Chartwell Signals Stability Amid Seniors Housing Boom

- Cash Distribution: $0.051 per Trust Unit, payable February 17, 2026

- FFO Growth: 14% compound annual growth rate projected (2024–2026)

- Occupancy Rate: 94.8% (as of December 31, 2025)

Experts view Chartwell’s stable payouts and strong occupancy rates as positive indicators, though they caution that long-term reliability depends on managing high payout ratios and regional market variations.

Chartwell Eyes Growth with Stable Payouts in Seniors Housing Boom

MISSISSAUGA, ON – January 15, 2026 – Chartwell Retirement Residences (TSX: CSH.UN), one of Canada’s largest seniors housing operators, has signaled confidence in its financial and operational standing with the announcement of its January 2026 cash distribution and a detailed occupancy update. The release provides a window into the company's strategy of balancing shareholder returns with portfolio growth, all while navigating the powerful demographic tailwinds of Canada’s aging population.

The company declared a cash distribution of $0.051 per Trust Unit, payable on February 17, 2026. This move, coupled with an ongoing Distribution Reinvestment Plan (DRIP) offering a 3% bonus in units, underscores an effort to maintain investor appeal through consistent payouts.

A Closer Look at Financial Health and Payouts

For income-focused investors, the sustainability of distributions is paramount. Chartwell's ability to maintain its monthly payout hinges on its financial performance, particularly its Funds From Operations (FFO), a key metric for real estate trusts. Recent data shows a positive trajectory, with FFO per unit from continuing operations growing from $0.51 in 2023 to $0.76 in 2024. This upward trend is supported by analyst forecasts, with some projecting a robust 14% compound annual growth rate for FFO per unit between 2024 and 2026.

However, the company's payout ratio—the proportion of earnings paid out as distributions—remains a critical point of analysis. In mid-2025, Chartwell’s payout ratio was reported at 79%. While considered high, it is not uncommon in the real estate sector. Earlier analyses from late 2023 had flagged the FFO and Adjusted Funds from Operations (AFFO) payout ratios as elevated, but with an expectation of improvement through 2024 and 2025. Projections for 2024 aimed for an 83% FFO payout ratio, suggesting a gradual move towards a more sustainable level.

Contrasting this optimism, some historical analyses have pointed to volatility in earnings and FFO over the past decade, raising questions about long-term reliability. Despite these concerns, current-year analyst expectations for earnings growth remain strong at over 11%, reflecting confidence in the sector's favorable market conditions.

Occupancy Strength and Strategic Portfolio Shifts

Operational performance, particularly resident occupancy, is the engine that drives financial results. Chartwell's latest update reveals a weighted average occupancy of 94.8% for its newly defined 2026 'same property' portfolio as of December 31, 2025. This figure reflects a strategic change in how the company reports its core assets.

Effective January 1, 2026, the 'same property' portfolio was expanded to 99 properties and 16,566 suites. This was achieved by integrating 11 properties from its 'Growth' category and two from 'Repositioning.' This move is designed to provide investors with a clearer view of the performance of its mature, stabilized assets by excluding properties still under development or slated for sale. The integration of these properties, which had slightly lower average occupancy rates, resulted in the modest adjustment of the portfolio's overall occupancy from the 95.2% reported for the smaller 2025 portfolio.

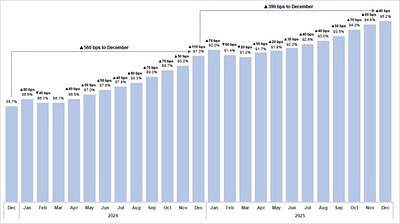

This update is the latest milestone in a period of impressive recovery. The Canadian senior living sector saw average occupancy rebound from a low of approximately 78% during the pandemic in 2021 to nearly 92% by mid-2025. Chartwell's own results mirror this industry-wide trend, with the company reporting significant year-over-year occupancy gains in each quarter leading up to this announcement. It posted a 510 basis point increase in Q4 2024 and a 530 basis point increase in Q1 2025, demonstrating sustained momentum in filling its suites.

Riding the Demographic Wave

Chartwell's performance is inextricably linked to Canada's demographic destiny. The nation is experiencing an unprecedented expansion of its senior population. As of late 2024, nearly 7.6 million Canadians, or 18.9% of the population, were aged 65 or older. Projections indicate this will climb to 23% by 2030, with the 85-and-over cohort expected to triple by 2046.

This 'silver tsunami' is the primary driver of demand for the continuum of care Chartwell provides, from independent living to long-term care. The demand is further intensified by favorable supply-side dynamics. A slowdown in new construction starts, combined with a persistent shortage of publicly funded long-term care beds, has created a supply-demand imbalance that benefits private operators.

These market fundamentals have fueled strong rental growth, with average rent increases in the 4% to 6% range annually in 2023 and 2024. This has led some market observers, such as Hazelview Investments, to identify seniors housing as a leading sector for Canadian REITs, potentially set to outperform other real estate asset classes over the next decade. While the overall outlook is bright, regional variations persist. Markets like Durham, Calgary, and Ottawa have seen a slower occupancy recovery due to localized supply overhangs, a challenge that requires careful navigation. As a market leader, Chartwell is well-positioned to leverage its scale and operational expertise to capitalize on the powerful, long-term demographic opportunity. The company's strategic portfolio management and focus on operational excellence are key to converting these demographic tailwinds into tangible growth and sustained shareholder value.

📝 This article is still being updated

Are you a relevant expert who could contribute your opinion or insights to this article? We'd love to hear from you. We will give you full credit for your contribution.

Contribute Your Expertise →