Albertsons' AI Gambit: A Bet on the Four-Minute Grocery Shop

- 46 minutes: Average time consumers spend on grocery shopping (Capital One Shopping Research).

- 4 minutes: Time Albertsons claims its AI assistant can reduce grocery shopping to.

- 25%: Recent quarterly digital sales growth for Albertsons, now accounting for 9% of total grocery revenue.

Experts view Albertsons' AI shopping assistant as a strategic move to dominate digital grocery commerce, but caution that success will depend on balancing innovation with consumer trust and privacy concerns.

Albertsons' AI Gambit: A Bet on the Four-Minute Grocery Shop

BOISE, ID – December 03, 2025 – The weekly grocery shop, a ritual that Capital One Shopping Research estimates takes the average consumer 46 minutes, is the latest battleground for artificial intelligence. Albertsons Companies (NYSE: ACI) has fired a significant volley with the launch of its AI shopping assistant, a sophisticated digital tool the company claims can slash that time to a mere four minutes. This move is more than just a new feature; it's a strategic declaration in the high-stakes race to dominate the digital grocery aisle, placing Albertsons at the forefront of a major shift toward what the industry is calling 'agentic commerce.'

Available across its 22 banners, including Safeway, Vons, and Jewel-Osco, the AI assistant, powered by OpenAI models, aims to transform the customer journey from a passive search-and-click process into a dynamic, conversational experience. It represents a significant investment in a digital-first strategy, one that acknowledges the changing habits of consumers who increasingly value convenience and personalization above all else. But as competitors race to deploy their own AI agents, the launch raises critical questions about strategy, competitive advantage, and the delicate balance between innovation and consumer trust.

From Search Bar to Digital Butler

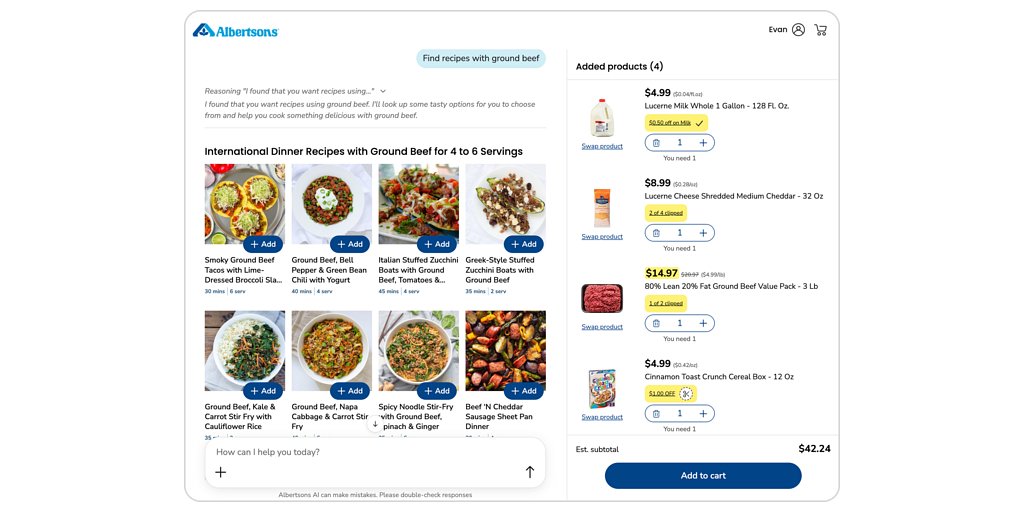

Albertsons' new tool is a prime example of 'agentic commerce,' where an AI doesn't just answer questions but proactively executes complex tasks on the user's behalf. This moves far beyond the capabilities of a traditional website search bar. The assistant is designed to be a comprehensive meal and shopping planner that understands context and nuance.

