The New Gig: Can Watching Videos Really Boost Your Financial Health?

- 60 million users: Freecash's global user base.

- $25 to $60/month: Estimated earnings for consistent users.

- 4.8/5 Trustpilot score: From over 250,000 reviews.

Experts would likely conclude that while Freecash's video-watching feature offers a low-effort way to earn supplemental income, its long-term impact on financial well-being is limited and raises concerns about data privacy and the devaluation of labor.

The New Gig: Can Watching Videos Really Boost Your Financial Health?

TORONTO, ON – December 03, 2025 – In an age where financial pressures are a constant source of stress for many Canadians, the allure of earning extra money with minimal effort is more powerful than ever. Tapping into this demand, the global rewards platform Freecash recently announced a new feature allowing its 60 million users to get paid for watching videos. The move positions the company to capitalize on the booming gig economy, where monetizing downtime has become a key strategy for personal finance management.

The announcement paints a simple, appealing picture: turn idle screen time into tangible rewards like cash or gift cards. “Adding video watching to our inventory aligns perfectly with our mission to make it easy for anyone, anywhere, to earn money online,” said Tom, a media contact at Freecash, in the official press release. But as with any innovation promising easy money, the true impact on community and individual well-being warrants a closer look. Does this represent a meaningful step toward financial empowerment, or is it another chapter in the complex, often fraught, relationship between technology, labour, and personal data?

The Promise of Passive Pennies

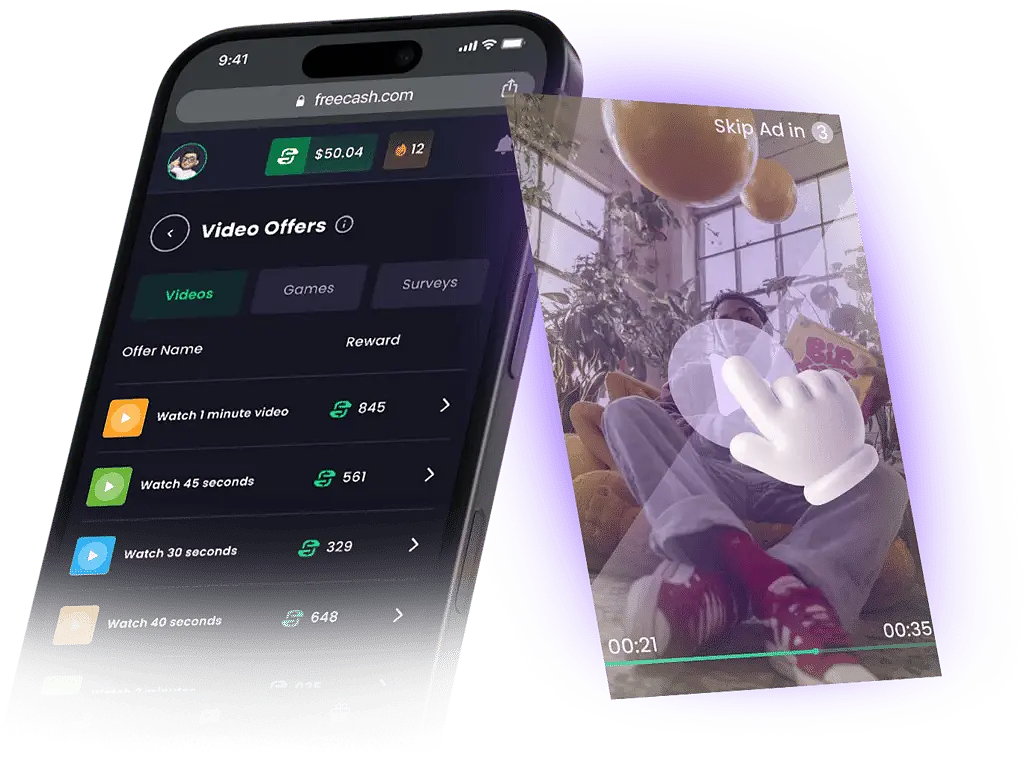

At its core, Freecash operates within the 'Get-Paid-To' (GPT) ecosystem, a corner of the internet where users are compensated for completing small digital tasks. Before the video feature, the platform already offered rewards for playing mobile games, completing market research surveys, and signing up for new services. The addition of video watching is a logical extension, targeting one of the most common passive activities online.

