H&R REIT’s $1.5B Overhaul Signals a New Real Estate Era

- $1.5 billion: Value of retail and office properties H&R REIT is divesting

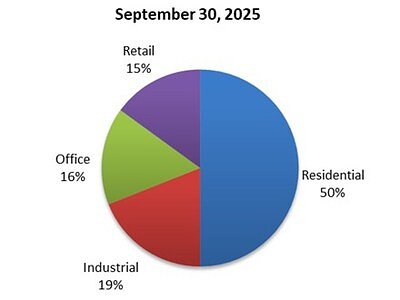

- 83%: Projected concentration of residential and industrial assets post-sale (up from 69%)

- 9.3x to 8.7x: Expected improvement in debt-to-Adjusted EBITDA ratio after the transaction

Experts would likely conclude that H&R REIT's aggressive portfolio overhaul reflects a strategic response to shifting commercial real estate dynamics, prioritizing resilience in residential and industrial sectors while reducing exposure to struggling office and retail markets.

H&R REIT’s $1.5B Overhaul Signals a New Real Estate Era

TORONTO, ON – November 25, 2025 – H&R Real Estate Investment Trust has fired the starting gun on a dramatic portfolio reshaping, announcing binding agreements to divest $1.5 billion of its retail and office properties across Canada and the United States. The move is the most aggressive step yet in a multi-year strategy to pivot away from the struggling traditional commercial sectors and double down on the more resilient residential and industrial asset classes.

The proceeds, which approximate the assets' September 30, 2025, IFRS valuations, are earmarked primarily for debt repayment. This financial maneuver is designed not only to simplify the REIT’s complex structure but to significantly strengthen its balance sheet, positioning it for what management hopes will be a new era of growth and long-term unitholder value.

The Anatomy of a Strategic Pivot

This decisive action is the culmination of a strategy set in motion back in June 2021. At that time, H&R announced a “transformational strategic repositioning plan” to transition from a broadly diversified REIT into a more focused entity. When the plan began, its residential and industrial holdings amounted to just 35% of the total portfolio. The goal was clear: shed non-core assets to unlock value and reinvest in higher-growth sectors.

The journey has been methodical. Key milestones included the spin-off of its enclosed mall portfolio into Primaris REIT and the blockbuster $1.47 billion sale of the Bow office tower and Bell office campus. Now, this latest $1.5 billion divestiture represents a massive acceleration.

"These sales accelerate the REIT's portfolio simplification strategy of selling office and retail properties, while reducing leverage and positioning the REIT to drive sustainable long-term value for all unitholders," stated Tom Hofstedter, Executive Chair and Chief Executive Officer, in the official announcement.

The assets on the chopping block are significant and diverse, including H&R’s 33.1% stake in Echo Realty L.P.'s U.S. retail portfolio, 27 Canadian retail properties, and three major office towers: Hess Tower in Houston, and 145 Wellington and 88 McNabb in the Toronto area. Once these sales close, primarily in January 2026, H&R’s portfolio composition will be unrecognizable from its 2021 profile. The concentration in residential and industrial assets will leap from 69% to a commanding 83%, fundamentally altering the REIT's risk profile and growth trajectory.

Reading the Commercial Real Estate Tea Leaves

H&R’s move is not happening in a vacuum; it’s a calculated response to a deeply bifurcated commercial real estate market. The "flight to quality" trend has become the defining narrative, particularly in the office sector. Modern, amenity-rich, and environmentally sustainable buildings are commanding premium rents, while older, less-desirable properties face soaring vacancy rates and immense refinancing challenges.

Across North America, office vacancy rates remain stubbornly high, with the U.S. national rate hovering near 19%. While return-to-office mandates are driving some demand, it is almost exclusively for top-tier spaces. This leaves a vast inventory of Class B and C office buildings in a precarious position. H&R's sale of assets like Hess Tower—especially ahead of Hess Corporation’s planned departure from a third of the building in 2026—appears to be a prescient move to de-risk before market conditions potentially worsen for that specific asset.

The retail sector tells a similar, albeit more nuanced, story. While headlines have long been dominated by the "retail apocalypse," the reality is more complex. Essential retail, such as grocery-anchored centers and quick-service dining, has proven remarkably resilient. However, the broader market for traditional retail space remains under pressure from e-commerce and shifting consumer habits. By divesting a large swath of its Canadian retail properties and its stake in a U.S. portfolio, H&R is effectively reducing its exposure to these long-term secular headwinds. The timing capitalizes on a period of relative stability in the essential retail market while exiting before any potential downturn.

Deleveraging for a New Era of Growth

Beyond the strategic repositioning, this $1.5 billion transaction is a masterclass in financial engineering. Of the gross proceeds, approximately $1.1 billion will flow directly to repaying corporate debt. The buyer of the Echo Realty stake will also assume around $369 million in debt, further lightening H&R's balance sheet.

This deleveraging is critical. As of September 30, 2025, H&R’s debt-to-Adjusted EBITDA ratio stood at 9.3x. Post-transaction, the REIT projects this key leverage metric will improve to a more manageable 8.7x, with a stated goal of keeping it below 9.0x going forward. This newfound financial fortitude provides crucial breathing room in a higher-interest-rate environment and enhances the company's capacity for future growth initiatives.

The move does come with a short-term trade-off. The divested assets contributed $33.3 million to Q3 2025 net operating income. H&R estimates that had the sales been completed earlier, its Funds from Operations (FFO) would have been lower by approximately $0.06 per unit in the third quarter. This highlights the profitability challenges that have weighed on the company, which reported a net loss of $322.87 million in Q3 2025, largely due to writedowns on the very office assets it is now selling.

However, management is looking past the immediate FFO dilution. The strengthened balance sheet creates new opportunities for capital allocation. The REIT has already signaled its intent to apply for a Normal Course Issuer Bid (NCIB), which could see it use up to $200 million of its new debt capacity to repurchase its own units. For a REIT whose units have traded at a persistent discount to its Net Asset Value (NAV), an accretive buyback program could be a powerful tool for delivering direct value to unitholders.

A Sharpened Portfolio and the Path Ahead

With this sale, H&R REIT is emerging as a leaner, more focused entity. The remaining portfolio will be dominated by its Lantower Residential platform in high-growth U.S. sunbelt markets and its industrial properties. While the industrial segment has seen a recent dip in occupancy and operating income, the long-term fundamentals of logistics and e-commerce-driven demand remain robust.

The REIT's retail exposure will shrink to a single, high-performing asset: a 342,000-square-foot component of the mixed-use River Landing development in Miami. This property, which also includes residential and office space, saw its net operating income increase by 5.3% year-over-year in Q3 2025, demonstrating the value of well-located, modern mixed-use developments.

The transformation is not yet complete. H&R confirmed it remains in negotiations to sell two more significant Toronto office properties (310-330 Front St. W. and 25 Sheppard Ave. W.). Furthermore, these sales are part of a wider negotiation process for assets totaling approximately $2.6 billion, suggesting another $1.1 billion in dispositions could be on the horizon. As CEO Tom Hofstedter noted, the REIT will "begin to market a number of other properties to aggressively accelerate this strategy." For investors and analysts watching from the sidelines, the message is clear: H&R REIT is not just renovating; it is rebuilding its foundation for a new and very different future.