“Our goal at Albertsons Companies is to make our customers’ lives easier,” said Jill Pavlovich, SVP of Digital Customer Experience, in the company's announcement. “We are laser-focused on using AI as part of our strategy to meet customers when and how they choose to shop.”

The features are ambitious. 'Plan Meals' can generate a full week's menu and populate a shopping cart with a de-duplicated ingredient list. 'Fridge Cleaner' tackles food waste by suggesting recipes based on ingredients a user already has. Perhaps most impressively, the 'Shop Lists' feature can interpret a typed list or even a smartphone photo of a handwritten note, find the corresponding products, and add them to the cart. For consumers, the value proposition is clear: a radical reduction in the time and mental energy required for grocery shopping.

This launch builds on the company’s earlier 'Ask AI' tool, which reportedly drove higher engagement and larger basket sizes. The new, more powerful assistant is designed to deepen that relationship. As Pavlovich explained, the system can handle complex queries like planning a meal for six with leftovers while accommodating a vegetarian guest, all while factoring in current sales and coupons. It’s a vision of hyper-personalized service delivered at scale, a digital concierge for the masses.

A Crowded Field of AI Competitors

While Albertsons' move is a significant step, it is not happening in a vacuum. The grocery sector is a hotbed of AI-driven innovation, and every major player is placing strategic bets on similar technologies. The competitive landscape is rapidly evolving into an arms race for the most intelligent and helpful digital assistant.

Kroger recently partnered with Instacart to launch its own 'Cart Assistant,' another agentic tool aimed at simplifying meal planning. Walmart, the nation's largest grocer, has not only integrated shopping into OpenAI's ChatGPT but has also developed its own in-house AI assistant, 'Sparky,' to summarize reviews and guide customers. Not to be outdone, Target has also enabled shopping through ChatGPT, while Amazon continues to leverage its massive AI capabilities for everything from its 'Just Walk Out' cashierless technology in Amazon Fresh stores to sophisticated product recommendations.

This industry-wide pivot signals a fundamental belief that AI will be the key differentiator in the next era of retail. The fight is no longer just about price or store location; it's about owning the customer relationship through superior data intelligence and a frictionless digital experience. Albertsons' success will depend not only on the quality of its technology but also on its ability to outmaneuver these well-funded competitors, each vying to become the default shopping agent for American households.

The Strategic Payoff and Privacy Price Tag

For Albertsons, the investment in AI is a core component of its growth strategy. The company has seen robust digital sales growth—up 25% in a recent quarter to account for 9% of total grocery revenue—and AI-powered personalization is seen as critical to sustaining that momentum. By simplifying discovery and offering intuitive guidance, the company aims to foster loyalty and increase basket size, turning a transactional relationship into an advisory one.

This digital push is also tied to a broader corporate objective: a three-year plan to realize $1.5 billion in cost savings and productivity gains. A more efficient online shopping experience can drive sales and improve operational leverage. However, this strategy comes with inherent risks, chief among them the issue of data privacy.

AI-driven personalization requires access to vast amounts of customer data—purchase history, browsing habits, and even the contents of a user’s refrigerator. While this data fuels the convenience customers crave, it also stokes significant privacy concerns. Recent research indicates that a majority of shoppers, around 58%, are wary of how AI uses their personal data, with many perceiving these tools as vehicles for upselling rather than genuine assistance. The challenge for Albertsons and its competitors is to build trust through transparency. Retailers must be explicit about what data they collect and how it is used, giving customers meaningful control. Failure to do so risks a consumer backlash that could undermine the very foundation of this new, data-driven business model.

As Albertsons rolls out its AI assistant, with plans for mobile integration and budget optimization features in early 2026, it is navigating this complex terrain. The company is betting that the profound convenience offered by a four-minute grocery shop will outweigh consumer hesitation. The ultimate success of this AI gambit will hinge on its ability to prove that it can deliver on its ambitious promise of a smarter, faster, and more enjoyable shopping experience without compromising the trust it has built with millions of customers over decades.