The appeal is undeniable. For individuals juggling multiple jobs, caregiving responsibilities, or navigating the high cost of living, the idea of earning even a small amount during a bus commute or while waiting in line can feel like a productive use of otherwise lost time. This model of micro-earning aims to lower the barrier to entry for supplementary income, requiring no special skills or significant time commitment. Research suggests consistent users on such platforms might earn between $25 to $60 a month—a sum that, while not life-changing, could help offset a utility bill or a week's worth of groceries, thereby alleviating a small but significant slice of financial anxiety.

This promise of accessible earnings is central to the company’s pitch. With a low payout threshold and options ranging from PayPal transfers to cryptocurrency, the platform is designed to provide quick and flexible access to funds. For many, this immediacy can be a crucial tool for managing tight budgets in a landscape where traditional wages often lag behind inflation.

Reality Bites: Navigating the Micro-Task Maze

While the press release heralds a straightforward new earning method, the on-the-ground experience for users can be more complex. Recent independent reviews and user discussions suggest that the 'watch videos' feature on Freecash may not be as prominent or consistently available as other tasks like gaming or surveys. This discrepancy highlights a common challenge in the GPT space: the gap between a service's marketing and its day-to-day functionality. While the company may be building out this feature, current users might find their earning potential from videos is limited compared to other activities.

Competitors like InboxDollars and PrizeRebel have more established video-watching components, offering a variety of content from ad clips to TV show segments. This competitive landscape suggests that while Freecash is a legitimate and popular platform—boasting a 4.8/5 Trustpilot score from over 250,000 reviews—its latest offering is entering a crowded and well-defined market. Users seeking to specifically monetize video-watching may find more robust options elsewhere.

Furthermore, the user experience on any rewards platform is not without its hurdles. Forum discussions reveal common complaints that plague the industry, including offers that fail to track properly, leading to lost earnings and frustrating support interactions. More critically, platforms like Freecash enforce strict terms of service, with violations such as using a VPN or having multiple accounts per household resulting in sudden account freezes. While these rules are in place to prevent fraud, they can sometimes catch legitimate users in the crossfire, instantly cutting off access to their accumulated earnings.

The Hidden Cost of 'Free' Money

Perhaps the most significant aspect of this business model, and the one with the broadest community impact, is the underlying transaction of data. The 'win-win-win' model described by Freecash—where advertisers, users, and the platform all benefit—is predicated on the monetization of user attention and information. When a user watches a video or completes a survey, they are not just earning a few cents; they are also providing valuable data points.

An analysis of the platform's privacy policy reveals a standard but extensive data collection practice. Freecash gathers personal information provided at sign-up, payment details, and user-generated content from surveys. It also automatically collects browsing activities, IP addresses, and device information through cookies and other trackers. This data is used to personalize content, prevent fraud, and, crucially, to target advertisements. The policy states that information may be shared with advertisers, marketing partners, and analytics providers. Some privacy evaluations have raised flags, noting that user data is used to build profiles for personalized ads that follow users across other websites and services.

In essence, users are bartering their digital footprint for small monetary rewards. This exchange is at the heart of the modern internet economy, but it raises important questions about informed consent and the true value of personal data. For communities already facing economic vulnerability, the trade-off may seem necessary, but it contributes to a system where personal information becomes another resource to be extracted in exchange for financial subsistence. The long-term impact of this data monetization on individual privacy and digital autonomy remains a significant and often overlooked cost.

Micro-Gigs and the Search for Financial Wellness

Ultimately, the rise of platforms like Freecash and features like paid video-watching reflects a larger trend within the gig economy: the atomization of work into bite-sized, on-demand tasks. On one hand, this provides unprecedented flexibility and accessibility, opening doors for people who cannot commit to traditional employment structures. It offers a tangible, if modest, tool for financial resilience in uncertain times.

On the other hand, it shines a light on the growing precarity of labour. The very demand for such apps underscores a systemic issue where primary incomes are often insufficient to provide financial security. Critics argue that while micro-tasking can provide a temporary financial patch, the low pay rates—often amounting to well below minimum wage when calculated hourly—can create a 'time sink' that distracts from efforts to find more stable and meaningful employment.

As these digital platforms become more deeply integrated into the fabric of daily life, the conversation must evolve beyond whether they are 'legit' or 'a scam.' The more pressing question for community well-being is what role they should play. Are they an empowering tool for financial self-management, or do they risk normalizing a form of digital piecework that devalues labour and trades privacy for pennies? The answer likely lies somewhere in between, but as more Canadians turn to their screens for a financial lifeline, it is a question that demands our continued attention.