US Office Market's Cautious Comeback: A Divided and Downsized Recovery

- Leasing Activity: 5% year-over-year increase in 2025, totaling 410 million square feet of space.

- Average Lease Size: 15% smaller than pre-pandemic levels, now roughly 3,500 square feet.

- Regional Disparities: San Jose/San Francisco saw a 40% surge in leasing, while Boston's 52% growth masked high lab vacancies (41.7% in Boston, 25.7% in Cambridge).

Experts conclude that the U.S. office market is undergoing a structural transformation, with recovery uneven across regions and driven by smaller, higher-quality spaces, hybrid work models, and sector-specific demand like AI and life sciences.

US Office Market's Cautious Comeback: A Divided and Downsized Recovery

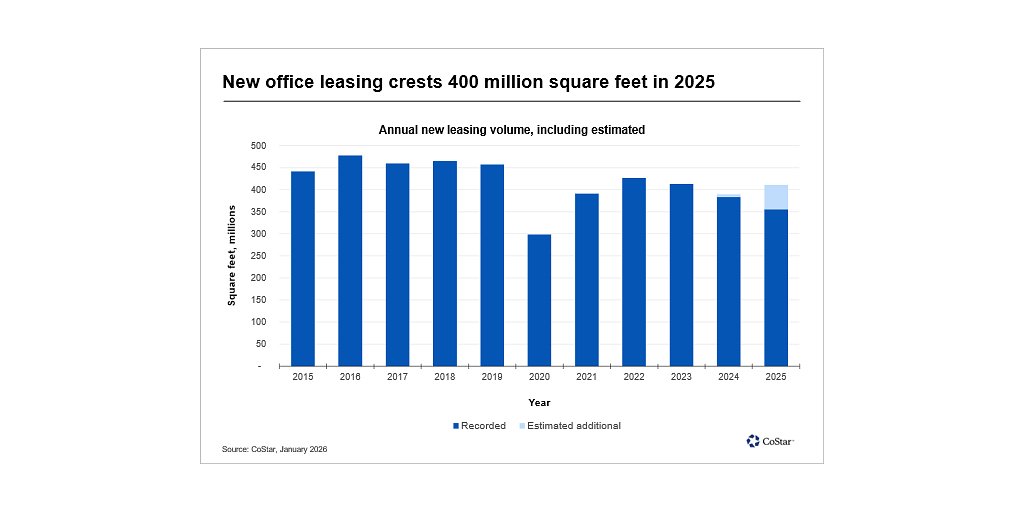

ARLINGTON, VA – January 09, 2026 – The American office market showed signs of life in 2025, with leasing activity climbing 5% year-over-year, according to recently released data from CoStar Group. This uptick, which saw tenants sign for an estimated 410 million square feet of space, marks a notable rebound from 2024, a year that saw leasing volume sink to a 15-year low. However, a deeper analysis of the market reveals a complex and fractured landscape, one defined not by a uniform recovery but by profound structural shifts, stark regional divides, and a corporate move toward smaller, higher-quality spaces.

While the year closed with three consecutive quarters of leasing volume exceeding 100 million square feet for the first time since 2022, the nature of these deals tells a story of a market in transformation. The total number of transactions is near an all-time high, but the size of the average lease is shrinking, pointing to a new reality for landlords and tenants alike.

“Despite the rebound in 2025, leasing activity has yet to return to the level seen in the late 2010s,” said Phil Mobley, national director of office analytics at CoStar Group, in the company's release. “The average lease size was roughly 3,500 square feet – more than 15% smaller than the five-year pre-pandemic average.” This trend underscores a fundamental re-evaluation of spatial needs in the era of hybrid work.

A Tale of Two Coasts: AI Fuels the West, Boston's Boom Hides a Complex Reality

The national average masks dramatic regional disparities. The technology sector, particularly the explosive growth of artificial intelligence, is acting as a powerful engine for recovery in specific coastal hubs. San Jose and San Francisco saw leasing activity surge by 40%, a gain largely attributed to the voracious appetite of AI firms for physical office space.

