Regional Grocers Win Price War, Topping U.S. Retail Rankings

- Regional Grocers Dominate: For the first time, the top 3 U.S. grocers in the dunnhumby Retailer Preference Index (RPI) are all regional chains: H-E-B (1st), Market Basket (2nd), and Woodman’s (3rd).

- Price Sensitivity at Record High: “Saving customers money” now accounts for 41% of customer preference, the highest ever recorded.

- Economic Pressures: 56% of Americans cannot cover a $400 unexpected expense, and 58 million experience food insecurity.

Experts agree that the rise of regional grocers reflects a fundamental shift in consumer priorities, where value, quality, and community trust outweigh national scale and digital convenience in today’s economically anxious market.

Regional Grocers Dethrone Giants as Value Becomes King in the Aisles

CINCINNATI, OH – January 07, 2026 – In a seismic shift for the $1 trillion U.S. grocery industry, a trio of regional powerhouses has officially claimed the top spots in a key annual ranking, signaling a profound change in American shopping habits. For the first time in the nine-year history of the dunnhumby Retailer Preference Index (RPI), the nation’s top three grocers are all regional chains, with Texas-based H-E-B leading the pack, followed by Market Basket and a newcomer, Woodman’s.

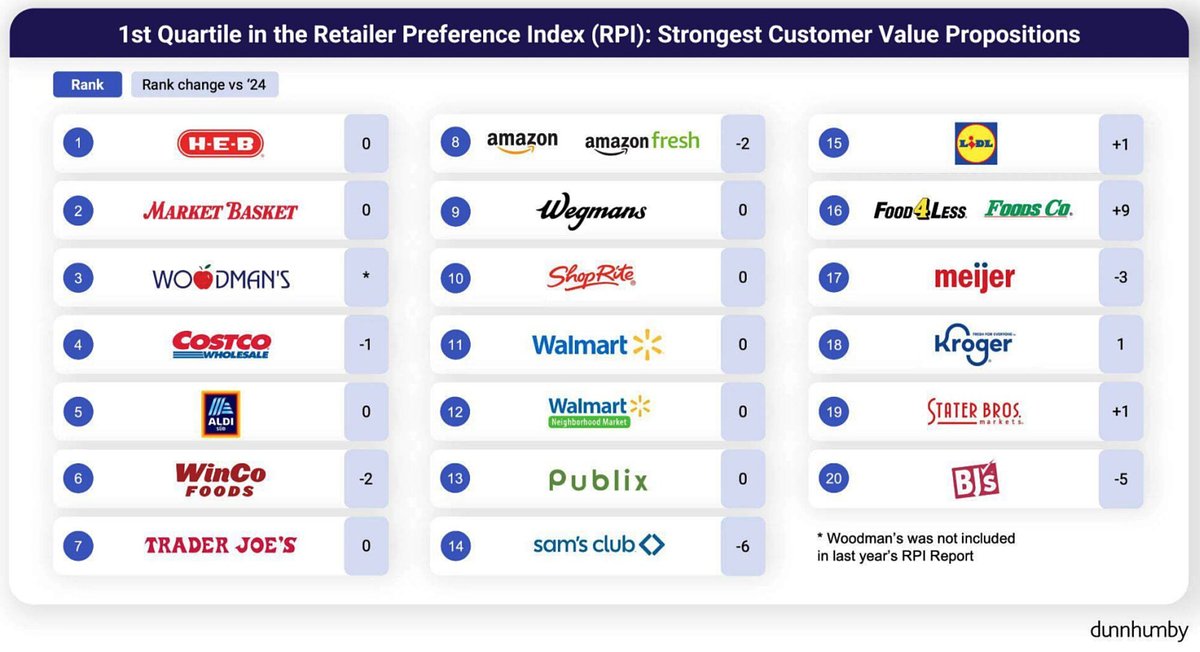

The ninth annual report from the global customer data science firm dunnhumby underscores a market increasingly defined by economic anxiety, where providing tangible value has become the undisputed path to success. H-E-B secured the top position for the fifth time, cementing its reputation for excellence. New England's Market Basket held strong at number two for the second consecutive year, while Wisconsin-based Woodman’s made a stunning debut in third place, displacing wholesale giant Costco from the top tier. The rest of the top ten includes Costco (4), Aldi (5), Winco Foods (6), Trader Joe's (7), Amazon (8), Wegman’s (9), and ShopRite (10).

