Institutional Investors Brace for 2026 Correction, Shift Portfolio Strategies

A new Natixis survey reveals growing anxiety among institutional investors about a potential market correction in 2026, prompting a re-evaluation of risk and a move towards more diversified portfolios.

Institutional Investors Brace for 2026 Correction, Shift Portfolio Strategies

NEW YORK, NY – November 19, 2025

After years of largely uninterrupted market gains, a sense of caution is descending upon institutional investors. A new annual survey from Natixis Investment Managers indicates that a significant majority – 79% – are anticipating a market correction in 2026, signaling a potential shift in investment strategies and a recalibration of risk tolerance. While optimism about long-term growth remains, the confluence of geopolitical instability, persistent inflation concerns, and the potential for an AI-fueled tech bubble is driving a more cautious outlook.

Correction Anticipation & Key Concerns

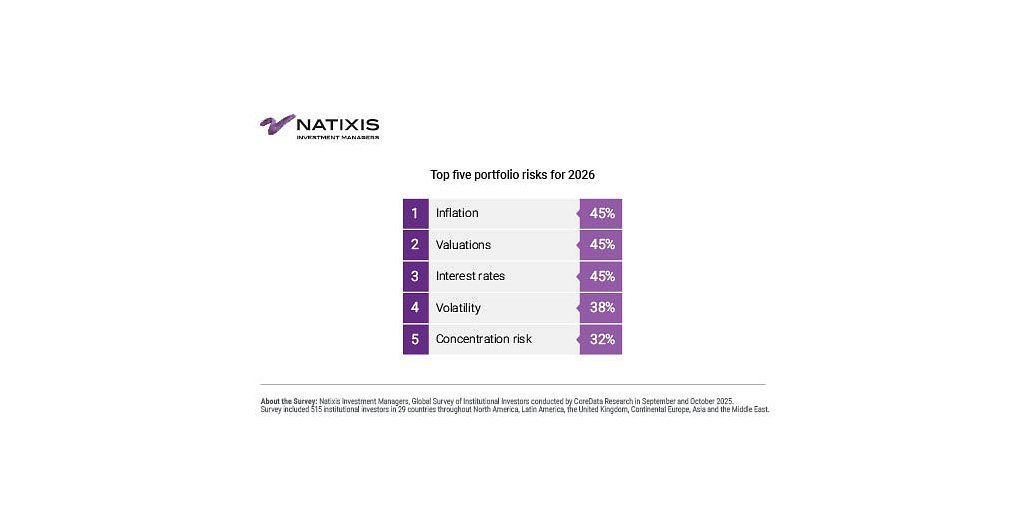

The expectation of a correction isn't a prediction of a catastrophic crash, but rather a widespread belief that markets are due for a period of consolidation, or even a moderate pullback. The average probability assigned to a 10-20% correction is a substantial 49%, with a further 20% seeing the possibility of a deeper decline exceeding 20%. This apprehension isn’t occurring in a vacuum. The survey highlights three primary sources of concern: geopolitical risks, particularly centered around China; the resurgence of inflationary pressures; and the potential for an overvaluation in technology stocks driven by the rapid expansion of artificial intelligence.

“Investors are facing a more complex risk landscape than we’ve seen in years,” notes one source at a large pension fund. “The geopolitical situation is incredibly fluid, and the potential for escalation in several regions is real. Combine that with the uncertainty around inflation and the hype surrounding AI, and you have a recipe for increased volatility.”

China looms large in the minds of investors, with 45% identifying the nation as the biggest geopolitical risk. Concerns range from potential conflicts in the South China Sea and broader regional tensions to the country's dominance in rare earth elements – a vital component in numerous high-tech applications. This dominance, investors fear, could be weaponized, creating supply chain disruptions and fueling further inflationary pressures. “The concentration of rare earth production in one country is a significant vulnerability,” says a portfolio manager at a sovereign wealth fund. “It creates a systemic risk that we need to account for.”

The AI Bubble and Inflationary Pressures

The rapid ascent of artificial intelligence has also sparked concerns about a potential tech bubble. While most investors remain bullish on the long-term potential of AI, 41% express worry that current valuations are unsustainable. The massive influx of capital into AI startups, coupled with the high costs of developing and deploying AI technologies, has led some to believe that a correction in the sector is inevitable.