Huawei Reclaims China's Smartphone Crown in Major Market Shake-Up

- Huawei's Market Share: 17% with 46.8 million units shipped in 2025

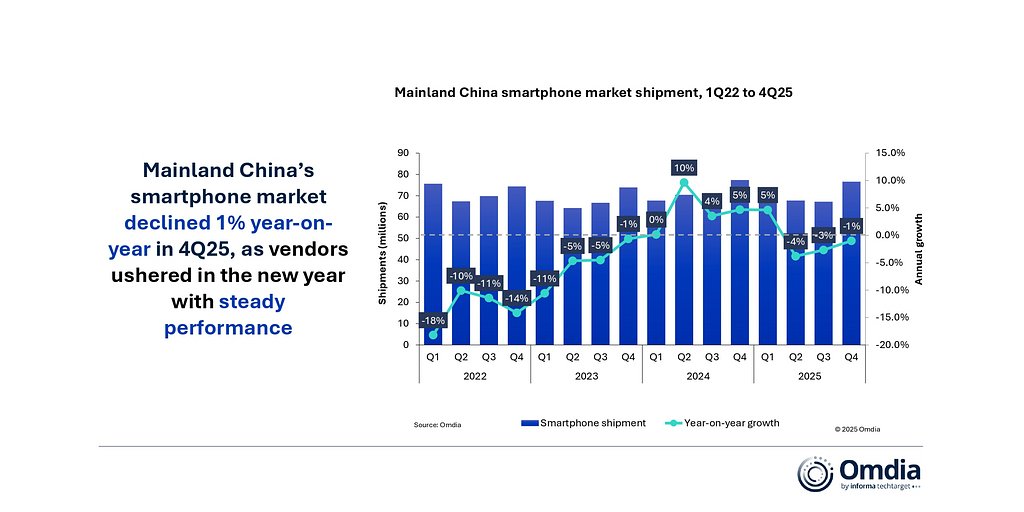

- Overall Market Contraction: 1% decline in 2025, totaling 282.3 million smartphones shipped

- Apple's Q4 Performance: 22% market share with 16.5 million units shipped

Experts view Huawei's return to the top spot as a testament to its strategic resilience and technological independence, while noting that the market remains intensely competitive with all major players investing heavily in innovation and AI integration.

Huawei Reclaims China's Smartphone Crown in Major Market Shake-Up

LONDON, UK – January 15, 2026

In a seismic shift for the global technology landscape, Huawei has reclaimed the top spot in mainland China’s fiercely competitive smartphone market for the first time in five years. According to a new report from market research firm Omdia, despite an overall market contraction of 1% in 2025, Huawei surged ahead to capture a 17% market share with 46.8 million units shipped. The achievement marks a stunning comeback for a company that has weathered intense geopolitical pressure and supply chain disruptions.

The full-year results paint a picture of a tight, dynamic race. Huawei was followed closely by vivo, which secured second place with 46.0 million units and a 16% share. Apple, buoyed by a powerful fourth-quarter performance, landed in a near-statistical tie for third place, shipping 45.9 million iPhones for a 16% share. The total market saw 282.3 million smartphones shipped in 2025, down slightly from 284.6 million the previous year, signaling a mature market where strategic maneuvering is paramount.

The Phoenix Rises: Huawei's Resilient Comeback

Huawei's return to dominance is a story of strategic resilience and technological independence. After years of being hampered by US sanctions that cut off its access to advanced 5G chipsets, the company has successfully re-engineered its supply chain. A key factor in its 2025 success was the increasing use of its self-designed Kirin processors, such as the Kirin 9030 found in its flagship Mate 80 Pro Max. This breakthrough, developed in partnership with domestic semiconductor firms, effectively restored 5G capabilities to its premium devices, a crucial feature for Chinese consumers.

This technological sovereignty was coupled with a massive investment in its proprietary software ecosystem. In October 2025, Huawei launched HarmonyOS 6, a comprehensive upgrade to its operating system featuring a refined user interface, enhanced AI integration, and a new security architecture. To fuel this growth, the company committed RMB 1 billion to support innovation within the HarmonyOS and AI ecosystem. This focus on creating a seamless cross-device experience has cultivated strong brand loyalty and provided a compelling alternative to Android.