In Silicon Valley and San Francisco, the impact is undeniable. AI-related companies have leased over 5 million square feet in the city over the past five years and are projected to absorb millions more annually. Major deals in 2025 included OpenAI reportedly leasing nearly 800,000 square feet from Uber, chipmaker Etched taking nearly 50,000 square feet in San Jose, and AI giant Nvidia leasing a 102,000-square-foot building. Fueled by over $100 billion in venture capital since 2020 and a culture that often favors in-person collaboration, these companies are single-handedly revitalizing local markets that were hit hard in the post-pandemic downturn.

On the other coast, Boston was the headline winner, posting a staggering 52% year-over-year growth in leasing activity, which brought its annual volume back to its pre-pandemic average. Yet, this figure belies significant challenges within its key life sciences sector. While a few major commitments, such as Biogen's 580,000-square-foot headquarters lease, bolstered the city's numbers, the broader lab market is grappling with record-high vacancies. In the third quarter of 2025, lab availability rates soared to 41.7% in Boston and 25.7% in Cambridge, with asking rents declining. This suggests Boston's growth was driven by a handful of strategic, large-scale deals from established players rather than a widespread market recovery.

Meanwhile, other major metropolitan areas faced headwinds. Markets including Seattle, Atlanta, Houston, and Philadelphia all registered declines in leasing activity. In Houston, for example, the office market remained tenant-favorable throughout 2025, with vacancy rates climbing above 26% and sublease availability continuing to rise as companies right-sized their operations.

The Shrinking Footprint and the Flight to Quality

The most significant structural shift revealed by the 2025 data is the continued decline in average lease size. The 15% reduction from pre-pandemic norms reflects a permanent change in how corporations view and utilize office space. With hybrid work models firmly entrenched, companies no longer need a dedicated desk for every employee, leading them to optimize their footprints to cut costs and improve efficiency.

This trend, however, is not just about downsizing; it is also about upgrading. Known as the “flight to quality,” companies are trading quantity for quality, leaving older, less desirable buildings for smaller but more modern, amenity-rich spaces in prime locations. These premium offices are designed to be destinations—hubs for collaboration, innovation, and culture-building that can entice employees to commute.

This shift is forcing a clear bifurcation in the market. Landlords of newer, Class A buildings with state-of-the-art amenities, sustainable features, and flexible layouts are successfully attracting tenants. In contrast, owners of older Class B and C properties are facing immense pressure, leading to higher vacancies and a greater need to either invest heavily in upgrades or consider alternative uses for their buildings.

Reshaping the Urban Landscape

The challenges facing lower-tier office buildings are accelerating a trend that could reshape urban centers: office-to-residential conversions. In cities like Philadelphia, which is grappling with high office vacancy, municipal incentives are encouraging developers to transform underutilized office towers into much-needed housing. This adaptive reuse strategy not only helps alleviate housing shortages but also removes obsolete office inventory from the market, aiding in the long-term rebalancing of supply and demand.

Simultaneously, the pipeline for new office construction has slowed to a crawl. The combination of fewer new buildings coming online and the conversion of existing ones is expected to gradually ease the oversupply that has plagued the market. Experts believe that while a full return to pre-pandemic occupancy levels is unlikely in the near future, this market reset is a necessary step toward stabilization.

The U.S. office sector is navigating a period of profound redefinition. The modest growth in 2025 signals not a return to the past, but the emergence of a new, more discerning and dynamic market. Success is no longer guaranteed by location alone but is increasingly dependent on asset quality, flexibility, and the ability to provide an environment that supports the future of work. As capital markets begin to thaw and interest rates stabilize, the stage is set for a slow, asset-specific recovery driven by innovation in both technology and real estate strategy.

📝 This article is still being updated

Are you a relevant expert who could contribute your opinion or insights to this article? We'd love to hear from you. We will give you full credit for your contribution.

Contribute Your Expertise →