Student Housing Titan: Landmark's $15B Milestone & Global Expansion

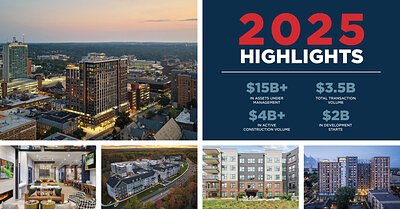

- $15B Milestone: Landmark Properties' portfolio crossed $15 billion in assets under management in 2025.

- $2B in New Development: The company launched $2 billion in new development starts across ten major projects.

- 6,800+ Beds Added: Landmark delivered six new communities in 2025, adding over 6,800 beds to its portfolio.

Experts view Landmark's vertically integrated business model and strategic global expansion as essential for success in the resilient student housing sector, setting a new industry standard for scale and performance.

Student Housing Titan: Landmark's $15B Milestone & Global Expansion

ATHENS, Ga. – January 08, 2026 – While much of the real estate sector navigated a landscape of caution and rising interest rates, student housing developer Landmark Properties announced a record-shattering 2025, cementing its status as a dominant force in the industry. The Athens-based firm closed the year with its portfolio crossing the $15 billion threshold in assets under management, fueled by its most active development year in history and a strategic international expansion into the United Kingdom.

The company launched an unprecedented $2 billion in new development starts across ten major projects and closed approximately $3.5 billion in transactions. This performance, which includes a single portfolio transaction valued at over $1 billion, signals not only the firm's formidable scale but also the persistent, high-octane demand for purpose-built student housing, an asset class proving remarkably resilient against economic headwinds.

A Blueprint for Growth in a Complex Market

Landmark's remarkable 2025 performance was not a matter of chance but the result of a meticulously crafted business model that industry experts see as increasingly essential for success. The company operates as a fully vertically integrated organization, a structure that gives it end-to-end control over development, construction, investment management, and property operations. This model has proven to be a critical advantage in a volatile market.

By managing its own projects through its in-house general contractor, Landmark Construction, the company can exert greater control over costs, timelines, and quality—a significant benefit at a time when construction costs and supply chain disruptions have plagued the industry. By the end of 2025, Landmark Construction had a record $4 billion in projects under construction, a testament to the sheer volume of its pipeline.

This operational structure is powered by deep and diversified access to capital. In 2025, Landmark secured $1.4 billion in new loans across 19 different transactions and expanded its network to 46 active institutional investment partners. This broad base of financial support insulates the company from the capital constraints that can stall projects for less-established firms.

As Wes Rogers, Chairman and CEO of Landmark Properties, stated in the announcement, the company's success is a product of navigating a "complex cycle that requires vertical integration, access to equity and debt capital, and market expertise that only fortress institutions like Landmark can deliver." This sentiment underscores a broader industry trend where scale and comprehensive in-house capabilities are becoming prerequisites for leading the market.

Redrawing the Map of Student Living in the U.S.

The financial milestones translate directly into a tangible transformation of student housing landscapes across the United States. In addition to its record development starts, Landmark delivered six new communities for the Fall 2025 academic year, adding over 6,800 beds to its portfolio. These are not traditional dormitories but modern, amenity-rich communities designed for today's students, featuring a mix of high-rise, mid-rise, and townhome-style designs in key university markets from California to Connecticut.

Recent project announcements paint a clear picture of this strategy in action. In December 2025, the company broke ground on The Metropolitan on South U, a 950-bed community adjacent to the University of Michigan's campus in Ann Arbor. That same month, it announced plans for The Mark Auburn, an 825-bed project near Auburn University. Other 2025 starts include The Mark Fort Collins near Colorado State University and The Retreat at Boone near Appalachian State University. These developments target flagship universities where enrollment growth consistently outpaces the supply of quality housing, creating a persistent need that Landmark is uniquely positioned to fill.

These projects reflect a fundamental shift in student living, moving far beyond a simple place to sleep. They often include state-of-the-art fitness centers, resort-style pools, private study rooms, and high-speed internet, effectively competing with and often surpassing the quality of on-campus options and the conventional multifamily market.

A Global Vision Takes Root in the UK

Perhaps the most significant indicator of Landmark’s ambition is its calculated expansion beyond U.S. borders. In 2025, the company firmly planted its flag in the United Kingdom, one of the world's most mature and competitive purpose-built student accommodation (PBSA) markets. The UK market is highly attractive, driven by a large and growing international student population and a structural undersupply of modern housing, particularly in top-tier university cities.

Landmark's entry point is a prime development site acquired in central London, pedestrian to University College London, the UK's largest university. The project on William Road is set to deliver 225 high-amenity student beds in a location where demand is exceptionally high. But the company’s vision extends beyond the capital. It is actively growing its UK-based team and expanding a pipeline of future projects in key regional hubs, including Birmingham, Durham, and Glasgow—cities with prestigious universities and strong student demand.

To navigate the local market, Landmark is collaborating with Centurion Corporation, a global PBSA operator with existing experience in the UK. This partnership combines Landmark’s development and capital expertise with on-the-ground operational knowledge, creating a formidable entry strategy. With a UK development pipeline already exceeding 3,000 beds, Landmark is poised to export its successful model and become a significant player in the European student housing sector.

Solidifying Leadership Through Scale and Recognition

The company’s growth is reflected not just in its portfolio but also in its organizational scale, which now includes over 1,600 employees across six offices. To manage this expansion, Landmark recently elevated several key executives to C-suite positions, strengthening its leadership team for strategic growth. Walt Templin was promoted to President and Chief Investment Officer, Jason Doornbos to Chief Development Officer, and Art Templin to Chief Operating Officer of Development and Construction.

This market leadership is consistently validated by third-party industry publications. For the seventh consecutive year, Student Housing Business ranked Landmark as the nation's top student housing developer. The company also secured top spots on lists from Multi-Housing News and Building Design + Construction, often as the only student-focused developer in the top tier alongside giant conventional multifamily firms. This array of awards for development, construction, marketing, and operations underscores the success of its vertically integrated approach, which continues to set a new standard for excellence and performance in the global student housing industry.

📝 This article is still being updated

Are you a relevant expert who could contribute your opinion or insights to this article? We'd love to hear from you. We will give you full credit for your contribution.

Contribute Your Expertise →