ProVerum's Gentle BPH Stent: A New Challenger in a $12B Market

With FDA approval and $80M in funding, ProVerum’s ProVee system aims to disrupt the BPH treatment market by prioritizing safety and patient quality of life.

ProVerum's Gentle BPH Stent: A New Challenger in a $12B Market

DUBLIN, Ireland – December 10, 2025 – In the competitive world of medical technology, a significant new player has just been cleared for the field. ProVerum Limited, a Dublin-based spin-out from Trinity College Dublin, announced yesterday it received FDA approval for its ProVee® System, a novel treatment for benign prostatic hyperplasia (BPH). While new device approvals are common, this one signals a potential strategic shift in a market affecting over 12 million men in the U.S. alone. Backed by a fresh $80 million in funding, ProVerum is not just introducing a new product; it's challenging the established order of BPH care with a device built on the principle of a gentler, less invasive approach.

A Non-Ablative Approach to a Common Condition

For decades, the standard interventional treatments for BPH—an enlargement of the prostate gland that obstructs urine flow—have involved a trade-off. Procedures like Transurethral Resection of the Prostate (TURP), long considered the gold standard, effectively remove tissue but come with significant risks, including bleeding, incontinence, and sexual side effects like retrograde ejaculation. Newer minimally invasive options, such as Rezum (steam ablation) and GreenLight (laser vaporization), reduce recovery time but still rely on destroying or removing prostatic tissue.

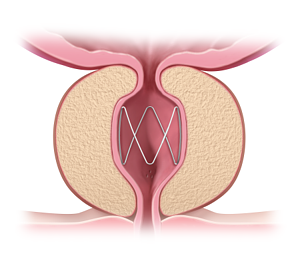

The ProVee System operates on a fundamentally different principle. It is a next-generation prostatic urethral stent, a small, flexible nitinol device designed to be a permanent implant. Rather than cutting, burning, or vaporizing tissue, the ProVee is delivered via a flexible cystoscope—a tool familiar to every urologist—and gently expands to hold open the obstructed prostatic urethra. This non-ablative mechanism, which applies radial force to compress the prostatic lobes, is the core of its value proposition.

The clinical data that secured its FDA approval underscores this focus on safety and quality of life. The ProVIDE trial, a rigorous randomized, double-blind, sham-controlled study, not only met all its primary and secondary endpoints for symptom relief and improved urine flow but did so with a remarkable safety profile. The study reported zero device- or procedure-related serious adverse events. Crucially for many patients, sexual function was preserved throughout the 12-month follow-up, with no instances of de novo sustained retrograde ejaculation or erectile dysfunction. Furthermore, no patients in the trial required catheterization after the procedure, a common and uncomfortable requirement for more invasive treatments.

"The data from the ProVIDE clinical study are very impressive and make a strong case for the ProVee System to become a first-line interventional therapy to treat BPH," said Dr. Steven A. Kaplan, Professor of Urology at the Icahn School of Medicine at Mount Sinai and the study's Global Lead Investigator.

Disrupting the Crowded BPH Device Market

ProVerum enters a fiercely competitive landscape dominated by major med-tech players. The primary battleground for minimally invasive BPH treatments is currently occupied by devices like Teleflex's UroLift and Boston Scientific's Rezum. UroLift, another non-ablative option, uses small implants to pull back prostatic tissue, while Rezum uses steam to ablate it. Both have successfully carved out significant market share by offering an alternative to traditional surgery.

ProVerum's strategy appears to be a direct challenge to these incumbents, positioning ProVee as an even less disruptive option. The company emphasizes its potential as an office-based procedure, possibly performed under local anesthesia, which lowers the barrier to entry for both patients and healthcare systems. The preservation of sexual function is a powerful differentiator that could resonate strongly with a large segment of the BPH patient population who are hesitant to undergo treatments with known sexual side effects.

This patient-centric focus on a "gentle revolution" could prove to be a potent market-disruption tool. While UroLift also preserves sexual function, ProVee's stent-based design offers a different mechanical approach. Its design as a permanent but retrievable implant also seeks to overcome the historical drawbacks of older prostatic stents, which were often plagued by complications like migration and tissue ingrowth, making them difficult to manage or remove. By engineering a solution that appears to have learned from the past, ProVerum is making a calculated bid to redefine the prostatic stent category altogether.

The Financial Firepower for a US Launch

A groundbreaking device is only as good as the commercial strategy behind it. Here, ProVerum has demonstrated serious intent. Coinciding with its regulatory progress, the company recently closed a substantial $80 million Series B financing round. The round was led by MVM Partners, a prominent healthcare investor, and included participation from other major players like OrbiMed and the Ireland Strategic Investment Fund (ISIF). This infusion of capital, which brings the company's total funding to over $124 million, provides the financial muscle necessary for a robust commercial launch in the lucrative U.S. market.

The funds are earmarked for scaling up production, building a commercial team, and executing a market-entry strategy. This level of financial backing from sophisticated healthcare investors signals strong confidence not only in the ProVee technology but also in ProVerum's ability to navigate the complex U.S. healthcare market and compete with established giants. For a university spin-out founded in 2016, securing the largest-ever funding round for an Irish university spin-out is a testament to the perceived value of its innovation. The company's stated goal is to establish ProVee as a "first-line interventional therapy," suggesting an aggressive strategy aimed at capturing patients earlier in their treatment journey, before they move on to more invasive options.

The Next Hurdle: Securing Reimbursement

While FDA approval and significant funding are monumental achievements, the final and perhaps most critical test for ProVerum lies in securing reimbursement. In the U.S. healthcare system, a device's commercial success is inextricably linked to its coverage by Medicare and private insurance companies. Without clear and favorable reimbursement codes and policies, patient access remains limited, and adoption by physicians can stall.

ProVerum now faces the complex task of convincing payers that the ProVee System is not just clinically effective but also economically sound. The company will need to differentiate its permanent, retrievable stent from older "temporary prostatic stents," which some major insurers still classify as investigational and do not cover. The goal will be to secure a reimbursement pathway similar to that of established MISTs like UroLift, which has dedicated CPT codes for its procedure.

The strong clinical data from the ProVIDE study—particularly the lack of post-procedure catheterization and serious adverse events—will be a crucial asset in these negotiations. A procedure that avoids complications and potential re-interventions can present a compelling cost-effectiveness argument to payers. ProVerum's journey is far from over; having conquered the regulatory and funding mountains, it now must navigate the intricate terrain of market access and reimbursement to deliver its promising technology to the millions of men it aims to help.

📝 This article is still being updated

Are you a relevant expert who could contribute your opinion or insights to this article? We'd love to hear from you. We will give you full credit for your contribution.

Contribute Your Expertise →