The Digital Divide: Why Banks Are Failing Their Oldest Customers

As national banks celebrate rising satisfaction from digital innovation, a new study reveals a silent crisis: older customers are being left behind.

The Digital Divide: Why Banks Are Failing Their Oldest Customers

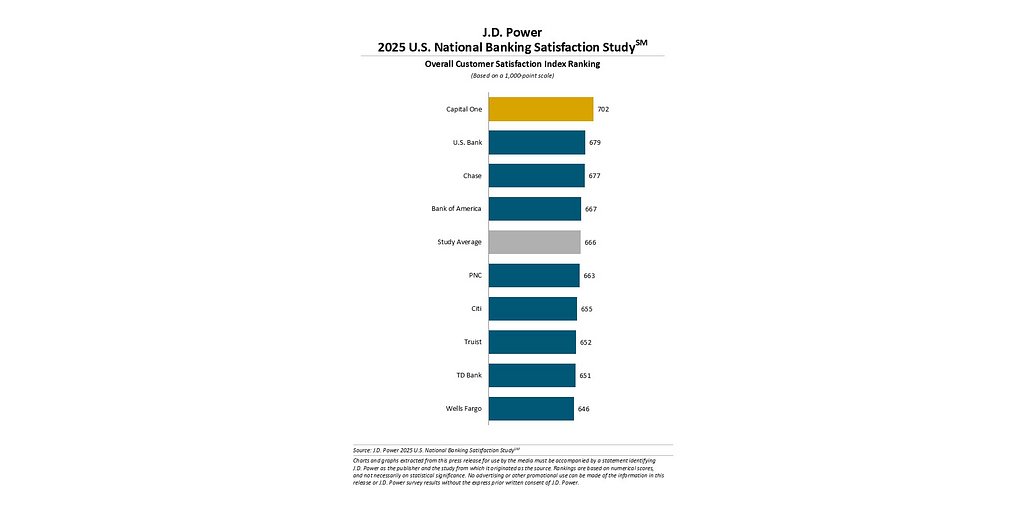

TROY, MI – December 11, 2025 – For the third consecutive year, the nation's largest banks are celebrating a victory. A new study from J.D. Power shows customer satisfaction has once again climbed, rising 8 points to an overall score of 666 on a 1,000-point scale. The drivers of this success are the very pillars of modern banking innovation: slicker digital channels, more attractive account offerings, and a growing sense of trust from the public. Yet, beneath this headline of progress lies a troubling and deepening fracture.

The J.D. Power 2025 U.S. National Banking Satisfaction Study reveals a stark generational divide. While customers aged 64 and younger report a significant 12-point surge in satisfaction, their counterparts aged 65 and older have seen their satisfaction levels completely stagnate. The digital wave lifting the banking industry is leaving its most tenured and often most loyal customers stranded on the shore. This isn't just a statistical anomaly; it's a sign that the relentless push for digital-first banking may be creating a silent crisis in customer service, one that impacts a vulnerable and vital segment of the population.

The Digital Dividend and Its Discontents

There is no doubt that the investments national banks have made in technology are paying dividends. Customers are reporting higher satisfaction with the reasonableness of fees, the support offered during financial challenges, and the quality of their core products like checking accounts and credit cards. This broad improvement has propelled some institutions to new heights. For the sixth straight year, Capital One has secured the top spot in overall satisfaction with a score of 702, followed by U.S. Bank at 679 and Chase at 677. Their continued dominance underscores a successful strategy built on leveraging technology to create a more convenient and seemingly trustworthy banking experience for the majority of their clientele.

This success, however, makes the concurrent failure to engage senior customers all the more glaring. The study, which surveyed over 11,600 retail banking customers, points to a clear source of the discontent. The very areas where technology cannot easily replace a human touch—problem resolution and personalized financial advice—are where satisfaction has declined for the 65-and-older demographic. While a younger user might celebrate resolving an issue through a chatbot in minutes, an older customer facing a complex fraud concern or seeking advice on retirement income may find the same digital interface to be an impersonal and frustrating barrier. The innovation that saves one customer time is costing another peace of mind.

Beyond the App: A Crisis in Human Connection

The satisfaction gap isn't merely about digital literacy or a reluctance to adopt new technology. It strikes at the heart of what different customers value in a banking relationship. For many seniors, a bank is not just a utility for transactions but a trusted institution where personal relationships and human judgment matter. When a problem arises, they often seek not just a solution, but empathy, patience, and the assurance that comes from speaking with a knowledgeable person.

As banks continue to streamline operations, reduce branch footprints, and funnel customer service inquiries toward automated systems, they are inadvertently dismantling the very support structures that this demographic relies on. The study’s findings suggest that while banks have become adept at allowing customers to “bank how and when they want,” this flexibility primarily benefits those who want to bank digitally. For those who prefer or require personalized help, the options are narrowing, and the quality of service is perceived to be in decline.

Paul McAdam, senior director of banking and payments intelligence at J.D. Power, articulated the challenge directly in the report. “National banks are achieving higher overall customer satisfaction through enhanced digital experiences, improved account offerings and strengthened trust,” he stated. “Yet older customers who prefer more personalized help aren’t seeing the same benefits... Closing the divide requires increased focus on empathy, patience and customized financial guidance for seniors.” His words serve as a direct call to action, highlighting that the next frontier of innovation may not be technological, but human.

The Path Forward: Balancing Innovation with Inclusion

The J.D. Power study serves as more than a report card; it is a strategic roadmap highlighting a critical market and ethical challenge. For institutions like Capital One, which have demonstrated six years of consistent leadership, the question becomes how to sustain that excellence by explicitly addressing this service gap. For the rest of the industry, it's a clear warning that a single-minded focus on digital transformation risks alienating a demographic with significant financial assets and deep-seated loyalty.

Addressing this issue requires moving beyond superficial gestures. While fraud prevention seminars and accessible websites are important first steps, they do not replace the need for high-quality, personalized interaction. The solution likely lies in a hybrid model where state-of-the-art digital tools are complemented by well-staffed, empowered customer service centers and branch personnel trained specifically to handle the complex needs of older adults with patience and expertise.

Ultimately, financial institutions hold a unique position of trust and responsibility in society. As consumer advocates and regulators increasingly focus on financial inclusion, the ability of a bank to serve all its customers equitably will become a key measure of its long-term viability and social license to operate. The data is clear: the current wave of innovation has delivered impressive gains, but its benefits are not being shared by all. For national banks, the challenge is clear: true market leadership will be defined not just by the sophistication of their apps, but by the empathy of their service.

📝 This article is still being updated

Are you a relevant expert who could contribute your opinion or insights to this article? We'd love to hear from you. We will give you full credit for your contribution.

Contribute Your Expertise →