IBKR's GlobalTrader Revamp: AI and Simplicity Target New Investors

Interactive Brokers' redesigned GlobalTrader app blends AI-powered insights and a user-friendly interface to make global markets more accessible than ever.

Interactive Brokers' GlobalTrader Revamp: AI Targets New Investors

GREENWICH, Conn. – December 18, 2025

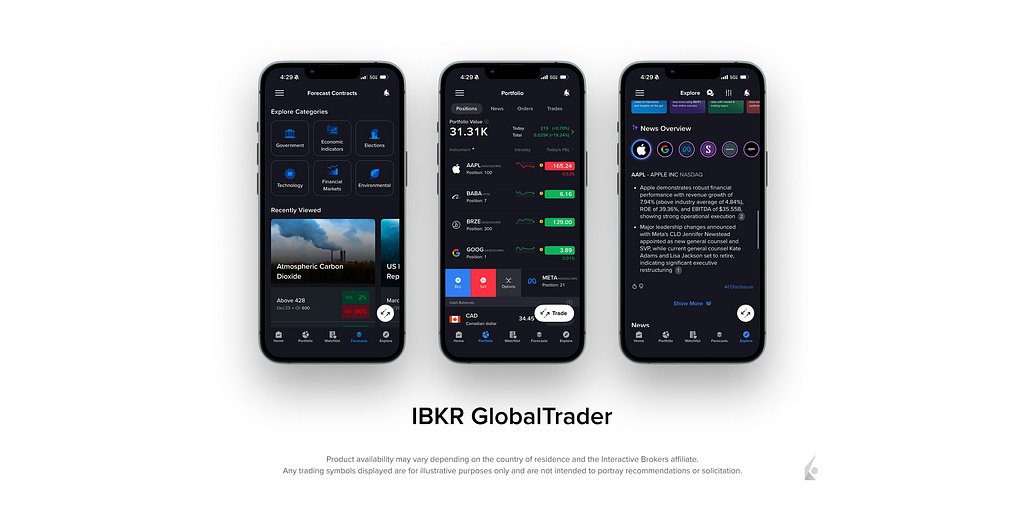

Interactive Brokers has launched a significant redesign of its IBKR GlobalTrader mobile app, a strategic move aimed at simplifying global investing and attracting a wider audience. The revamped platform, now live for iOS and Android, blends a streamlined, intuitive interface with sophisticated tools like AI-driven news summaries and direct access to forecast contracts, signaling a clear push to compete for the growing market of retail and novice investors.

The update reflects a pivotal trend in the financial industry: the democratization of powerful trading tools. While Interactive Brokers (Nasdaq: IBKR) has long been the platform of choice for professional traders and institutions due to its vast market access and advanced features, its flagship platforms have often been perceived as complex for beginners. The new GlobalTrader is designed to dismantle that barrier, offering a simplified gateway to the firm’s global trading engine.

Lowering the Barrier to Global Markets

The core of the GlobalTrader redesign is a fundamental rethinking of the user experience. Drawing inspiration from the minimalist design of neobrokers like Robinhood, the app features a clean interface, simplified navigation, and intuitive workflows. The goal is to make trading across more than 160 international markets feel as straightforward as a domestic transaction.

“We created IBKR GlobalTrader as a streamlined complement to our flagship IBKR Mobile, bringing the power of our comprehensive trading tools into a simpler, more intuitive experience,” said Milan Galik, Chief Executive Officer of Interactive Brokers, in the company's announcement. “The app makes it easy for novice investors who might be new to our platform to trade across global markets from one place.”

This simplification is most evident in the new order ticket. Users are first presented with a 'Focused' view, which guides them step-by-step through placing a trade. For those who need more granular control, an 'Advanced' ticket is just a tap away, preserving the depth the company is known for. This dual approach effectively caters to both newcomers and experienced traders who prefer a mobile-first experience.

Further enhancing accessibility is the redesigned ‘Explore’ section. It now features 'Investment Themes,' a tool that helps users discover opportunities by linking companies, their products, and competitors across the S&P 1500 universe. This thematic approach to research helps demystify market relationships and provides a guided path for investors looking for new ideas without getting lost in raw data. The app's enhanced watchlists, which now include intraday spark charts, provide a quick visual reference for an asset's daily performance, another feature aimed at delivering key information with minimal friction.

AI and Innovation in Your Pocket

Beyond its user-friendly interface, the redesigned GlobalTrader app stands out by integrating cutting-edge technology directly into the mobile experience. The introduction of AI-generated news summaries on the Explore and Quote Details pages aims to transform how investors consume market information. Instead of sifting through lengthy articles, users receive concise, AI-driven summaries that highlight key market insights, streamlining the research process significantly.

Perhaps the most innovative addition is the seamless integration of 'Forecast Contracts'. These unique, CFTC-regulated financial instruments allow investors to trade on the outcome of specific yes-or-no questions about future real-world events. Topics range from economic indicators like the Consumer Price Index and Fed Funds Rate to political outcomes and even climate data.

Forecast Contracts are designed to be accessible, with prices typically ranging from $0.02 to $0.99. The price of a contract reflects the market's perceived probability of an event occurring. A correct prediction settles at $1.00 per contract, while an incorrect one settles at $0.00. Uniquely, these contracts also pay monthly incentive coupons based on their daily closing value, offering a potential return even while waiting for the outcome. By embedding these directly into its most user-friendly app, Interactive Brokers is not just offering a new product but democratizing access to a sophisticated tool for hedging and speculation.

A Strategic Play in the Brokerage Battleground

This launch is more than a simple app update; it is a calculated strategic maneuver in the fiercely competitive brokerage industry. With this redesign, Interactive Brokers is directly challenging both established full-service brokers like Fidelity and Charles Schwab and disruptive fintech platforms like Robinhood. The company is betting it can offer the best of both worlds: the global reach and low costs it's famous for, packaged within an interface that rivals the simplicity of the most popular beginner apps.

The strategy appears to be paying off. The company noted that the app has already seen "strong early adoption" among introducing brokers, who see it as a powerful tool to simplify global investing for their own clients. This highlights a dual-purpose appeal, serving not only individual retail investors but also the financial professionals who guide them.

This move aligns with IBKR's broader growth trajectory. The firm has consistently reported robust account growth, with customer accounts rising 32% year-over-year in the first quarter of 2025. This success is built on a foundation of technological superiority and a strategic expansion of its client base, which began with the introduction of its commission-free IBKR Lite offering in 2019. The new GlobalTrader is the next logical step in this evolution, targeting the rapidly growing demographic of younger, mobile-centric investors who demand both power and simplicity.

By embedding advanced features like AI analytics and forecast contracts into its most accessible platform, Interactive Brokers is setting a new standard for what retail investors can expect from a mobile trading app. This push for innovation will likely pressure competitors to enhance their own offerings, accelerating the trend of bringing institutional-grade capabilities to the mainstream market.

📝 This article is still being updated

Are you a relevant expert who could contribute your opinion or insights to this article? We'd love to hear from you. We will give you full credit for your contribution.

Contribute Your Expertise →