The New Blueprint: Investing in Lumber Intel for Luxury Builds

- Lumber Price Volatility: Western Spruce-Pine-Fir prices dropped to US$390 per thousand board feet in late November 2025, down from $470 earlier in the year.

- Tariff Impact: U.S. countervailing duties on Canadian softwood lumber increased to 35.2%, pressuring Canadian sawmills.

- Data Service Cost: Madison’s 'Sawmill Curtailment Lookout' offers monthly intelligence for US$1,289 annually.

Experts emphasize that proactive intelligence on lumber supply and pricing is critical for luxury developers to mitigate risks in an increasingly volatile market.

The New Blueprint: Investing in Lumber Intel for Luxury Builds

VANCOUVER, BC – December 04, 2025

For the discerning developer or the aspirational homeowner commissioning a custom mountain retreat, the vision is often one of soaring wooden beams and expansive hardwood floors. The reality, however, is increasingly one of volatile commodity markets, unpredictable supply chains, and budget-shattering delays. In late 2025, the North American lumber market remains a landscape of profound uncertainty, where the price of a tranquil aesthetic is constant vigilance. For those operating at the highest end of real estate, the most critical new investment isn't in rare marble or smart home technology, but in the strategic intelligence needed to navigate the turbulent timber trade.

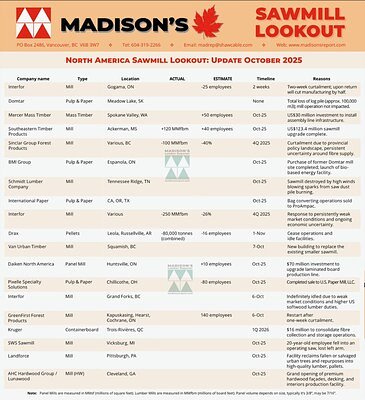

This high-stakes environment has elevated the need for precise, actionable information, transforming data from a simple commodity into a strategic asset. Answering this call is Madison's Lumber Reporter, a venerable industry voice since 1952, which is underscoring the value of foresight with its specialized 'Sawmill Curtailment Lookout'—a monthly intelligence report that offers a ground-level view of the continent's lumber production capacity.

A Market of Splinters and Spikes

The challenges roiling the lumber market are multifaceted and deeply entrenched. Benchmark softwood lumber prices, such as Western Spruce-Pine-Fir, have seen significant fluctuation, dropping to around US$390 per thousand board feet in late November after seeing prices well above $470 earlier in the year. This volatility is not random; it is the result of a confluence of powerful economic and political pressures.

A primary source of instability is the ongoing trade friction between the United States and Canada. In a significant move, the U.S. Department of Commerce recently more than doubled countervailing duties on Canadian softwood, bringing the total tariff rate to a punishing 35.2%. With forecasts suggesting these duties could climb even higher in 2026, Canadian sawmills face immense financial pressure, directly impacting supply into the U.S. market.

This is compounded by a mixed demand picture. While pockets of the U.S. are experiencing renewed housing demand, the broader construction sector is slowing. Projections for 2025 show only modest growth in U.S. engineering and construction spending, with the residential sector remaining weak due to affordability challenges and tight credit. For luxury developers, this means that even as some costs moderate, the availability of specific high-grade materials can become unpredictable as mills adjust production to shifting demand signals. Add in persistent transportation logjams, regional labor shortages, and the ever-present threat of wildfires and pest infestations restricting timber supply, and the result is a supply chain fraught with risk.

From Sawdust to Spreadsheets: The Power of Granular Data

In this environment, reacting to market prices is a losing game. The key to success lies in anticipating supply shifts before they ripple through the market. This is the strategic value offered by a tool like Madison’s 'Sawmill Curtailment Lookout'. For an annual investment of US$1,289, subscribers gain access to a detailed monthly ledger of operational changes at sawmills across the U.S. and Canada.

An analysis of the service’s recent reporting reveals a depth of information that goes far beyond simple news alerts. The data is granular, cataloging not just which mills are changing their output, but by how much—measured in millions of board feet for lumber or square feet for panels—and, most importantly, why. One entry might detail a mill indefinitely idling and shedding 80 employees due to “weak market conditions and higher US softwood lumber duties.” Another might note a 13 million board foot reduction in response to “persistent uncertainty around fibre supply.”

Conversely, the report also tracks restarts and investments, flagging a mill adding 10 employees as part of a $70 million upgrade to its production line. For a luxury builder or investor, this level of detail is a strategic blueprint. Knowing a major supplier of engineered wood in Ontario is expanding capacity could influence future project planning in the Great Lakes region. Learning that multiple mills in British Columbia are curtailing production due to log shortages allows a procurement manager to secure alternative sources for West Coast species before a spot shortage sends prices soaring.

This intelligence transforms decision-making from a reactive scramble into a proactive strategy. It allows developers to hedge against price volatility, adjust construction timelines based on material availability, and provide clients with more accurate budget forecasts. In the context of a multi-million dollar custom home where delays can cost tens of thousands per week, the subscription fee becomes a negligible insurance premium against catastrophic disruption.

A Legacy of Insight for a Modern Frontier

While the data is cutting-edge, the source behind it is steeped in history. Madison's Lumber Reporter has been a trusted, independent voice in the forest products industry for over 70 years. This legacy provides a foundation of credibility that is essential in the often-opaque world of commodity trading. The firm has successfully navigated the transition from a traditional weekly print publication to a modern intelligence provider, complementing its foundational price reporting with interactive online dashboards and specialized analytical tools.

This evolution mirrors a broader trend in luxury markets: the growing importance of provenance and expertise. Just as affluent consumers demand transparency in the sourcing of their diamonds or food, sophisticated investors now require unimpeachable data to guide their capital. By focusing on the niche, high-impact area of sawmill operations, Madison's has carved out a vital role, providing the kind of specialized intelligence that separates savvy players from the rest of the market.

Ultimately, the frontier of luxury is no longer defined solely by physical opulence but by the sophistication of the processes that create it. As the complexities of global supply chains and economic headwinds intensify, the ability to look ahead becomes the most valuable asset of all. For those building the high life, access to real-time, granular data on the very first link in the supply chain is not just an advantage—it is becoming an absolute necessity.