Lumber Wars: US Industry Fires Back on Housing Cost Blame

A U.S. lumber group refutes claims that tariffs drive up home prices, arguing Canada's unfair trade practices are the real issue in the ongoing dispute.

Lumber Wars: US Industry Fires Back on Housing Cost Blame

WASHINGTON, DC – January 06, 2026 – The long-simmering trade dispute over softwood lumber between the United States and Canada has erupted anew, with a major U.S. industry group launching a forceful counter-offensive against claims that American trade policies are fueling the nation's housing affordability crisis. The U.S. Lumber Coalition issued a statement today accusing Canada and the National Association of Home Builders (NAHB) of disseminating "misinformation" and arguing that the focus on lumber costs is a distraction from the real issues.

In its statement, the coalition asserts that softwood lumber prices, when adjusted for inflation, are at historically low levels—54% lower than their 1975 average. This directly challenges the narrative pushed by home builders and Canadian officials, who have consistently linked U.S. tariffs on Canadian lumber to rising construction costs for American families. The coalition is calling for Canada to "right-size its lumber industry consistent with market realities" rather than relying on what it describes as unfairly subsidized exports to the United States.

"The true aim of the U.S. trade remedy measures... is to enable the U.S. lumber industry to grow to its potential without market-disrupting surges of imported lumber," stated Zoltan van Heyningen, Executive Director of the U.S. Lumber Coalition. The statement marks a significant escalation in rhetoric, reframing the debate from one of consumer costs to one of fair trade and domestic industrial strategy.

A Battle of Numbers: Deconstructing the Cost of a Home

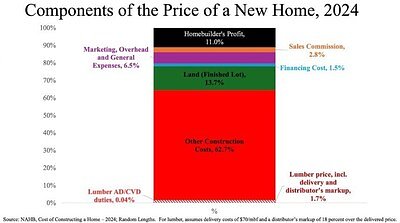

At the heart of the conflict is a fundamental disagreement over how much lumber truly contributes to the price of a new home. The U.S. Lumber Coalition contends that the material accounts for a mere 1-2% of the final sales price, making its cost a negligible factor in the broader housing affordability equation. They argue that factors like land value, labor shortages, and regulatory burdens are the primary drivers of skyrocketing home prices.

To support this, the coalition points to a stark divergence in trends: while new home prices have continued to climb, they note that softwood lumber prices have fallen dramatically from their pandemic-era peaks. This, they argue, proves the two are disconnected. "The cost of lumber makes up less than 2 percent of the total cost of a new home, and hence never has and never will be a factor in housing affordability," the coalition's press release declared.

However, U.S. home builders paint a very different picture. The NAHB has consistently argued that tariffs directly translate to higher costs passed on to buyers. Their economic analyses have suggested that lumber's share of the construction cost—a different metric than final sales price—is significantly higher, with some reports placing the rough lumber package between 6.5% and 8% of the total build cost. In recent years, the NAHB has estimated that price volatility and tariffs have added thousands of dollars to the price tag of an average single-family home. This discrepancy in metrics—final sales price versus construction cost—lies at the core of the dueling economic narratives.

The Roots of the Dispute: Subsidies and Tariffs

The current tariffs are not a new phenomenon but the latest chapter in a trade saga spanning decades. The U.S. government, spurred by petitions from domestic producers, has long alleged that Canada's lumber industry is unfairly subsidized. The central claim revolves around "stumpage fees"—the rates provincial governments charge for harvesting timber on public lands. U.S. producers argue these fees are set artificially low, giving Canadian companies an unfair cost advantage.

These allegations have been repeatedly investigated by the U.S. Department of Commerce, which has consistently found evidence of both subsidization and "dumping"—the practice of selling lumber in the U.S. market for less than it costs to produce or sells for in Canada. These findings are the legal basis for imposing the antidumping and countervailing duties (AD/CVD) on most Canadian softwood lumber imports.

Canada has vehemently and consistently rejected these claims. Canadian officials, from the federal Minister of International Trade to provincial leaders, have labeled the duties "unjustified" and "punitive." They maintain that their forestry management practices are fair and not equivalent to a subsidy. Ottawa has repeatedly challenged the U.S. tariffs through dispute settlement panels under both the World Trade Organization (WTO) and the Canada-United States-Mexico Agreement (CUSMA), vowing to defend its industry and workers.

An American Industry Rebuilds

For the U.S. Lumber Coalition, the enforcement of these trade laws is not merely punitive but strategic. They frame the tariffs as a necessary shield that allows the domestic industry to invest, expand, and create American jobs. According to their data, the strategy is working. The coalition reports that since the current AD/CVD cases began in 2016, the U.S. lumber industry has increased its production capacity by over 8 billion board feet.

"Eight years of enforcing AD and CVD laws have already demonstrated that U.S. producers are prepared to capitalize on that opportunity," van Heyningen explained in the release. He elaborated that this growth trajectory, if sustained, could allow the U.S. industry to achieve a capacity level sufficient to meet the nation's consumption needs in a typical year.

This narrative of a domestic manufacturing renaissance is central to the coalition's argument. They contend that a stronger, more self-reliant U.S. lumber industry provides a more stable and secure supply chain for building American homes. The goal, as van Heyningen put it, is to see "U.S. capacity expansions" that reduce reliance on what they deem to be volatile and unfairly traded Canadian imports. This vision directly counters Canadian arguments that the U.S. housing market cannot function without a steady flow of lumber from north of the border.

📝 This article is still being updated

Are you a relevant expert who could contribute your opinion or insights to this article? We'd love to hear from you. We will give you full credit for your contribution.

Contribute Your Expertise →