The company’s premium product lines, including the popular Mate, Pura, and Nova series, drove its sales volume. In a bold strategic move, Huawei even reduced prices for its Mate 80 series in November, absorbing rising component costs to maintain competitive pricing and capture market share.

Apple's Precision Strategy in a Crowded Field

While Huawei captured the full-year crown, Apple demonstrated its enduring power in the premium segment, particularly in the final quarter of 2025. The American tech giant led the market in Q4, shipping 16.5 million units for an impressive 22% market share and achieving a remarkable 26% year-on-year growth for the quarter. This surge was instrumental in securing its top-three position for the year.

Apple's success hinged on a carefully executed product strategy for its iPhone 17 lineup. “Apple achieved solid shipment growth by leveraging a product differentiation and upgrade strategy, supporting overall volumes while refining its portfolio,” commented Hayden Hou, Principal Analyst at Omdia. The redesigned iPhone 17 Pro series was met with strong consumer reception, while the base iPhone 17 model received a significant upgrade, doubling its entry-level storage to 256GB while maintaining the same price as its predecessor. This move boosted the base model's value proposition and made it a larger contributor to Apple's sales mix than in previous years.

However, the market environment presented unique challenges. National subsidy policies, which aimed to stimulate consumer spending in early 2025, often had price caps that excluded some of Apple's higher-priced Pro models, slightly blunting its momentum in the first half of the year.

A Battlefield of Brands: vivo, Xiaomi, and OPPO Vie for Position

The narrow margins separating the top vendors underscore the intense competition among China's domestic brands. vivo’s second-place finish was powered by a rich and diverse portfolio that spans multiple price bands, from its budget-friendly Y series to its high-end flagships, allowing it to cater to a broad consumer base.

Xiaomi, which secured the fourth position with 43.7 million units, continued its aggressive strategy of offering high specifications at competitive prices. The company made a strategic play by bringing forward the launch of its flagship Xiaomi 17 Ultra to December, getting ahead of competitors' 2026 rollouts. Its Mi 15 series was also well-received, making significant progress in the company's push toward premiumization.

OPPO (including OnePlus) rounded out the top five with 42.8 million units. The company saw its performance rebound in the fourth quarter and continues to push innovation in form factors like foldable phones. The market remains a complex battleground where each player is forced to continuously refine its product mix, pricing, and channel strategy.

Navigating the Future: Rising Costs and the AI Imperative

Looking ahead to 2026, smartphone vendors face a new set of formidable challenges. Omdia analysts warn that rising component costs, particularly for memory, will squeeze profit margins and create a difficult balancing act for manufacturers. “Rising memory costs are creating a highly dynamic environment for component supply, product strategy, and pricing strategy, compelling vendors to strategically balance cost allocation, price competitiveness, and hardware upgrade paths,” Hou noted.

This cost pressure is occurring alongside an industry-wide imperative to invest heavily in next-generation technologies. The race to integrate generative AI directly onto devices is heating up, with nearly 40% of smartphones sold in China during the first quarter of 2025 already being GenAI-enabled. This trend is forcing all brands to pour resources into AI and building out robust cross-device ecosystems, following the path forged by Huawei's HarmonyOS.

Despite these short-term cost pressures, analysts believe the focus on innovation will not waver. “Despite short-term cost pressures, vendors are sustaining investments in long-term value drivers, including channel enhancements - such as flagship store expansions and renovations - AI and cross-device ecosystem development, and imaging innovation,” Hou added. This suggests that while the market may not see significant volume growth, the fierce competition will continue to drive technological advancement, making 2026 another year defined by value growth and product innovation in China's smartphone market.

📝 This article is still being updated

Are you a relevant expert who could contribute your opinion or insights to this article? We'd love to hear from you. We will give you full credit for your contribution.

Contribute Your Expertise →