PayPal's New Ad Engine: Turning Transactions into Targeting Gold

PayPal is leveraging its vast transaction data to challenge ad giants, offering advertisers a direct view of actual purchases, not just clicks.

PayPal's New Ad Engine: Turning Transactions into Targeting Gold

SAN JOSE, CA – January 06, 2026 – PayPal has officially entered the digital advertising arena with a formidable new weapon: its vast trove of first-party transaction data. The company today launched PayPal's Transaction Graph Insights & Measurement program, a new advertising solution designed to give merchants a direct, cross-platform view into actual consumer purchase behavior, moving far beyond the traditional metrics of clicks and impressions.

The move signals a significant strategic pivot for the payments giant, aiming to monetize its unique position at the heart of digital commerce and challenge the dominance of established ad tech "walled gardens" like Google, Meta, and Amazon.

Unlocking the Full Purchase Journey

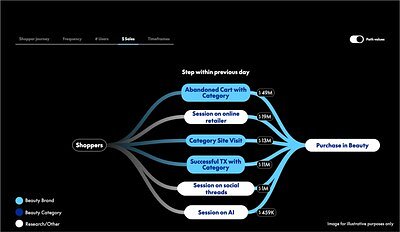

At the core of the new offering is what PayPal calls its "Transaction Graph." This system connects purchase data and user activity signals across its ecosystem, which includes over 430 million consumer accounts and tens of millions of merchants globally. Unlike platforms that only see activity within their own environment, PayPal's graph aims to construct the complete, and often messy, path to purchase.

For example, a consumer's journey for a new pair of running shoes might start with a search on a retailer's site, price comparisons on a marketplace, and reading reviews on a social platform. They might use Venmo to pay a friend for a race entry fee, then finally purchase the shoes and other gear using PayPal Checkout. While other ad platforms see isolated fragments of this journey, PayPal claims it can connect these disparate events into a single, coherent narrative of high intent.

"The era of the empowered shopper demands advertising solutions built on real commerce data, not modeled intent," said Mark Grether, Senior Vice President and General Manager of PayPal Ads. "Unlike walled-garden platforms that only see activity within their own ecosystem... PayPal's Transaction Graph connects verified purchases across tens of millions of merchants. This means you can see which campaigns actually drive sales, not just clicks or impressions."

This shift from probabilistic models to deterministic, purchase-based identity is the program's central value proposition. In a digital landscape grappling with the demise of third-party cookies, PayPal is betting that its verified, first-party data will provide a more accurate and durable foundation for ad targeting and measurement.

A Strategic Diversification Beyond Payments

The launch is more than just a new product; it represents a calculated move by PayPal to diversify its revenue streams and build a new growth engine. The company has been signaling its ambitions in the ad space, notably with the appointment of Grether in 2024 to build out its advertising business. This initiative is a cornerstone of that strategy, turning a massive data asset—previously used primarily for payment processing and security—into a high-margin commercial product.

This places PayPal in direct competition not only with tech giants but also with other players in the burgeoning commerce media space. Retail media networks have grown by leveraging their own first-party sales data, but their view remains confined to their own stores. Even other payment networks are waking up to the opportunity, with Mastercard having launched its own commerce media network in late 2025. PayPal's competitive edge, however, lies in the sheer breadth of its network, which spans across a diverse range of online merchants, big and small.

By offering advertisers insights into true category market share and the ability to identify high-intent shoppers before they convert elsewhere, PayPal is positioning itself as an indispensable tool for understanding the entire digital marketplace, not just a single corner of it.

Early Wins and Building Advertiser Trust

To prove its efficacy, PayPal is highlighting early success stories. Ulta Beauty, the nation's largest specialty beauty retailer, used the platform's Offsite Ads to target a high-intent audience. The results were compelling: compared to the weeks prior, Ulta saw a 20% increase in transaction spend via PayPal during the campaign. A brand lift study conducted by measurement partner Lucid also showed a 136% increase in brand favorability, far exceeding the benchmark.

This ability to demonstrate tangible sales lift is resonating with other major brands. "When PayPal Ads showed us their Transaction Graph insights, we immediately saw the potential," said Monica Austin, CMO at Blizzard Entertainment. "The ability to leverage commerce intelligence across game releases, performance media, and attribution measurement aligns perfectly with how we think about continually improving player engagement."

Recognizing that self-reported metrics can be met with skepticism, PayPal has also launched a Measurement Partnership Program. This program enlists a certified list of independent third-party validators—including industry heavyweights like AppsFlyer, Cint, Experian, iSpot, Kantar, Kochava, and LiveRamp—to provide objective campaign validation. This strategic move is designed to build trust and assure advertisers of the integrity of the results.

The Privacy Tightrope

Leveraging sensitive financial transaction data for advertising inevitably places PayPal under a microscope. As the company operates globally, it must navigate a complex web of data protection regulations, including Europe's GDPR and California's CCPA. The core challenge will be balancing the delivery of granular, person-level insights for advertisers with the stringent privacy and consent obligations owed to its 430 million users.

While the company has over 25 years of experience managing sensitive data, using it for advertising is a new frontier that will be closely watched by consumers and regulators alike. Transparency about how data is used, aggregated, and anonymized, along with providing users with clear and simple opt-out controls, will be critical to maintaining trust. The success of this ambitious ad tech venture will depend not only on the power of its data but also on its ability to walk this privacy tightrope flawlessly.

The program is immediately available for US-based advertisers, with a planned expansion into the United Kingdom and Germany to follow.

📝 This article is still being updated

Are you a relevant expert who could contribute your opinion or insights to this article? We'd love to hear from you. We will give you full credit for your contribution.

Contribute Your Expertise →