Nevada King's High-Tech Gold Gambit: Chasing a Tier-One Asset

With AI-guided drills and a new discovery, Nevada King aims to transform its Atlanta mine into a major US gold asset. Will the market take notice?

Nevada King's High-Tech Gold Gambit: Chasing a Tier-One Asset

VANCOUVER, BC – December 11, 2025 – In the vast, mineral-rich expanse of eastern Nevada, a high-stakes geological chess match is underway. Nevada King Gold Corp. has just launched a fully-funded, 20,000-meter drill program, a move that signals more than just another season of exploration. It's a calculated offensive designed to prove that its Atlanta Gold Mine Project, already hosting a respectable 1.1-million-ounce resource, is merely the tip of a much larger, district-scale gold system. The company is betting that a combination of aggressive drilling and cutting-edge data science can push the project across the threshold from a promising deposit to a strategically significant, multi-million-ounce asset in the heart of America's premier gold jurisdiction.

The Quest for Critical Mass

For any junior mining company, defining a resource of over one million ounces is a significant achievement. But in the world of large-scale mining, the concept of "critical mass" is paramount—the point at which a deposit becomes large enough and rich enough to justify the immense capital expenditure of building a mine. Nevada King's leadership believes they are on the cusp of that moment, and the new Phase 4 program is laser-focused on delivering the ounces to prove it.

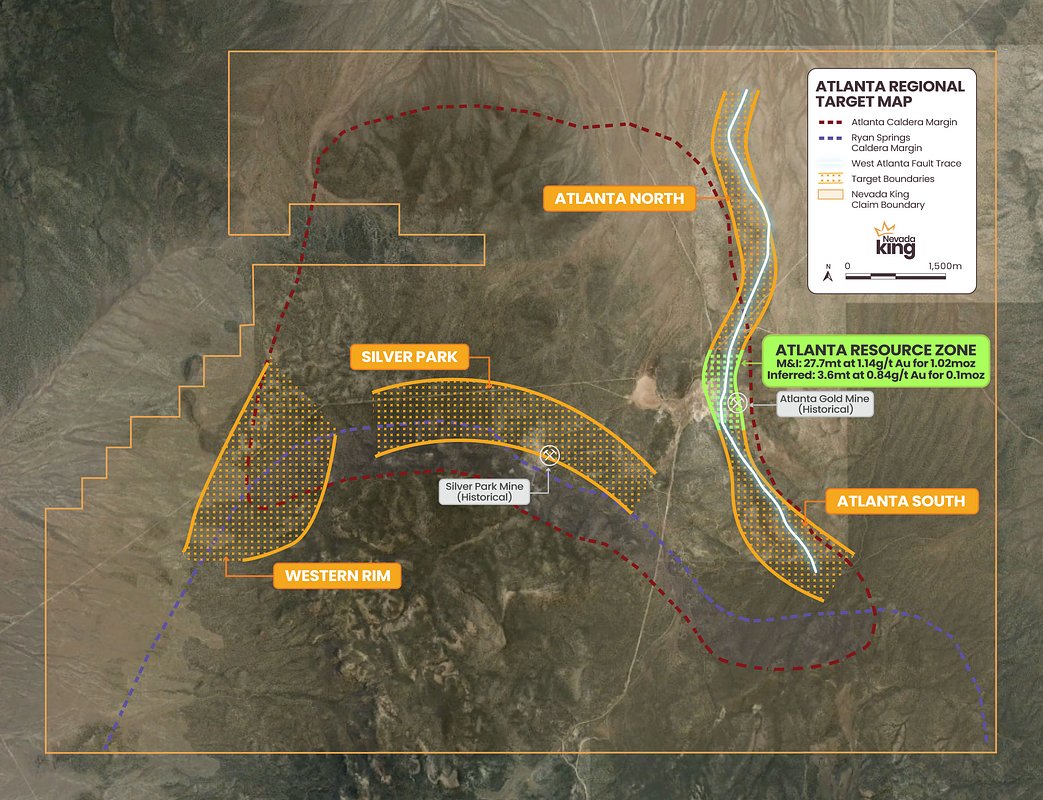

The strategy hinges on systematically stepping out from the known Atlanta Resource Zone (ARZ) to test a pipeline of new regional targets identified during a prior 30,000-meter campaign. The undisputed star of this new phase is Silver Park East, a newly discovered zone of mineralization located two kilometers from the main deposit. With 5,000 meters of drilling allocated, the company aims to rapidly define the scale of this potential satellite body, testing its continuity and vectoring toward higher-grade zones.

