What Ailing Mortgage Apps Can Teach the Future of Healthcare

- Average satisfaction score for mortgage servicer mobile apps: 704/1000 (22 points lower than websites, 38 points lower than wealth management apps)

- Only 44% of mortgage apps deliver basic fundamentals like uptime and modern interface

- Just 12% of apps offer crucial features like directing extra payments to principal or escrow alerts

Experts agree that the mortgage industry's digital shortcomings highlight the critical need for human-centered design in complex sectors like healthcare, where intuitive, empowering digital tools are essential for effective user engagement and long-term trust.

What Ailing Mortgage Apps Can Teach the Future of Healthcare

TROY, MI – December 04, 2025 – For decades, managing a mortgage was a decidedly analog affair, a relationship conducted through mailed statements and phone calls. While nearly every other industry has embraced the mobile revolution, the mortgage servicing sector has remained a notable laggard. A new study confirms this digital deficit, revealing a landscape of uneven, underdeveloped, and often frustrating mobile app experiences for millions of homeowners. But the implications of this failure extend far beyond the world of finance. For those of us focused on building the future of healthcare, the mortgage industry's stumble serves as a powerful and timely cautionary tale about the perils of neglecting the digital user experience.

The Anatomy of a Digital Failure

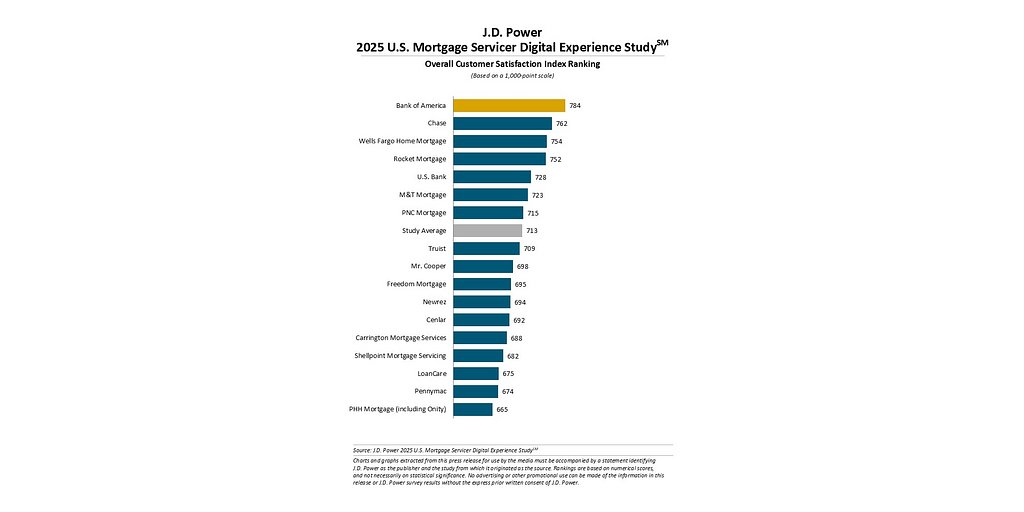

The inaugural U.S. Mortgage Servicer Digital Experience Study from J.D. Power paints a stark picture of an industry struggling to meet modern consumer expectations. The report found that the average overall satisfaction score for mortgage servicer mobile apps is a mere 704 on a 1,000-point scale. This isn't just a low score in isolation; it's a significant 22 points lower than the satisfaction with the servicers' own websites and trails far behind apps in adjacent financial sectors, such as wealth management (38 points lower) and retirement providers (35 points lower).

The problem isn't just a matter of polish; it's foundational. According to the study, fewer than half of mortgage apps—just 44%—successfully deliver on basic fundamentals like reliable uptime and a clean, modern interface. When it comes to providing genuinely valuable tools, the numbers plummet. A paltry 12% of apps empower users with crucial features like the ability to easily direct extra payments toward their principal balance or identify an impending shortage in their escrow account. For the average homeowner trying to manage their single largest financial asset, this isn't just an inconvenience; it's a barrier to effective financial management.