The Regional Renaissance

The dominance of regional players marks a pivotal moment, challenging the long-held assumption that national scale and digital prowess are the primary drivers of retail success. Instead, the 2026 rankings reveal that a deep connection to local communities, operational efficiency, and an unwavering focus on the core fundamentals of price and quality are what truly resonate with today's shoppers.

H-E-B's continued reign is a masterclass in this strategy. The beloved Texas grocer excels by delivering a superior combination of savings, quality, and in-store experience. Its success is built on a robust private label program that offers high-quality products at competitive prices, a resilient supply chain that mitigates cost fluctuations, and a deep-seated community trust that national brands struggle to replicate. While it lacks a traditional points-based loyalty card, its consistent low prices and targeted digital coupons foster a fierce loyalty among its customer base.

Woodman’s arrival in the top three is perhaps the most telling indicator of the current consumer mindset. The employee-owned Wisconsin chain, known for its massive, no-frills stores and deep discounts, leapfrogged established national competitors by delivering exceptional results in the two most important pillars of the RPI: “Price, Promotions, and Rewards” and “Quality.” Its success demonstrates that a straightforward value proposition can be a powerful competitive advantage in a price-sensitive environment.

Market Basket’s consistent performance further solidifies the trend. The chain has cultivated a loyal following through its aggressive pricing and a strong emphasis on fresh, quality products, proving that regional grocers can effectively compete and win against the largest retailers in the country.

A Market Defined by Economic Anxiety

The ascent of these regional champions is not happening in a vacuum. It is a direct reflection of the immense financial pressure facing American households. According to dunnhumby's research, the most crucial driver of a grocer's long-term success is now “saving customers money,” which accounts for a record-high 41% of customer preference. This emphasis on thrift is a uniquely American story, driven by higher rates of insecurity compared to other developed nations.

Data paints a stark picture of this vulnerability. A staggering 56% of Americans report being unable to cover an unexpected $400 expense, a figure that has worsened over the past year. Furthermore, an estimated 58 million people in the U.S. now experience food insecurity, with many forced to skip meals due to affordability issues. With consumer confidence remaining fragile amid concerns over inflation and personal finances, shoppers are adapting their behavior by actively seeking discounts, switching to store brands, and prioritizing retailers that help stretch their budgets.

“2025 threw a lot of curveballs at the U.S. consumer. Shopper confidence dropped as concerns about higher prices, fewer job opportunities, and stagnant wages eroded purchasing power,” noted Matt O’Grady, President of the Americas for dunnhumby, in the report's press release. “In this environment, building trust with American shoppers has never been more critical.”

This economic reality is also forcing a convergence of quality and value. Consumers are no longer willing to accept a trade-off; they demand both. Savings-focused retailers like Aldi and Walmart are actively working to close the quality perception gap with their traditional competitors, making quality a key battleground alongside price.

Digital Dethroned: The Struggles of National Giants

The report also serves as a cautionary tale for retailers that have staked their growth on digital convenience. Amazon, which held the top spot in 2021 and 2022, fell two places to eighth, while Sam's Club plummeted six spots. According to dunnhumby, their decline is largely due to the waning importance of the “Digital” pillar in the eyes of consumers, coupled with weaker performance in the now-critical areas of price and quality.

In previous years, a seamless online experience and rapid delivery were seen as key differentiators. Today, while still important, they are considered table stakes. When households are struggling to make ends meet, the convenience of two-hour delivery is less compelling than the promise of a lower grocery bill. The report notes that neither Amazon nor Sam’s Club ranks in the first quartile for price or quality, the two attributes that matter most to shoppers right now.

This shift suggests that a digital-first strategy is insufficient on its own. The retailers thriving in 2026 are those using technology not just for customer-facing convenience, but to enhance core operations—streamlining supply chains, optimizing pricing, and personalizing promotions through tools like the once-maligned digital circular, which is now seeing a resurgence as a key touchpoint for value-seeking shoppers.

The findings indicate that the path forward for the entire industry requires a recalibration. While the battle for the top spot appears settled for now with H-E-B's entrenched leadership, the race for second place is wide open, with any of the retailers ranked second through eighth having a realistic chance to claim it. Success will hinge on a retailer's ability to authentically connect with consumers and deliver on the fundamental promise of value. For the foreseeable future, the grocers who win will be those who best prove to shoppers that they can save them money without sacrificing the quality of the food on their tables.

📝 This article is still being updated

Are you a relevant expert who could contribute your opinion or insights to this article? We'd love to hear from you. We will give you full credit for your contribution.

Contribute Your Expertise →