As Nevada King CEO John Sclodnick stated, "Phase 3 drilling has demonstrated tremendous exploration upside... Importantly, we've discovered a new mineralized zone at Silver Park East... This is a major milestone that validates both the strength of the mineral system and the effectiveness of our targeting approach." He emphasized the goal: "With 1.1 million ounces already defined, Atlanta stands out as one of the rare and potentially large-scale gold systems in the U.S. that sits on the cusp of critical mass. Phase 4 is laser-focused on pushing us over that threshold."

The remaining 15,000 meters of drilling will be deployed flexibly across other high-priority zones, including Atlanta South, Atlanta North, and the intriguing Western Rim target. This approach allows the company to follow the most promising results, efficiently allocating capital to the areas with the highest probability of success. Success at any one of these targets, particularly Silver Park East, could fundamentally rewrite the project's economic potential.

Beyond the Drill Bit: Data-Driven Discovery

While the roar of reverse circulation drills marks the physical effort, the intellectual horsepower driving this exploration campaign is equally impressive and firmly plants Nevada King at the intersection of traditional geology and modern technology. The company isn't just punching holes in the ground; it's leveraging a sophisticated, multi-layered data-driven strategy to de-risk what has historically been a high-risk endeavor.

This innovative approach involves integrating vast datasets, including geophysical surveys like CSAMT and gravity, high-resolution drone magnetics, hyperspectral imaging, and extensive geochemical soil and rock sampling. Where this process takes a futuristic turn is in its application of machine learning. By feeding these disparate layers of information into an AI model, the company has generated an internally ranked pipeline of targets, allowing geologists to prioritize areas with the highest statistical probability of hosting gold.

According to VP of Exploration Justin Daley, the previous phase provided "critical geological and structural data... validating our regional targeting models." He noted the company's "systematic, data-driven approach" is designed to "fast-track resource conversion and unlock the full, district-scale potential." This fusion of human geological expertise with artificial intelligence represents a significant shift in exploration methodology. It enables the team to 'see' through the post-mineral volcanic cover that obscures much of the property's potential, transforming a challenging exploration environment into a data-rich field of opportunity.

A Treasure Map of Geological Potential

The Atlanta project is nested within Nevada's famed Battle Mountain trend, a geological fairway that has produced many of the world's most significant gold deposits. While the project's history includes past production of 110,000 ounces of gold and 800,000 ounces of silver from an open pit in the 1970s and 80s, Nevada King's work is revealing a far more complex and potentially larger system.

The exploration targets highlight this geological diversity. While Silver Park East appears to share characteristics with the main Atlanta resource, the Atlanta South target is generating excitement for a different reason. Drilling there has intercepted mineralization within Pogonip Limestone, a key host rock for Carlin-type gold deposits, the very type that made Nevada a global mining powerhouse. The presence of high arsenic values, a classic pathfinder element for Carlin systems, further supports this interpretation. Unlocking a new deposit type at Atlanta would be a game-changer, adding another dimension to the project's already significant epithermal potential.

Further afield, the Western Rim target represents a large-scale, early-stage opportunity defined by a multi-kilometer corridor of gold-bearing veins. To access this promising area, the company is now applying for its fifth modification to its Plan of Operations with the Bureau of Land Management (BLM), a necessary regulatory step that underscores the practical realities of expanding operations on federal land.

The Investor's Paradox: Progress vs. Perception

For investors and market watchers, Nevada King presents a compelling paradox. On one hand, the company has consistently delivered strong exploration results, more than doubling its measured and indicated resource in its 2025 update and making new discoveries. Analyst sentiment is overwhelmingly positive, with a consensus "Strong Buy" rating and average price targets suggesting a potential upside of over 300% from its current trading levels.

On the other hand, the company's stock has been trading near its 52-week low, declining significantly year-to-date. This disconnect between geological success and market valuation is a common frustration in the junior mining sector, where long timelines, capital-intensive work, and market sentiment can create volatility. While the Phase 4 program is announced as "fully-funded," the aggressive exploration required to prove out a district-scale system necessitates a significant and continuous cash burn, a factor savvy investors watch closely.

The success of this new drilling phase could be the catalyst that closes this valuation gap. If the drills at Silver Park East can confirm a significant new satellite deposit, or if Atlanta South shows definitive signs of a robust Carlin-type system, it could force a market re-rating. The coming months of drill results will therefore be scrutinized not just for grams per tonne of gold, but for their power to shift perception and prove that the company's high-tech, systematic exploration strategy is building one of Nevada's next major gold mines.

📝 This article is still being updated

Are you a relevant expert who could contribute your opinion or insights to this article? We'd love to hear from you. We will give you full credit for your contribution.

Contribute Your Expertise →