Plugsic's 'Delta-Zero' Aims to End 'Gambling' for Retail Traders

- 3 Automated Functions: Delta-Zero combines real-time hedging, basis capture logic, and an automated kill-switch for risk management. - Non-Custodial Architecture: Users retain full custody of funds via API integration with their brokerage accounts. - Early User Feedback: Anecdotal reports suggest the strategy outperforms simple HODLing during flat/sideways markets.

Experts would likely conclude that Plugsic's Delta-Zero protocol represents a significant advancement in democratizing institutional-grade risk management tools for retail crypto investors, shifting the focus from speculative trading to market-neutral strategies for sustainable yield.

Plugsic Unlocks Institutional Hedging for Retail Crypto Investors

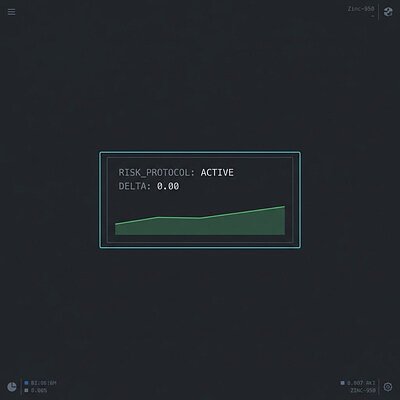

NEW YORK, NY – January 19, 2026 – Financial technology provider Plugsic has officially deployed its "Delta-Zero" risk management protocol, introducing a level of automated, defensive trading infrastructure previously confined to the world's most sophisticated proprietary trading desks. The update to its "Sovereign Execution" platform aims to fundamentally reshape how independent investors interact with volatile markets, particularly in the digital asset space, by mathematically isolating positions from price volatility.

For years, the retail trading experience has been largely defined by directional speculation—betting on whether an asset's price will rise or fall. This approach, while simple, exposes investors to significant and often unpredictable risk. Plugsic's new protocol offers a stark alternative by enforcing a strict market-neutral mandate, a strategy long considered the bedrock of institutional capital preservation.

The End of 'Directional Gambling'

The core philosophy behind Delta-Zero is to shift the focus from predicting market direction to profiting from market mechanics. Instead of incentivizing what the company calls "directional gambling," the software automates the complex process of hedging to maintain a portfolio that is, in theory, immune to the underlying asset's price swings.

"The defining characteristic of institutional capital preservation is neutrality," stated Matt Thompson, CFO at Plugsic, in the company's announcement. "Institutions don't gamble on which way the wind blows; they build windmills. Our Delta-Zero protocol is that windmill. It allows self-directed users to deploy logic that profits from market mechanics rather than market mood."

This approach represents a significant step in democratizing finance, moving beyond simply providing access to markets and instead equipping retail users with the sophisticated defensive tools needed for long-term survival. The goal is to capture yield not from risky price bets, but from inherent market inefficiencies.

How Delta-Zero Works: An Institutional Toolkit

The protocol's power lies in a combination of three key automated functions that run directly on a user's own brokerage account via API, a crucial feature that ensures users retain full custody of their funds and eliminates counterparty risk.

First is Real-Time Hedging. The system continuously monitors a user's portfolio exposure on a millisecond-by-millisecond basis. If the portfolio's net position begins to lean "long" (betting on a price increase) or "short" (betting on a decrease), the protocol instantly executes a counter-trade to re-establish neutrality. This dynamic rebalancing is critical in the fast-moving digital asset markets, where a portfolio's risk profile can change in an instant.

Second, the protocol employs Basis Capture Logic. This is a form of arbitrage that identifies and exploits small pricing differences between an asset's price on the spot market and its price in the futures market. By simultaneously buying the asset in one market and shorting it in the other, the system aims to lock in this "basis" or spread. Because the long and short positions cancel each other out, the user is hedged against price movements, with the potential profit coming from the captured spread and associated funding rates—a popular market-neutral strategy among professional crypto traders.

Finally, Delta-Zero includes an automated "Kill-Switch." This is a pre-programmed safety mechanism designed to protect capital above all else. In the event of an extreme market event like a "flash crash" or a sudden liquidity crisis, the protocol is designed to automatically exit all active positions and convert holdings into stable collateral, such as USDC or USDT. This feature acts as an emergency brake, prioritizing the preservation of principal when market conditions become dangerously unpredictable.

A New Path to Sustainable Yield

The launch of Delta-Zero comes as many investors are seeking more reliable sources of return in an often-turbulent economic climate. The high-risk, high-reward nature of crypto has attracted speculators, but has also deterred more conservative capital. By offering a tool designed for risk mitigation, Plugsic is targeting a different kind of market participant.

"We are seeing a flight to quality," Thompson added. "Our users aren't looking for a lottery ticket. They are looking for boring, predictable, mathematical yield. That is what infrastructure is supposed to provide."

This sentiment appears to be resonating. While the protocol is new, early anecdotal evidence from online trading forums suggests that users of Plugsic's beta platform have found value in its market-neutral approach. One user recently noted that the strategy was "significantly outperforming simply HODLing" during periods of flat or sideways market movement.

The protocol's non-custodial architecture is another significant differentiator in a competitive landscape. By operating as a middleware layer that connects to a user's existing brokerage account, Plugsic avoids taking custody of assets. This model directly addresses one of the primary risks in the digital asset space: the danger of exchange collapses or platform insolvency. Users maintain control of their capital, granting the software permission to execute trades on their behalf without ever handing over their funds.

While other platforms offer automated trading bots or elements of risk management, the integration of real-time delta hedging, basis capture, and an automated kill-switch into a single, non-custodial protocol for retail users appears to be a novel development. The company is positioning itself not as another trading platform, but as a provider of critical financial infrastructure, shifting the industry conversation from mere "access" to long-term "sustainability" for the self-directed investor. The protocol is now live for existing beta users of the Sovereign Execution platform, with new access requests being processed on a rolling basis.