AI's Hidden Engine: The $53 Billion Boom in Chip Packaging

Advanced chip packaging is the unsung hero of the AI revolution, with a market set to explode. But can the industry sustain its billion-dollar habit?

AI's Hidden Engine: The $53 Billion Boom in Chip Packaging

TAIPEI – December 09, 2025

The artificial intelligence arms race, a spectacle defined by algorithms and massive datasets, is powered by a less visible but increasingly critical battlefield: advanced semiconductor packaging. A new forecast from research firm DIGITIMES Asia projects that the global market for data center AI chip packaging will skyrocket from US$5.6 billion in 2024 to a staggering US$53.1 billion by 2030, a compound annual growth rate (CAGR) of over 40%. This explosive growth signals a fundamental shift, elevating chip packaging from a manufacturing afterthought to the strategic core of high-performance computing.

For decades, packaging was simply the protective shell for silicon. Today, it is the intricate, three-dimensional architecture that enables the next generation of AI. As the physical limits of Moore's Law become more apparent, engineers are no longer just shrinking transistors; they are stacking and connecting multiple chiplets—specialized pieces of silicon—into a single, powerful system. This system-level scaling is the only way to meet the insatiable demands of AI models for more memory, bandwidth, and processing power.

The New Kingmaker: From Afterthought to Strategic Frontier

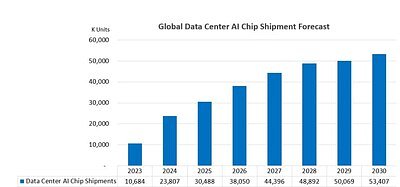

The market's frantic growth is not just about volume; it's about value. While total AI chip shipments are forecast to grow from 30.5 million units in 2024 to a healthy 53.4 million in 2030, the revenue from packaging is growing at a far more aggressive pace. The reason lies in the increasing complexity and content value of each package.

High-end GPUs, the workhorses of AI training, remain the centerpiece. According to the DIGITIMES report, GPU packaging revenue will remain over 40% higher than that of application-specific AI chips (ASICs) like Google's TPU by 2030. This is despite the fact that shipment growth for high-end GPUs is a relatively modest 10% CAGR. The discrepancy is explained by the move to sophisticated 2.5D and 3D packaging technologies, which integrate multiple GPU and I/O dies with crucial High Bandwidth Memory (HBM) modules. These complex assemblies, like TSMC's Chip-on-Wafer-on-Substrate (CoWoS) platform, are astronomically more valuable than traditional packaging methods.

Meanwhile, other segments are showing explosive shipment growth. Mid-range GPUs, ASICs, and interconnect-related chips—the vital networking components that allow thousands of processors to communicate—are expanding rapidly. This diverse ecosystem of silicon highlights that the AI data center is not a monolith but a complex interplay of specialized processors, each requiring advanced integration to function as a cohesive whole.

The Foundry Fortresses: Geopolitics and the Supply Chain

This technological revolution is geographically concentrated. Taiwan, home to the world's most advanced semiconductor ecosystem, is poised to be the primary beneficiary of the packaging boom. Projections indicate that Taiwanese suppliers, led by the dominant foundry TSMC, will command over 70% of the advanced AI chip packaging market by 2030. The island's mastery of cutting-edge manufacturing processes and its tight integration with the entire computing supply chain make it an indispensable hub.

TSMC, along with other key players like the outsourced semiconductor assembly and test (OSAT) giant ASE Technology Holding, are investing billions to expand their capacity for these high-margin services. They are not alone, however. Competitors like Intel in the U.S. and Samsung in South Korea are aggressively developing their own packaging solutions, such as Intel's Foveros and EMIB, to capture a piece of this lucrative market. The race is on, not just between companies, but between nations.

The push for technological supremacy has transformed the semiconductor supply chain into a geopolitical battleground. The U.S.-China tech rivalry has given rise to the concept of 'Sovereign AI'—the drive for nations to build and control their own domestic AI infrastructure, free from foreign dependence. Government-led initiatives like the U.S. CHIPS and Science Act and its European counterpart are pouring billions into onshoring manufacturing and R&D. This geopolitical realignment is expected to consolidate advanced packaging capabilities primarily around two poles: Taiwan and the United States, creating a new map of technological power for the coming decade.

AI's Billion-Dollar Question: Can the Compute Addiction Sustain Its ROI?

Despite the bullish forecasts, significant headwinds loom. The DIGITIMES report identifies key inhibitors, chief among them a growing concern over the return on investment (ROI) for the massive capital expenditures required to build and operate next-generation AI data centers. The industry's insatiable appetite for compute power is running up against hard physical and economic limits.

Power consumption is a primary concern. Modern AI racks are evolving to support power densities of up to one megawatt—a 10- to 100-fold increase over previous standards. The operational costs and environmental impact of such power draws are forcing hyperscalers like AWS, Google, and Microsoft to re-evaluate their infrastructure strategies. This is compounded by severe supply chain bottlenecks for critical components. High Bandwidth Memory, essential for feeding data to power-hungry GPUs, is facing historic shortages, with some reports citing order fulfillment rates as low as 70% and price surges of up to 50%.

This financial and logistical strain is fostering a sense of caution among cloud service providers and server brands. While budgets are being redirected towards high-priced AI servers, the sheer cost is prompting a more rigorous analysis of profitability. The central tension for the next five years will be the struggle between the demand for ever-more-powerful AI and the sobering reality of its cost. The industry is desperately searching for breakthroughs in efficiency, whether through new chip architectures, alternative memory technologies, or software optimization. How effectively these challenges are met will ultimately determine whether the market's explosive growth trajectory is sustainable or if the current boom is a precursor to a more measured, and perhaps more challenging, reality.

📝 This article is still being updated

Are you a relevant expert who could contribute your opinion or insights to this article? We'd love to hear from you. We will give you full credit for your contribution.

Contribute Your Expertise →