Techficient's AI-Powered Platform Disrupts Life Insurance, Driving Digital Transformation

A leading Insurtech firm is reshaping life insurance distribution with an AI-driven platform that accelerates underwriting, enhances customer experience, and unlocks new efficiencies for agents and carriers.

Techficient's AI-Powered Platform Disrupts Life Insurance, Driving Digital Transformation

By Margaret Mitchell

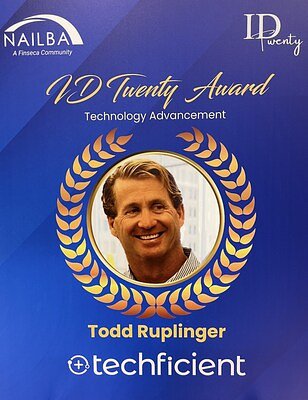

Boston, MA – November 12, 2025 – In an industry traditionally reliant on manual processes and lengthy application timelines, Techficient is emerging as a disruptive force in life insurance distribution. The Insurtech firm’s innovative platform, powered by artificial intelligence and data analytics, is streamlining underwriting, accelerating policy issuance, and enhancing the overall customer experience, earning the company industry recognition and a recent award for innovation.

Techficient's success is a testament to the growing demand for digital transformation within the life insurance sector. While the industry has historically been slow to adopt new technologies, mounting consumer expectations for instant gratification and the need for operational efficiency are forcing carriers and agencies to embrace innovation.

A Platform Built for Speed and Efficiency

The core of Techficient’s offering is its ‘Dynamic’ platform, a white-label solution designed to simplify the quoting and application process. Unlike traditional systems that often require medical exams and extensive paperwork, Dynamic leverages AI to assess risk profiles, pre-populate applications, and even instantly issue policies in certain cases. The platform currently services over 30 carriers and more than 100 different life insurance product types.

“The industry was ripe for disruption,” said one industry analyst. “Agents and consumers alike were frustrated with the slow pace of traditional life insurance applications. Techficient identified this pain point and built a solution that addresses it directly.”

Key features of the Dynamic platform include:

- AI-Powered Underwriting: Algorithms analyze applicant data to predict risk and automate underwriting decisions.

- Instant Decisioning: A significant percentage of applicants receive instant policy approval without the need for further review.

- Streamlined Application Process: Pre-populated forms and automated data transfer reduce manual effort.

- Enhanced User Experience: Intuitive interface and mobile-friendly design improve customer satisfaction.

Partnership with SBLI Demonstrates Tangible Results

Techficient’s impact is particularly evident in its partnership with The Savings Bank Mutual Life Insurance Company of Massachusetts (SBLI). The collaboration led to the development of 100% digital products, including EasyTrak Digital Term Life and OmniTrak, which are revolutionizing the way SBLI distributes and underwrites policies.

“We’ve seen dramatic improvements in our operational efficiency since implementing Techficient’s platform,” stated a source at SBLI. “Our agents are able to process more applications in less time, and our customers are receiving coverage faster than ever before.”

Specifically, EasyTrak allows for instant policy issuance without medical exams, and OmniTrak uses an innovative field underwriting platform with three pathways—instant decision, accelerated underwriting, and traditional underwriting—to guide applicants to the most efficient experience. The result? A faster, more convenient experience for both agents and consumers.

The Broader Insurtech Landscape

Techficient is not alone in its pursuit of digital transformation within the insurance industry. A growing number of Insurtech firms are developing innovative solutions that leverage AI, data analytics, and automation to address longstanding challenges.

Competitors like iPipeline, Zinnia, and Sure are also focusing on streamlining processes, enhancing user experience, and accelerating policy issuance. However, Techficient distinguishes itself through its focus on a comprehensive platform that integrates seamlessly with existing carrier systems and provides a truly end-to-end solution.

“Many Insurtech firms focus on a single aspect of the insurance value chain,” explained another industry expert. “Techficient’s strength lies in its ability to address multiple pain points across the entire process, from quoting to underwriting to policy issuance.”

The increasing competition in the Insurtech space is driving innovation and forcing traditional insurance companies to accelerate their digital transformation efforts. While the transition may be challenging, the benefits—including increased efficiency, reduced costs, and improved customer satisfaction—are undeniable.

The Future of Life Insurance is Digital

As consumer expectations continue to evolve and the demand for digital experiences grows, the future of life insurance is undoubtedly digital. Techficient is well-positioned to lead the charge, providing innovative solutions that empower carriers, agents, and consumers alike.

“We’re not just building a platform,” stated a Techficient representative. “We’re building the future of life insurance—a future that is faster, more efficient, and more accessible for everyone.”

While specific details about Techficient’s patent filings remain limited, the company’s commitment to innovation and its growing list of satisfied customers suggest that it is poised for continued success in the rapidly evolving Insurtech landscape. As the industry embraces digital transformation, Techficient’s AI-powered platform is likely to play a critical role in shaping the future of life insurance.