Pacaso Taps 'Million Dollar' Star to Redefine Luxury Home Ownership

- $1.5 billion valuation: Pacaso reached this milestone just a year after its 2020 launch.

- $1.2 billion in transactions: Facilitated by the company since its inception.

- $72.5 million raised: From over 17,500 retail investors in a recent Regulation A+ equity offering.

Experts view Pacaso’s partnership with Fredrik Eklund as a strategic move to legitimize fractional luxury home ownership, leveraging celebrity influence to overcome market skepticism and position co-ownership as a mainstream alternative in high-end real estate.

Pacaso Taps 'Million Dollar' Star to Redefine Luxury Home Ownership

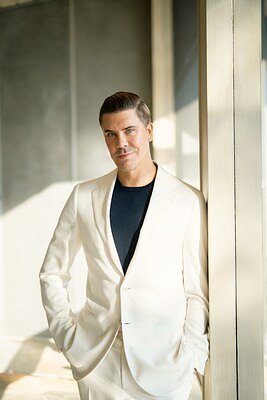

SAN FRANCISCO, CA – January 08, 2026 – Pacaso, the tech marketplace that shot to a billion-dollar valuation by fractionalizing luxury vacation homes, has announced a high-profile partnership with Fredrik Eklund, the real estate mogul and television personality from Bravo's “Million Dollar Listing.” The collaboration aims to leverage Eklund’s global network of affluent clients to accelerate the adoption of co-ownership as a mainstream model for acquiring second homes.

The partnership pairs Pacaso’s tech-driven platform with Eklund’s formidable sales prowess and celebrity status. Through a series of speaking engagements and exclusive dinner events in global hubs like Miami, London, and Paris, Eklund will act as a brand ambassador, introducing his clientele to what Pacaso frames as a smarter, more efficient way to own a piece of paradise.

“Fredrik has built one of the most respected and influential brands in luxury real estate, and his vision for how people live, invest, and enjoy homes aligns perfectly with Pacaso’s mission,” said Austin Allison, co-founder and CEO of Pacaso, in the announcement. Eklund echoed the sentiment, stating, “Pacaso is solving a clear market need I've seen for decades: people want beautiful homes in incredible locations without the commitment of full-time ownership.”

The Celebrity Playbook in High-End Real Estate

This move represents a significant strategic play for Pacaso, which is betting that Eklund’s endorsement can help overcome lingering skepticism about fractional ownership and solidify its legitimacy in the ultra-exclusive luxury market. Eklund is not just any real estate agent; he is a global brand. His Eklund|Gomes team at Douglas Elliman boasts a staggering $28 billion in total sales, giving him unparalleled access to the world's high-net-worth individuals.

By aligning with Eklund, Pacaso is deploying a modern influencer marketing strategy in a sector traditionally governed by personal relationships and old-world trust. The partnership is designed to do more than just generate leads; it's intended to change the conversation around what it means to own a luxury asset. It seeks to normalize the idea of sharing a multi-million dollar villa in the same way the sharing economy normalized sharing a car or a spare bedroom, albeit for a much wealthier demographic.

The collaboration underscores Pacaso’s ambition to move its co-ownership model from a niche alternative to a standard option for affluent buyers. For a company that reached a $1.5 billion valuation just a year after its 2020 launch, securing a figure like Eklund is a powerful tool to build brand credibility and navigate the complexities of the high-end market.

Is Fractional the Future of the Vacation Home?

At the core of Pacaso’s pitch is a solution to a well-known problem: the inefficiency of traditional second-home ownership. Research indicates that the typical vacation home sits empty for most of the year, with one study showing an occupancy rate of just 11%. Pacaso claims its properties, by contrast, are occupied nearly 90% of the year, spreading usage across up to eight co-owners.

The model is distinct from a timeshare. Pacaso purchases a luxury home, places it into a dedicated Limited Liability Company (LLC), and then sells deeded equity shares, typically from 1/8 to 1/2 of the property. Owners hold a real estate asset that can appreciate in value, and they can sell their share after a one-year minimum holding period. The company handles all aspects of property management, from interior design and maintenance to bill payments and scheduling, for an ongoing management fee.

This turnkey approach has found a receptive audience. After its initial venture capital funding, Pacaso recently closed a Regulation A+ equity offering, raising over $72.5 million from more than 17,500 retail investors, demonstrating broader market confidence. The company has facilitated over $1.2 billion in transactions since its inception and now operates in nearly 40 destinations across the U.S., Mexico, and Europe.

Democratizing Luxury or Repackaging Exclusivity?

While Pacaso promotes its model as expanding access to luxury properties, the concept has faced scrutiny. Critics question whether it truly “democratizes” ownership or simply repackages exclusivity for a slightly broader, yet still ultra-affluent, clientele. While a buyer might acquire a share of a $5 million home for $625,000, this price point remains far beyond the reach of the average person.

The model has also drawn ire from some local communities, who raise concerns about the potential for single-family homes to be operated more like hotels, impacting neighborhood character. Pacaso has consistently countered this by emphasizing that it prohibits short-term rentals and that its co-owners are invested, long-term community members, not transient tourists.

Furthermore, the co-ownership experience comes with trade-offs. Spontaneity is limited by a scheduling system, even with Pacaso's 'SmartStay' algorithm designed to ensure equitable access. Owners must also contend with a niche resale market for their shares, which can be less liquid than selling a whole property. The dependency on Pacaso’s continued success as the managing entity is another factor for potential buyers to consider.

The competitive landscape is also heating up, with other companies like Kocomo, VillaCircle, and Summer entering the space with similar co-ownership platforms. This growing competition suggests a genuine market trend, but it also means buyers will have more options and platforms to evaluate.

The Financials of Fractional Ownership

For prospective buyers, understanding the financial structure is key. Pacaso’s revenue comes from two primary sources: a one-time 12% service fee added to the purchase price of each share and a recurring monthly management fee that covers the property's operating expenses. These ongoing costs, which include property taxes, insurance, maintenance, and utilities, are divided proportionally among the owners.

Financing, once a hurdle for fractional ownership, is becoming more accessible. Pacaso offers its own financing options for qualified buyers, allowing them to finance up to 70% of their purchase. This development is crucial for lowering the initial cash barrier and broadening the model's appeal.

The exit strategy is a critical differentiator from timeshares. Because owners hold a deeded interest in the property via the LLC, they can sell their share on the open market. Pacaso facilitates this process, providing market data and connecting sellers with potential buyers. The company reports that its shares have historically resold for an average gain of 10%, though like any real estate asset, values are subject to market fluctuations.

The partnership with Fredrik Eklund is a clear signal of Pacaso’s intent to dominate this emerging category. By bringing one of real estate’s most recognizable faces into the fold, the company is making a calculated bet that celebrity influence can transform a disruptive idea into the new standard for luxury living.

📝 This article is still being updated

Are you a relevant expert who could contribute your opinion or insights to this article? We'd love to hear from you. We will give you full credit for your contribution.

Contribute Your Expertise →