Morgan Properties’ $354M Deal Signals Shift in Multifamily Investment

The acquisition of Dream Residential REIT adds 3,300 units to Morgan Properties’ portfolio, reflecting a growing trend of private equity investment in workforce housing and cross-border real estate deals.

Morgan Properties’ $354M Deal Signals Shift in Multifamily Investment

NEW YORK, NY – November 19, 2025

Private Equity Fuels Multifamily Expansion

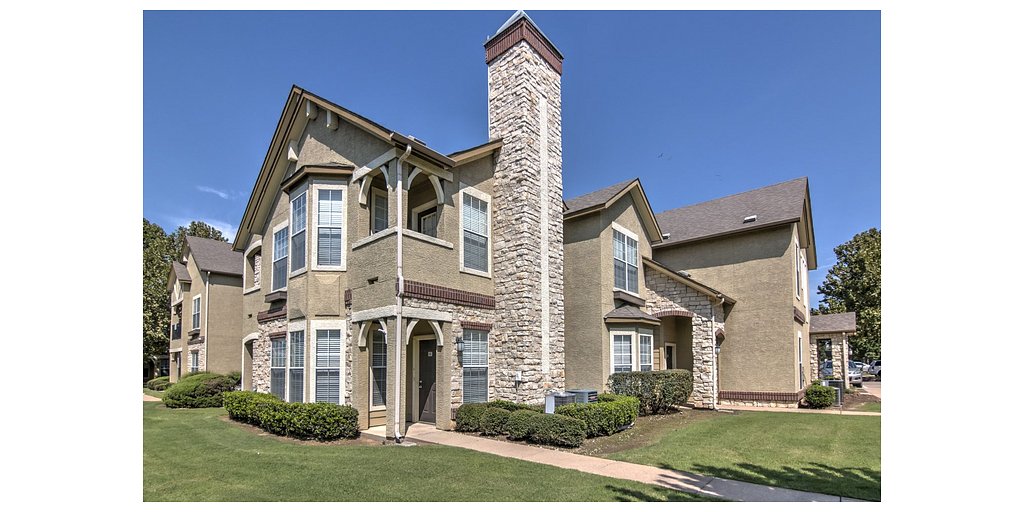

Morgan Properties, a leading national real estate investment and management company, has completed the acquisition of Dream Residential REIT, a publicly traded Canadian REIT, for $354 million. The deal adds 3,300 units across Texas, Ohio, Kentucky, and Oklahoma to Morgan Properties’ portfolio, bringing its total to over 110,000 units nationwide. This transaction highlights a growing trend of private equity firms acquiring and privatizing publicly traded REITs in the multifamily sector, particularly those focused on workforce housing. The move comes as investors increasingly target affordable rental options amid rising demand and limited supply.

“We’re seeing a definite shift in how these large portfolios are being handled,” noted one industry analyst. “Public REITs are facing pressure from investors to deliver consistent returns, and sometimes a private buyer can unlock value by taking a longer-term view and investing in property improvements.” The Dream Residential REIT deal provided an exit for shareholders, offering a significant premium over recent trading prices.

Focus on Workforce Housing Drives Investment

The acquisition aligns with Morgan Properties’ strategic focus on workforce housing – rental communities catering to essential workers and middle-income families. This asset class has demonstrated resilience during economic fluctuations and is poised to benefit from ongoing demographic trends. The company plans to invest $58 million in upgrades to the acquired communities, ranging from interior renovations to amenity enhancements. This commitment reflects a broader trend of investors recognizing the potential of value-add strategies in the workforce housing sector.

“There's a real demand for quality rental housing that’s affordable,” explained another source familiar with the deal. “Morgan Properties sees an opportunity to improve these assets and provide comfortable, modern living spaces for a wide range of residents.” The investment in upgrades is intended to increase property values, attract new tenants, and improve resident retention. This strategy is particularly effective in markets where wage growth has lagged behind rising housing costs.

Cross-Border Deals Reflect Global Real Estate Trends

The acquisition of a Canadian REIT by a US-based company underscores the growing trend of cross-border real estate deals. This activity is driven by a number of factors, including favorable exchange rates, access to capital, and the search for attractive investment opportunities. The deal also reflects the increasing integration of North American real estate markets.

“We’re seeing more and more US investors looking to Canada for real estate opportunities, and vice versa,” said a real estate attorney specializing in cross-border transactions. “Both countries offer stable economies and strong regulatory frameworks, making them attractive destinations for foreign investment.” The Dream Residential REIT acquisition is likely to encourage further cross-border activity in the multifamily sector.

Market Dynamics in Acquired Locations

The acquired properties are located in key markets across Texas, Ohio, Kentucky, and Oklahoma, each with unique demographic and economic characteristics. Ohio and Kentucky are experiencing moderate rent growth and a stable job market, while Texas and Oklahoma benefit from strong economic expansion and population growth. The demand for workforce housing is particularly strong in these regions, driven by a shortage of affordable rental options. In Ohio, rental markets have recently experienced fluctuations, but a sustained demand continues. Similarly, Oklahoma City is experiencing a stable market with moderate rent increases. The combination of strong demand and limited supply has created a favorable investment environment for Morgan Properties.

The company’s focus on value-add strategies is particularly well-suited to these markets, allowing it to enhance property values and attract a wider range of tenants. The planned capital improvements will help to address the growing demand for modern, comfortable rental housing in these regions.

Morgan Properties is now the third-largest apartment owner in the United States, consistently ranking among the top multifamily owners nationwide. This expansion reflects the company’s ability to identify attractive investment opportunities, execute complex transactions, and deliver strong returns for its investors. With over 110,000 units in its portfolio, Morgan Properties is poised to continue its growth trajectory in the coming years.