“Mobile is the future of lending,” noted Bruce Gehrke, senior director of wealth and lending intelligence at J.D. Power, in the press release. He points to a critical disconnect: while servicers have invested heavily in back-end modernization, that same focus has not been applied consistently to the customer-facing mobile experience. This oversight represents a massive missed opportunity for engagement and loyalty in an industry built on long-term relationships.

Escaping the Digital Basement

This digital malaise is not, however, an industry-wide inevitability. The J.D. Power study highlights a vast performance gap, proving that excellence is achievable. The top-performing brand, Bank of America, earned a satisfaction score of 784, a full 71 points higher than the industry average. Following closely were other national banking giants like Chase and Wells Fargo Home Mortgage. These leaders demonstrate that it is possible to build digital tools that customers value.

Their success isn't rooted in a secret formula. As Jon Sundberg, senior director of digital solutions at J.D. Power, explained, “The overall framework of an app experience is built on the core pillars of intuitive navigation, fast performance, and visual appeal.” Top-tier financial apps deliver on these essentials and build upon them with features that empower users. This includes comprehensive account dashboards, personalized alerts, robust security protocols like biometric login, and, crucially, self-service tools that provide transparency and control over complex elements like escrow and amortization.

By offering clear, accessible information and intuitive controls, these leading apps transform the user relationship from a passive, transactional one into an active, informed partnership. They reduce friction and anxiety, building the kind of trust that is paramount in any long-term service relationship. The success of these leaders proves that the industry’s overall poor performance is not a result of technological impossibility but a failure of strategic priority.

A Cautionary Tale for Patient-Centered Care

This is where the story pivots from finance to health. The challenges plaguing mortgage servicing—entrenched legacy systems, complex regulatory environments, high transaction volumes, and a historical B2B focus that deprioritized the end-user experience—are mirror images of the hurdles faced in healthcare. A mortgage is a complex, long-term commitment that is fundamental to a person's financial health. The relationship with our healthcare system is a deeply personal, lifelong journey that is foundational to our physical and mental well-being.

For years, healthcare has been undergoing its own digital transformation, rolling out patient portals, electronic health records (EHRs), and telehealth platforms. Yet, anyone who has tried to navigate these systems knows the experience is often just as fragmented and frustrating as that described by mortgage holders. How many of us have struggled to find a simple test result, book an appointment without making a phone call, understand a complex bill, or securely communicate with a provider through a clunky, unintuitive portal?

The parallels are undeniable. Just as mortgage servicers have underinvested in their mobile front door, many healthcare organizations have treated their digital tools as a compliance checkbox rather than a core component of the patient experience. The focus has been on digitizing existing, often inefficient, back-end processes rather than fundamentally redesigning the experience around the patient's needs.

From Financial Friction to Health Hurdles

The consequences of a poor user experience in mortgage servicing are significant, leading to customer frustration, increased calls to support centers, and a lack of financial clarity. In healthcare, the stakes are exponentially higher. A confusing interface isn't just an annoyance; it can be a genuine barrier to care. When a patient cannot easily access their medication list, understand pre-operative instructions, or schedule a follow-up, the risk of adverse health outcomes increases dramatically.

If only 12% of mortgage apps can provide clear alerts about an escrow account, what percentage of patient portals can proactively guide a diabetic patient in managing their blood sugar or help a cancer patient navigate their complex treatment schedule? The universal principles of human-centered design—simplicity, accessibility, personalization, and trust—are not industry-specific. They are fundamental human needs.

The mortgage industry's digital shortcomings provide a clear lesson: simply having an app is not enough. A digital tool that fails to empower its user is a failed investment. As healthcare continues to invest billions in technology, it must demand more than just functional code. It must demand empathy in design. It must learn from the missteps of other complex industries and recognize that in the world of health and wellness, a seamless, intuitive, and supportive digital experience is not a luxury feature—it is an essential component of modern, patient-centered care.