PayPal Launches No-Fee ‘Pay in 4’ in Canada, Challenging BNPL Landscape

PayPal enters Canada's booming ‘Buy Now, Pay Later’ market with a unique offering: zero fees for consumers. Will this disrupt established players and change how Canadians shop?

PayPal Launches No-Fee ‘Pay in 4’ in Canada, Challenging BNPL Landscape

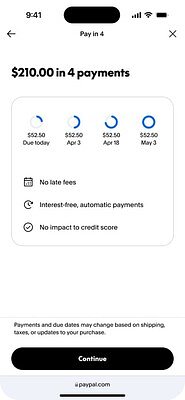

Toronto, ON – November 10, 2025 – PayPal today officially launched its ‘Pay in 4’ service in Canada, immediately differentiating itself from competitors in the rapidly growing ‘Buy Now, Pay Later’ (BNPL) market. Unlike many existing BNPL options, PayPal’s service boasts zero fees for consumers, a move analysts predict will shake up the Canadian financial landscape and force competitors to re-evaluate their pricing models.

This launch comes at a time of surging BNPL adoption in Canada. Driven by convenience and the appeal of spreading out payments, services like Afterpay, Klarna, and Affirm have become increasingly popular, particularly among younger demographics. However, concerns about hidden fees, potential debt accumulation, and the impact on credit scores have also emerged, prompting calls for greater regulation.

Disrupting the BNPL Status Quo

PayPal’s strategy is clear: to capture market share by addressing consumer pain points. “Consumers want flexibility, but they don't want to be penalized for it,” explains a financial technology analyst familiar with the launch. “Many BNPL services nickel and dime users with late fees or interest, even for relatively small purchases. PayPal is betting that a no-fee model will resonate with Canadians.”

While many BNPL services advertise zero-interest payments, a closer look often reveals fees for missed payments, rescheduling, or even account maintenance. These fees can quickly add up, negating the initial appeal of interest-free financing. PayPal’s commitment to a truly no-fee experience is a significant differentiator.

“The lack of fees is really attractive. I've used some BNPL services before and the late fee just isn’t worth the convenience,” shared one early adopter of PayPal's service.

A Competitive Landscape

The Canadian BNPL market is already crowded, with established players vying for market share. Affirm (through its PayBright acquisition) Afterpay, Klarna, and Sezzle are among the most prominent competitors. Each offers varying degrees of flexibility and features, but most rely on revenue generated from merchant fees and, increasingly, consumer fees.

“PayPal’s entry will undoubtedly put pressure on existing players,” says a retail industry consultant. “They’ll need to respond, whether that means lowering their fees, offering more competitive features, or doubling down on customer loyalty programs.”

The impact is already being felt. Sources indicate that several BNPL providers are internally reviewing their pricing strategies and exploring ways to offer more transparent and competitive options. However, analysts warn that a price war could also squeeze margins and lead to consolidation in the industry.

Beyond Fees: The Cadillac Fairview Partnership

PayPal isn’t just competing on price. The company has also forged a strategic partnership with Cadillac Fairview, one of Canada’s largest real estate companies. This collaboration allows consumers to use ‘Pay in 4’ at select CF shopping centres across the country, bridging the gap between online and in-store shopping.

“Offering a seamless payment experience, whether online or in-store, is crucial,” explains a technology analyst. “The Cadillac Fairview partnership is a smart move that expands PayPal’s reach and provides consumers with more options.”

The ‘Pay in 4, Play in 4’ promotional event at CF malls is driving initial adoption and generating buzz around the new service. Shoppers have a chance to win prizes while learning about the benefits of PayPal’s no-fee financing option.

Financial Implications and Consumer Concerns

While PayPal’s no-fee model is appealing to consumers, it raises questions about the company’s financial sustainability. How will PayPal generate revenue from ‘Pay in 4’ if it’s not charging consumers? The answer lies primarily in merchant fees. PayPal charges merchants a percentage of each transaction, similar to credit card processing fees.

“PayPal is leveraging its existing merchant relationships and scale to make this work,” explains a financial analyst. “They’re betting that increased transaction volume will offset the lack of consumer fees.”

However, some consumer advocates warn that the ease of using BNPL services, even without fees, could lead to overspending and debt accumulation. It’s crucial for consumers to understand the terms and conditions of the service and to only borrow what they can afford to repay.

“BNPL isn’t free money,” warns a consumer advocate. “It’s still a form of credit, and it’s important to use it responsibly.”

Furthermore, the long-term impact of BNPL services on credit scores remains a concern. While PayPal’s ‘Pay in 4’ currently doesn’t report to credit bureaus, other BNPL providers may do so, and missed payments could negatively affect a consumer’s credit rating. There’s growing pressure on regulators to establish clear guidelines for BNPL services to protect consumers and ensure transparency.

The Future of BNPL in Canada

PayPal’s entry into the Canadian BNPL market is a game-changer. By offering a no-fee service and partnering with major retailers, PayPal is poised to disrupt the industry and force competitors to adapt. While challenges remain, the future of BNPL in Canada looks bright, with consumers benefiting from more choice, greater transparency, and potentially lower costs.

“This is a pivotal moment for the BNPL market in Canada,” concludes a financial technology analyst. “PayPal has raised the bar, and now it’s up to other players to respond.”

As the BNPL landscape continues to evolve, consumers will undoubtedly demand more flexible, transparent, and affordable financing options. PayPal’s ‘Pay in 4’ is a step in the right direction, but ongoing innovation and responsible regulation will be crucial to ensure a sustainable and beneficial future for the industry.