Metallis Strikes Silver and Strategy with Idaho Antimony Discovery

- 4,859 g/t AgEq over 0.15 meters in drill hole GH25-05, the highest-grade intercept at the Greyhound Property

- 5.02% antimony concentration, a critical mineral with strategic geopolitical importance

- C$33 million market capitalization of Metallis Resources prior to the discovery

Experts would likely conclude that Metallis Resources' high-grade polymetallic discovery in Idaho, particularly its significant antimony content, positions the Greyhound Property as a strategically important asset in the quest for domestic critical mineral supply chains, though further exploration and permitting challenges remain.

Metallis Strikes Silver and Strategy with Idaho Antimony Discovery

VANCOUVER, BC – December 04, 2025 – In the high-stakes world of junior mineral exploration, a single drill program can redefine a company's trajectory. Metallis Resources Inc. (TSXV: MTS) may have just experienced such a moment, announcing a high-grade polymetallic discovery at its Greyhound Property in central Idaho that carries implications far beyond its impressive silver and gold intercepts. The discovery includes significant concentrations of antimony, a critical mineral at the heart of geopolitical supply chain tensions, positioning this historic mining district as a potential new node in America's quest for resource independence.

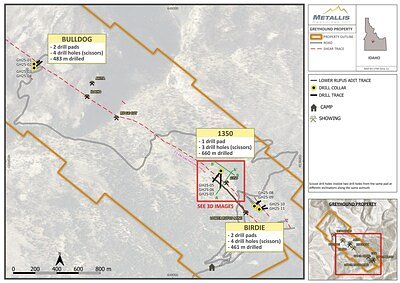

Metallis's inaugural diamond drilling program at the '1350 Zone' returned bonanza-grade results that have captured the market's attention. The headline intercept from drill hole GH25-05 featured a stunning 4,859 g/t silver equivalent (AgEq) over 0.15 meters within a broader interval of 795 g/t AgEq over 1.48 meters. Other holes confirmed the system's strength, with GH25-07 hitting 15.45 meters of 142 g/t AgEq. These results confirm not just high-grade pockets, but the potential for a robust, continuous mineralized system that remains open for expansion in all directions.

Unearthing a Polymetallic Prize

The Greyhound property is not new territory for miners. The area was an active silver camp in the early 1900s, but has seen little modern exploration since. Metallis, which optioned the property in February 2024, has applied modern geological models and exploration techniques to a district whose full potential was never realized. The company's work has validated historical data, which pointed to a high-grade system, but has also revealed crucial new dimensions.

"The exceptional silver grades, combined with consistently strong gold values that were historically underappreciated, underscore the strength of this system," commented Fiore Aliperti, Metallis' President and CEO, in the company's press release. Indeed, intercepts like 1.5 g/t gold over 3.8 meters are significant, adding another layer of economic potential to the silver-rich veins.

Perhaps most compelling from an exploration standpoint is the "blind discovery" of a second, parallel mineralized shear zone intersected about 50 meters away from the main target. This unexpected find, which returned 403.8 g/t AgEq over 0.75 meters, fundamentally expands the project's scope. It suggests the mineralizing event was more widespread than previously understood, opening up significant new target areas and transforming the Greyhound property from a single-vein prospect into a potential district-scale opportunity.

The Antimony Angle: Idaho’s Emerging Critical Mineral Hub

While the precious metal grades provide the initial luster, the story's strategic depth comes from a less familiar element: antimony. The drill core returned grades as high as 5.02% antimony, confirming that Greyhound is an antimony-rich system. This is not merely a geological curiosity; it is a matter of significant economic and strategic importance.

Antimony is designated a critical mineral by the United States and other Western nations for its essential role in defense and technology. It is used to create hardened lead alloys for batteries and ammunition and is a key component in flame retardants for everything from military uniforms to electronics. For decades, global supply has been dominated by China, which has recently implemented export restrictions, causing price spikes and underscoring the vulnerability of Western supply chains.

This discovery does not exist in a vacuum. The Greyhound property is located just 35 kilometers south of Perpetua Resources' Stibnite Mine, a major, fully permitted gold-antimony project poised to become the only domestic source of mined antimony in the United States. The emergence of another significant antimony discovery in the same geological region strengthens the case for central Idaho becoming a strategic hub for this critical mineral. This regional synergy could foster the development of integrated processing infrastructure, reducing reliance on foreign facilities and creating a secure, domestic antimony supply chain from mine to market.

A Small Cap's Big Bet on Idaho

For Metallis Resources, a junior explorer with a market capitalization of around C$33 million prior to this news, the discovery is potentially transformative. The company's primary focus has been its Kirkham Property in British Columbia's Golden Triangle, but its strategic foray into Idaho now appears to be a masterstroke. The inaugural drill program at Greyhound has successfully confirmed the high-grade thesis, significantly de-risking the project and providing a clear path forward for expansion.

"By identifying the position of the high-grade band within the thick shear and refining our understanding of the structural controls, the team has established a clear framework for expanding this discovery," Aliperti stated, signaling a confident and systematic approach to follow-up work. The company plans to return to the site as soon as seasonal access allows to build on these results.

The credibility of the findings is bolstered by adherence to industry-standard protocols, with a Qualified Person overseeing the program and samples analyzed by accredited labs. This technical rigor is crucial for building the market confidence necessary to fund the extensive follow-on drilling required to delineate a resource.

The Path Forward: Geology, Grades, and Governance

Despite the excitement, the path from discovery to production is long and requires navigating technical, financial, and regulatory challenges. Exploration is inherently uncertain; results from the Bulldog target on the same property were less conclusive due to poor drill recoveries in oxidized, near-surface rock. This serves as a reminder that even on a promising property, success is not guaranteed with every drill hole.

Furthermore, while Idaho is considered a top-tier mining jurisdiction, the permitting process for any new mine is a multi-year endeavor. The presence of polymetallic mineralization, including lead and zinc alongside antimony, will require meticulous environmental planning and community engagement to secure the social and regulatory license to operate. The nearby Stibnite project, while ultimately successful in its permitting, provides a case study in the complexities and timelines involved.

Metallis has noted geological similarities between the Greyhound mineralization and that of the prolific Lucky Friday Mine in northern Idaho, another deep, high-grade, structurally controlled vein system. While no guarantee of success, this geological analogue provides a powerful model for what Greyhound could become. With a combination of high-grade precious metals and a strategically vital critical mineral, Metallis has uncovered a deposit that is perfectly timed for the current economic and geopolitical climate.