Vizsla Silver Expands Panuco with Strategic Fresnillo Land Deal

Vizsla Silver acquires key claims from major Fresnillo, fueling its flagship Panuco project's growth and solidifying its position in a historic silver belt.

Vizsla Silver Expands Panuco with Strategic Fresnillo Land Deal

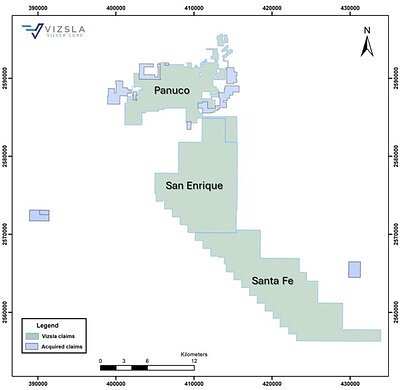

VANCOUVER, BC – December 18, 2025 – Vizsla Silver Corp. has significantly expanded its footprint in one of Mexico's most prolific precious metals belts, acquiring a strategic package of mining claims from industry giant Fresnillo plc. The deal, valued at US$6 million, gives Vizsla control of 2,378 hectares of prospective ground directly adjacent to its flagship Panuco silver-gold project in Sinaloa, Mexico, a move poised to accelerate the company's growth ambitions.

The acquisition provides Vizsla with ten claims along the legendary Panuco – San Dimas corridor. More importantly, it includes seven “Strategic Claims” totaling 1,734 hectares that cover potential extensions of high-grade veins already identified within the Panuco project. This tactical expansion comes just one month after Vizsla released a highly positive Feasibility Study for Panuco, and it signals the company's aggressive strategy to not only build a mine but to dominate a district.

A Strategic Expansion in a Prolific Corridor

Under the terms of the agreement, Vizsla Silver will pay US$2 million in cash and issue US$4 million in common shares (854,697 shares) to Fresnillo's subsidiary, Minera Fresnillo S.A. de C.V. In return, Vizsla gains control over ground that could be crucial for extending the life and enhancing the economics of its core asset.

"With this acquisition, we now have more prospective ground adjacent to our flagship Panuco project to continue exploring," stated Michael Konnert, President and CEO of Vizsla Silver, in a press release. "The Strategic Claims host past production along a trend of known mineralized structures, several of which are included in the recently announced Panuco Feasibility Study."

The transaction is more than just a simple land purchase; it is a calculated move to consolidate a district. The acquired claims are believed to host the potential continuations of several key vein systems, including La Luisa, Cruz Negra, and Cordon del Oro. By securing this adjacent ground, Vizsla’s exploration team can now follow these mineralized structures beyond their current property boundaries, unlocking new high-priority targets.

Konnert added that exploration success on these new claims could "not only have the potential to grow the overall resource base but also bolster mine economics in future mine updates and technical studies."

Bolstering Panuco's Future Economics

The timing of the acquisition is critical. In November 2025, Vizsla Silver published a robust Feasibility Study for the Panuco project that outlined a world-class mining operation. The study projected an after-tax Net Present Value (NPV) of US$1.8 billion, an impressive Internal Rate of Return (IRR) of 111%, and a rapid 7-month payback period based on prices of US$35.50 per ounce of silver and US$3,100 per ounce of gold. The initial mine plan forecasts annual production of 17.4 million silver-equivalent ounces over a 9.4-year life.

While these figures are already compelling, the addition of the Fresnillo claims offers significant upside. Any new resources discovered on the acquired ground could be incorporated into future mine plans, potentially extending the project's operational life well beyond the initial decade and increasing the total metal output. This is a crucial factor for investors and analysts, who often value longevity and resource growth potential as highly as initial economics.

Vizsla is wasting no time in assessing the new ground. The company announced it is expanding its high-resolution LiDAR survey to cover the Strategic Claims and will immediately begin regional reconnaissance mapping and rock sampling. This systematic approach is designed to quickly identify drill targets and integrate the new land into the broader district exploration model.

A Tale of Two Miners: Major and Junior Strategy

The deal also offers a fascinating glimpse into the differing strategies of major and junior mining companies. For a giant like Fresnillo, the world's largest primary silver producer with a vast portfolio of mines and projects across Mexico, the divestment represents strategic portfolio optimization. While the claims are prospective, they may not have been large enough to meet the company's internal development thresholds for a standalone operation. By selling the claims to a focused and well-funded junior explorer like Vizsla, Fresnillo monetizes a non-core asset while retaining exposure to future discoveries through its new equity position in Vizsla Silver.

For Vizsla, the acquisition is a textbook junior-miner growth strategy. By consolidating a district around a well-defined, high-value anchor asset, the company leverages its exploration expertise to create value that a larger entity might overlook. This symbiotic relationship allows majors to streamline their portfolios while providing juniors with the opportunity to build the next generation of mines.

Unlocking a Historic Silver Belt

The transaction casts a fresh spotlight on the Panuco-San Dimas corridor, a region steeped in mining history. With estimated historic production plus current resources and reserves of over 1.2 billion ounces of silver and 15 million ounces of gold, it stands as one of the most richly endowed precious metals belts on the planet. Vizsla's modern exploration techniques, applied to both its existing project and these newly acquired claims, have the potential to unlock significant new wealth from this historic district.

To fund its ambitious plans, Vizsla Silver has fortified its treasury. The company recently completed a US$100 million bought deal financing in June and announced plans in November for a US$250 million convertible notes offering. This financial strength ensures it has the capital required to pursue its dual-track strategy: methodically advancing the Panuco project towards construction while simultaneously conducting aggressive, district-scale exploration on its expanding land package. With a robust treasury and a clear plan, Vizsla Silver is now positioned to aggressively pursue both development and discovery, aiming to write the next major chapter in the Panuco district's storied history.

📝 This article is still being updated

Are you a relevant expert who could contribute your opinion or insights to this article? We'd love to hear from you. We will give you full credit for your contribution.

Contribute Your Expertise →