Vizsla Copper's Alaskan Gambit: A $44M Play for Critical Minerals

- $44.24 million: Amount raised in financing to advance critical mineral projects.

- 4.77 million tonnes: Indicated copper-zinc resource at Palmer Project with 3.5% copper-equivalent grade.

- 12.00 million tonnes: Inferred resource at Palmer Project with 3.1% copper-equivalent grade.

Experts view Vizsla Copper's acquisition of the Palmer Project and $44M financing as a strategic move to capitalize on North America's critical mineral needs, though success will depend on both geological potential and effective community engagement.

Vizsla Copper's Alaskan Gambit: A $44M Play for Critical Minerals

VANCOUVER, BC – December 04, 2025 – In a move that signals a significant escalation in the North American race for critical minerals, Vizsla Copper Corp. has simultaneously secured a prized Alaskan mining asset and a formidable $44 million financial war chest. The junior explorer announced today the closing of its acquisition of the Palmer Project, a high-grade copper-zinc deposit in southeast Alaska, and the completion of an oversubscribed private placement, heralding what CEO Craig Parry calls a "transformational moment" for the company.

The dual announcement positions Vizsla Copper to aggressively advance its portfolio at a time when geopolitical tensions and the green energy transition have placed an unprecedented premium on domestic metal supplies. By acquiring a project with a substantial existing resource and funding it for major exploration, the company is writing a new chapter in its growth story, one that pivots from British Columbia-focused exploration to a multi-jurisdictional development strategy with significant near-term catalysts.

A Strategic Prize in a Prolific Belt

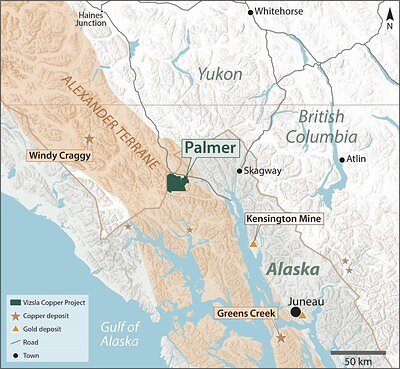

The centerpiece of the transaction is the Palmer Project, now 100% owned by Vizsla Copper following the acquisition of Constantine Metal Resources from American Pacific Mining Corp. Located just 60 kilometers from tidewater with established road access, Palmer is not a grassroots discovery but an advanced-stage asset with over US$116 million in historical investment. This legacy spending has already established a significant mineral resource and secured key state and federal permits, dramatically de-risking the path forward for its new owner.

The project is a volcanogenic massive sulfide (VMS) deposit, a geological formation renowned for hosting rich concentrations of multiple metals. According to a January 2025 technical report, Palmer hosts an Indicated Resource of 4.77 million tonnes at a copper-equivalent grade of 3.5% and a much larger Inferred Resource of 12.00 million tonnes at 3.1% copper-equivalent. These grades contain substantial quantities of copper and zinc, alongside valuable by-products like silver, gold, and barite.

For Vizsla Copper, this is "the right asset at the right time," as Parry noted, directly addressing "North America's hunger for critical minerals." This isn't mere corporate hyperbole. The Palmer Project lies within a prolific 1,000-kilometer mineral belt that also hosts major mines like Hecla’s Greens Creek. More importantly, the acquisition aligns perfectly with a continental push for supply chain security. With copper recently added to the U.S. critical minerals list due to its indispensable role in electrification and defense, a high-grade domestic project with a clear path to expansion becomes a strategic national asset, not just a corporate one.

Fueling the Exploration Engine

A prize asset is only as valuable as the capital available to advance it. Vizsla Copper has addressed this decisively, closing a non-brokered financing for gross proceeds of $44.24 million. The offering, which was significantly upsized from its initial targets due to strong investor demand, gives the company its "healthiest treasury in the Company's history" and the firepower for an ambitious, dual-front exploration campaign in 2026.

A portion of the funds will be deployed at the company's existing Poplar project in British Columbia, where a major winter drill campaign will aim to expand a recent discovery and test large-scale porphyry targets. However, the market's focus will undoubtedly be on Alaska. Vizsla plans a large summer drill program at Palmer, concentrating on expanding the known high-grade deposit around spectacular 2023 drill intercepts and testing multiple other VMS targets across the property's underexplored 15-kilometer prospective zone.

The financing structure itself reveals strategic planning, utilizing flow-through shares to fund Canadian exploration tax-efficiently, while the bulk of the proceeds from common shares will fuel the Alaskan push and cover acquisition costs. The participation of company insiders for over $2.4 million in the offering serves as a strong vote of confidence, signaling that management is firmly aligned with shareholders in its belief in the newly combined entity's potential.

Navigating the Alaskan Gauntlet

While the geological and financial fundamentals appear robust, the Palmer Project's future is not without significant challenges. The project is situated in the Chilkat Valley, an ecologically sensitive watershed of immense cultural importance to local Indigenous peoples. Despite CEO Craig Parry's pledge to "work constructively in collaboration and consultation with traditional landowners and communities," regional stakeholders have already voiced strong opposition.

Local Tlingit community leaders have expressed profound skepticism, viewing the project as a threat to their ancestral lands and traditional way of life, which is deeply connected to the region's salmon, moose, and grizzly bear populations. Concerns have been raised that the company's primary focus is on extraction and profit, not genuine partnership or the preservation of a vital ecosystem. One local leader bluntly described the project as "pure extraction and destruction of the land," highlighting a deep-seated distrust that will be a major hurdle for Vizsla Copper to overcome.

This tension between resource development and environmental stewardship is the critical, non-financial risk that will define the project's trajectory. Vizsla Copper's ability to move beyond boilerplate commitments and build authentic, trust-based relationships will be as crucial to its success as any drill result. The company's performance on this front will be scrutinized by investors, regulators, and the public alike, representing a key test of its social license to operate.

The Path to Value Creation

The transaction with American Pacific is structured to reward continued success. Vizsla Copper issued nearly 13.9 million shares for the acquisition and has committed to future milestone payments: $5 million upon expanding the total mineral resource to 22 million tonnes and another $10 million upon commencement of commercial production. These back-end payments align the interests of both parties and create clear, value-driving targets for Vizsla's management team.

With a powerful treasury, a resource-rich anchor asset, and a clear exploration plan, Vizsla Copper has executed a strategic pivot that dramatically elevates its profile in the junior mining space. The company now controls a project with the grade and scale to attract major-league attention in a world desperate for new sources of copper. However, its success will hinge not only on what it finds beneath the ground in Alaska but also on its ability to navigate the complex social and environmental landscape above it. For investors, the story of the Palmer Project is now a high-stakes chronicle of capital, geology, and community, with its most critical chapters yet to be written.