, and selectively employing tools to protect portfolios from the economic and political crosscurrents expected in the year ahead.

📝 This article is still being updated

Are you a relevant expert who could contribute your opinion or insights to this article? We'd love to hear from you. We will give you full credit for your contribution.

Contribute Your Expertise →