US Drivers Hit Brakes on EVs, Citing Cost as Brand Loyalty Crumbles

A new Deloitte study shows EV interest stalling as affordability woes and practical concerns push buyers back to gas and hybrids, rocking brand loyalty.

US Drivers Hit Brakes on EVs, Citing Cost as Brand Loyalty Crumbles

NEW YORK, NY – January 07, 2026 – The much-heralded electric vehicle revolution in the United States is facing a significant reality check, as a new study reveals that consumer interest in battery electric vehicles (BEVs) is barely growing. Instead, American car buyers are sticking with familiar and more affordable internal combustion engine (ICE) and hybrid vehicles, driven by persistent concerns over cost, charging, and practicality. This pragmatic shift is unfolding alongside a dramatic erosion of brand loyalty, forcing automakers to rethink their strategies in a market where value and quality now trump all else.

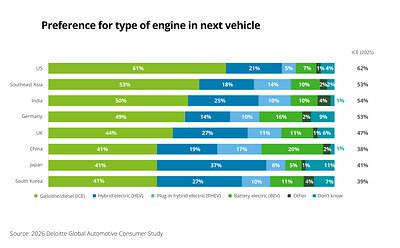

According to the “2026 Global Automotive Consumer Study” by Deloitte, purchase intent for fully electric vehicles in the U.S. rose by a mere two percentage points year-over-year to just 7%. In stark contrast, intent to buy traditional ICE vehicles (61%) and hybrid electric vehicles (26%) remained flat, holding a commanding 87% of consumer interest combined. The findings, based on a survey of over 28,000 global consumers, paint a picture of a U.S. market pumping the brakes on a full-scale EV transition, prioritizing financial stability and convenience over the promise of an all-electric future.

The Affordability Wall and the Hybrid Resurgence

The sluggish growth in EV adoption is not for a lack of awareness, but a reflection of deep-seated consumer anxieties. The Deloitte study pinpoints available driving range (cited by 47% of U.S. consumers), the time required to charge (44%), and overall cost (40%) as the top three barriers. This sentiment is echoed across the industry. A recent AAA survey found that the percentage of adults likely to buy an EV has fallen to its lowest point since 2019, with high purchase prices and battery repair costs being major deterrents.

Further complicating the landscape is the expiration of the federal EV tax credit in late 2025, a move that removed a key financial incentive for many prospective buyers. While state-level rebates and charging infrastructure investments from the NEVI program continue, their impact is not enough to overcome the fundamental affordability crisis noted by multiple analysts. According to Cox Automotive, affordability remains the single biggest constraint on the market heading into 2026, with dealer sentiment on EVs deteriorating.

In this environment, hybrid vehicles are emerging as the clear winner. Offering improved fuel economy without the range anxiety or charging hassles of BEVs, hybrids are experiencing what many experts call a “hybrid boom.” Major automakers are taking note and recalibrating their aggressive EV-only roadmaps. Ford, General Motors, and Stellantis have all announced pivots to a more flexible “multi-energy” strategy, increasing production of hybrid models to meet the swelling consumer demand. This strategic shift acknowledges that for the majority of mainstream buyers, hybrids represent a practical and accessible bridge technology.

Brand Loyalty in the Balance: A New Focus on Value and Service

Perhaps the most alarming trend for automakers is the precipitous decline in brand loyalty. The Deloitte study reveals that a staggering 53% of U.S. consumers plan to switch brands for their next vehicle purchase. This isn't a quest for the latest technology, but a return to fundamentals: consumers are primarily seeking better product quality (58%), superior vehicle performance (51%), and more transparent pricing (46%).

This shift indicates that the post-purchase experience is becoming a critical new battleground for customer retention. The study found that 57% of U.S. vehicle owners had their most recent service performed at a dealership, driven by trust in the quality of work. Tellingly, consumers reported higher trust in the dealership where they regularly service their vehicle (25%) than the one where they bought it (21%), underscoring the power of ongoing relationships.

“As new vehicle demand levels off, deeper collaboration between OEMs and dealers, particularly around servicing and the post-purchase journey, will be important to strengthening loyalty and sustaining engagement in a market where traditional growth levers are becoming harder to pull,” noted Lisa Walker, U.S. automotive sector leader at Deloitte, in the report.

This new reality pressures manufacturers and their dealer networks to deliver tangible value not just at the point of sale, but throughout the entire ownership lifecycle. Transparency in service pricing, quality repairs, and consistent communication are no longer just good practices; they are essential strategies for survival in an era of the discerning, brand-agnostic consumer.

The Connected Car Conundrum: Security vs. Privacy

As vehicles increasingly become computers on wheels, consumers are sending mixed signals about what they value in a software-defined car. There is strong interest in connected features that enhance safety and security, with a majority of U.S. consumers willing to pay for anti-theft tracking (61%) and pedestrian detection systems (59%).

However, this enthusiasm is tempered by significant privacy concerns. Consumers expressed high levels of discomfort with the sharing of personally identifiable information, including data from synced devices (62%) and vehicle location data (58%). This creates a delicate tightrope for automakers to walk: how to deliver valuable connected services without alienating privacy-conscious customers.

The challenge is further exemplified by consumer attitudes toward over-the-air (OTA) software updates. While more than half (52%) of U.S. consumers say regular OTA updates would make them keep their vehicle longer, 38% are unwilling to pay anything extra for them. This suggests that what automakers view as a potential revenue stream, many consumers see as a baseline expectation for a modern vehicle.

Jody Stidham, a managing director at Deloitte, described this as a “strategic dilemma” for the industry. While OTA updates can enhance performance and build loyalty, they may also slow down the vehicle replacement cycle, impacting future sales. In a market already squeezed by affordability pressures, convincing customers to pay for digital add-ons they believe should be standard will be an uphill battle, forcing automakers to carefully consider how and when they deliver software-enabled value.

📝 This article is still being updated

Are you a relevant expert who could contribute your opinion or insights to this article? We'd love to hear from you. We will give you full credit for your contribution.

Contribute Your Expertise →