Holiday Debt Hangover Looms as Consumer Credit Cracks Widen

Holiday spending pushed credit balances to a new high, but a sharp rise in delinquencies signals a K-shaped economy where many face a financial reckoning.

Holiday Debt Hangover Looms as Consumer Credit Cracks Widen

SAN FRANCISCO, CA – December 19, 2025 – As Americans wrapped up their holiday shopping, they also racked up record levels of debt, pushing average consumer credit balances to a new post-pandemic high. But beneath the festive spending surge, new data reveals widening cracks in the foundation of U.S. consumer financial health, with a significant rise in late-stage delinquencies signaling a looming debt hangover for a growing segment of the population.

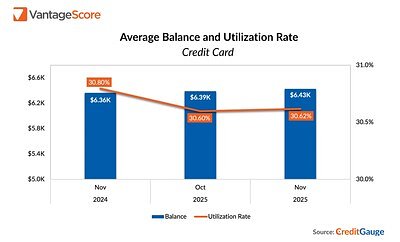

The latest CreditGauge report from VantageScore, released today, paints a complex and bifurcated picture of the American consumer. While overall credit originations for personal loans and credit cards rose, suggesting many tapped into liquidity for the holidays, the concurrent spike in serious delinquencies highlights a persistent "K-shaped" economy where financial stability is diverging sharply. The average credit balance climbed to $106,000 in November, a 1.4% increase from the previous year, yet the average VantageScore 4.0 credit score held steady at 701, masking the turmoil bubbling below the surface.

"Average credit balances grew in November compared to the previous year, while Personal Loan and Credit Card originations also increased year-over-year — suggesting that more consumers are accessing additional liquidity in comparison to last year's holiday season," said Susan Fahy, EVP and Chief Digital Officer at VantageScore. "Many consumers entered the 2025 festive season with tighter household budgets, likely due to a combination of a softer labor market and persistently higher prices, among other factors."

The Alarming Rise in Serious Delinquencies

While the headline numbers suggest resilience, a deeper dive into delinquency data reveals significant areas of stress. The VantageScore report noted a 30% year-over-year relative increase in late-stage delinquencies (90-119 days past due), a metric that often precedes defaults and charge-offs. This trend is not isolated. Broader market data confirms that specific credit products are becoming major sources of financial distress.

Auto loans have emerged as a particularly stark warning sign. Delinquency rates have surged to levels not seen since the 2008 Great Financial Crisis, with approximately 3.88% of all auto loans past due. The pressure is most acute in the subprime sector, where delinquencies have matched record highs, indicating that rising vehicle prices and high interest rates are pushing the most vulnerable households to the brink.

An even more dramatic shock to the system has come from student loans. Following the resumption of mandatory payments, severe delinquency rates have skyrocketed. By some measures, nearly one-third of federal student loan borrowers with a payment due were severely delinquent by spring 2025—the highest rate ever recorded. This has created a ripple effect, with research showing that borrowers struggling with student debt are now exhibiting significantly higher mortgage delinquency rates, challenging the long-held assumption that homeowners prioritize their mortgage above all other debts.

Credit cards, the primary vehicle for holiday spending, are also flashing red for specific demographics. While overall delinquency rates remain below long-term historical averages, they have soared in lower-income communities, reaching over 20% for 90-plus day delinquencies in some of the nation's poorest ZIP codes. Younger borrowers, particularly those aged 18-35, are also missing payments at an accelerating rate, with their delinquency rates climbing over 16% year-over-year.

A Tale of Two Consumers

These diverging trends underscore the "K-shaped" reality of the U.S. economy. On one side, a large portion of the population, particularly those in the "super prime" credit tier, continues to demonstrate financial stability. The percentage of consumers in this lowest-risk category has actually grown since before the pandemic, from 37% to nearly 41%. This group’s stability is a key reason why the national average credit score has remained buoyant.

On the other, downward-sloping arm of the 'K', a growing cohort is falling further behind. This group is disproportionately made up of younger individuals, lower-income households, and those burdened by auto and student loan debt. For them, persistently high interest rates—with credit card APRs hovering between 22-24%—and inflation on essential goods have eroded any financial buffer they may have had.

"What we're seeing is not a universal decline in credit health, but a targeted crisis," noted one independent economist. "The combination of high borrowing costs and the resumption of student loan payments has created a perfect storm for households that were already living on the edge. They are using credit not for discretionary spending, but to fill income gaps for necessities."

This bifurcation is also visible geographically, with states in the Deep South, such as Mississippi and Louisiana, consistently reporting the nation's highest rates of credit card and mortgage delinquency, reflecting deeper regional economic disparities.

Lenders Walk a Financial Tightrope

Faced with this dual reality, financial institutions are performing a delicate balancing act. On one hand, they are meeting the holiday-fueled demand for credit, with year-over-year originations for credit cards and personal loans increasing by 0.34% and 0.56% respectively.

On the other hand, they are showing signs of caution. Lenders have tightened standards in some respects, with the average credit line on new accounts decreasing, particularly for subprime borrowers. This suggests an attempt to manage exposure to the riskiest segments of the market while still capitalizing on credit growth among more stable consumers.

However, the rising stress in portfolios is undeniable. Banks are bracing for an increase in charge-offs as the current wave of delinquencies matures. The sharp rise in defaults on auto loans, even among some near-prime and prime borrowers, indicates that traditional risk models may not be fully capturing the economic pressures facing households today.

"Lenders are having to become much more sophisticated in their risk analysis," a financial sector analyst commented. "It's no longer enough to look at a credit score. They have to understand the interplay between different types of debt, like how a student loan payment can impact a borrower's ability to pay their auto loan or mortgage."

As the holiday season concludes, the focus now shifts to the first quarter of 2026. With interest rates projected to remain elevated and the labor market showing signs of cooling, the ability of consumers to manage their newly acquired debt will be a critical test for the broader economy. The stability of the majority may keep the system afloat, but the growing distress at the bottom of the K-shaped economy presents a significant and unpredictable risk moving forward.

📝 This article is still being updated

Are you a relevant expert who could contribute your opinion or insights to this article? We'd love to hear from you. We will give you full credit for your contribution.

Contribute Your Expertise →