Targa Deepens Bet on Argentine Gold with Major Project Expansion

- 66% expansion of El Zanjon project's land package, adding 22,755 hectares to a total of 57,276 hectares.

- 1.25 million shares issued to Aegis Resources Ltd. as part of an option agreement.

- 23,000 meters of drilling required over 12 years to earn an 80% interest in the project.

Experts would likely view Targa's strategic expansion and structured option agreement as a calculated, high-potential move in a proven gold-silver belt, though they would emphasize the need for independent verification of historical data to advance the project.

Targa Deepens Bet on Argentine Gold with Major Project Expansion

VANCOUVER, BC – January 08, 2026 – Targa Exploration Corp. has significantly increased its footprint in one of South America’s most prolific precious metals belts, announcing a major expansion of its El Zanjon gold-silver project in Santa Cruz, Argentina. The move, which grows the project's land package by 66%, signals an aggressive strategy to chase geochemical anomalies extending to the edge of its previous holdings.

In a dual announcement, the Vancouver-based junior explorer also confirmed it has issued 1.25 million shares to private company Aegis Resources Ltd., cementing the first stage of an option agreement to acquire the promising Argentinian asset. The strategic expansion and payment underscore Targa's commitment to advancing El Zanjon, located in a region renowned for multi-million-ounce gold and silver deposits.

A Strategic Land Play in a Prolific Gold Belt

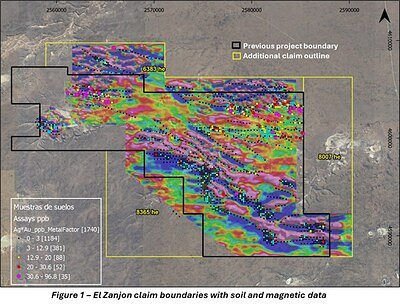

The acquisition of three new exploration concessions adds 22,755 hectares to the project, bringing the total contiguous land package to a substantial 57,276 hectares. This positions Targa with a commanding presence in the Deseado Massif, a geological province that hosts world-class epithermal gold-silver mines, including AngloGold Ashanti's Cerro Vanguardia mine, located just 30 kilometers north of El Zanjon.

The expansion is not a random land grab but a calculated move based on prior exploration data. The new claims were specifically staked to cover the potential northeastward continuation of a significant geochemical anomaly identified by previous explorers. This proactive measure aims to secure the full extent of the prospective trend before a potential discovery is made, a critical de-risking strategy in grass-roots exploration.

"Previous geochemical sampling identified an area of interest that ran up to the edge of the old project boundary," stated Targa CEO, Cameron Tymstra, in the company's press release. "This expansion of El Zanjon will cover any potential continuation of that trend to the northeast and help protect our project boundaries in the event of a discovery."

The largest of the new concessions, an 8,007-hectare block on the eastern edge, directly covers this potential extension. Additional concessions on the northern and southwestern boundaries were added to secure areas with elevated gold values in historical soil samples and unexplored ground believed to share similar geological characteristics to the primary target zones.

Following Geochemical Footprints Beneath the Cover

Exploring in the Deseado Massif presents a unique challenge that also offers a compelling opportunity. Much of the prospective Jurassic-age volcanic rock, which hosts the region's rich mineral deposits, is concealed beneath a layer of younger, barren sedimentary cover, typically 30 to 100 meters thick. This has left large areas, including El Zanjon, significantly underexplored despite their proximity to major mining operations.

The previous operator, Rugby Resources, pioneered the exploration approach at El Zanjon by employing advanced techniques to 'see' through this cover. By using specialized ionic leach geochemistry, which detects faint metal ions that have migrated upwards from a buried deposit, Rugby was able to identify several promising gold-silver targets. This work was complemented by ground magnetic surveys that outlined structural features, such as faults and flexures, which are known to control mineralization at nearby mines like Cerro Vanguardia.

This historical work has provided Targa with a valuable head start, outlining multiple drill-ready targets. However, the company has prudently noted that it has not yet completed sufficient work to verify these historical results under the stringent Canadian National Instrument 43-101 disclosure standards. This means Targa's initial on-the-ground program will be crucial for independently validating the data through its own sampling and analysis before it can be formally relied upon for future resource calculations. This verification process is a standard but vital step in advancing an exploration project toward development.

The Financial Blueprint for Discovery

The strategic expansion is underpinned by a carefully structured option agreement with Aegis Resources Ltd., a private entity that was spun out of Rugby Resources in 2025. The issuance of 1,250,000 Targa shares at a deemed price of $0.20 per share represents the first of three tranches of share payments required under the deal.

This equity-based transaction allows Targa, a junior explorer with a market capitalization of approximately C$9 million, to secure a highly prospective asset without a large upfront cash expenditure. Under the terms of the agreement, Targa can earn an 80% interest in El Zanjon by making a series of cash and share payments and, most significantly, by completing an ambitious 23,000 meters of drilling over a twelve-year period. This long-term, milestone-driven approach ties the acquisition cost directly to exploration success and project advancement.

For Targa shareholders, the issuance of 1.25 million shares represents a modest dilution of approximately 2.6%, a common trade-off in the junior mining sector to fund growth and acquire high-potential assets. By leveraging its equity, the company preserves its cash reserves for the on-the-ground exploration work essential for making a discovery.

Navigating the Path to Drilling

With the expanded land package secured, Targa is now focused on the final administrative steps before launching its inaugural exploration program at El Zanjon. The company is developing detailed plans and budgets while awaiting the approval of updated Environmental Impact Statements (EIS) for both its El Zanjon and nearby Venidero projects.

"We look forward to getting on the ground at both El Zanjon and Venidero in the first half of this year," Tymstra commented, adding that the company anticipates receiving the necessary approvals sometime in February 2026. This timeline may be aided by the fact that Rugby Resources had already successfully navigated the provincial system to obtain an Environmental Impact Assessment and drill water permits in 2023, potentially streamlining the process for Targa's updated submissions.

Upon receiving the green light, Targa will be positioned to begin the critical work of verifying historical data and testing the high-priority drill targets at El Zanjon for the first time. Success in this initial phase could rapidly advance the project and validate the company's strategic bet on this underexplored corner of Argentina's premier gold-silver territory.

📝 This article is still being updated

Are you a relevant expert who could contribute your opinion or insights to this article? We'd love to hear from you. We will give you full credit for your contribution.

Contribute Your Expertise →