Spain's Iberian Belt Gains Momentum: Pan Global Resources Unlocks Potential at Escacena

Positive assay results and a large geophysical anomaly signal promising prospects for Pan Global Resources' Cañada Honda target in Spain's mineral-rich Iberian Pyrite Belt, bolstering Europe's critical mineral supply chain.

Spain's Iberian Belt Gains Momentum: Pan Global Resources Unlocks Potential at Escacena

NEW YORK, NY – November 18, 2025

Iberian Pyrite Belt Heats Up with New Exploration Results

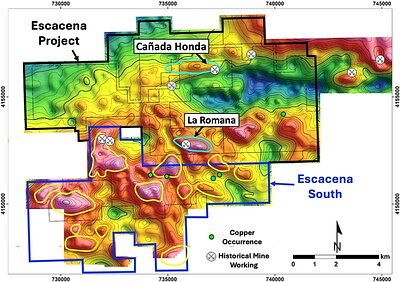

Pan Global Resources Inc. has announced encouraging channel sampling results from its Cañada Honda target, part of the Escacena Project in southern Spain. The company reported 1.14 grams per tonne (g/t) gold over 26 meters from near-surface mineralization, reinforcing the potential for a significant gold and copper deposit within the historically prolific Iberian Pyrite Belt. This comes amidst increasing European interest in securing domestic sources of critical minerals needed for the energy transition.

The assay results, coupled with a substantial 3-kilometer long geophysical anomaly, indicate the possibility of a large-scale deposit at Cañada Honda, drawing attention to the region as a key area for future mineral development. While the company continues to advance its exploration program, industry experts suggest that the Iberian Pyrite Belt is poised for a resurgence in mining activity.

Unlocking Potential in a Historic Mining District

The Iberian Pyrite Belt, spanning parts of Spain and Portugal, boasts a rich mining history dating back millennia. Romans and Tartessians actively mined the region for metals like gold, silver, and copper. Despite past exploitation, considerable potential remains, particularly for volcanogenic massive sulfide (VMS) deposits. Pan Global's Escacena Project lies within this fertile ground, immediately adjacent to previously operating mines like Aznalcóllar and Los Frailes, currently undergoing redevelopment.

“The region is remarkably well-endowed with mineralization,” says an independent geological consultant familiar with the area. “The historical mining activity provides a solid foundation for modern exploration, and the existing infrastructure can significantly reduce development costs.”

Pan Global’s exploration program at Cañada Honda is focused on delineating the extent of the mineralization and assessing its economic viability. The company is utilizing a combination of geological mapping, geophysical surveys, and drilling to build a comprehensive understanding of the deposit. According to company statements, drilling during the initial phase in 2024 focused on the eastern end of the 3km geophysical anomaly, yielding results that suggest a much larger mineralized system.

Navigating the Competitive Landscape and Financial Considerations

The Iberian Pyrite Belt is increasingly attracting attention from mining companies seeking to secure critical mineral supplies. Competitors such as Grupo México (redeveloping the Aznalcóllar mine), First Quantum Mining, and Emerita Resources are actively exploring and developing projects in the region. This competitive environment underscores the potential of the belt but also presents challenges for Pan Global Resources.

“There’s a lot of activity in the area, which is both a positive and a negative,” commented an industry analyst. “Competition can drive innovation and investment, but it also increases the risk of project delays and cost overruns.”

Pan Global’s financial position is a key factor in its ability to advance the Escacena Project. As of January 31, 2023, the company had approximately C$8.9 million in cash. While this provides a solid foundation for near-term exploration activities, significant further investment will be required to bring the project into production. An AI analyst report indicates that despite promising results, Pan Global faces substantial financial and operational challenges. The company is actively working towards a maiden Mineral Resource Estimate for its La Romana deposit by the end of 2025, a critical milestone that could significantly improve its financial outlook.

The reported 1.14 g/t gold over 26 meters is within the economic range for open-pit gold mining, but the presence of 0.16% copper alongside gold further enhances the value. “Polymetallic deposits are particularly attractive in the current environment,” explains an expert in ore deposit geology. “The ability to recover multiple metals from a single ore body can significantly improve project economics.” The company’s exploration program, combined with favorable geological conditions and a strategic location, positions it to capitalize on the growing demand for critical minerals.