Ford's EV Reality Check: A Pivot to Profit, Hybrids & the Power Grid

Ford hits the brakes on its aggressive EV plan, pivoting to profitable hybrids and a bold new venture in battery energy storage. What does this mean?

Ford's EV Reality Check: A Pivot to Profit, Hybrids & the Power Grid

DEARBORN, MI – December 15, 2025

In a move sending shockwaves through the automotive world, Ford Motor Company has announced a dramatic strategic pivot, hitting the brakes on its aggressive all-electric vehicle ambitions to redeploy capital towards its profitable truck and hybrid lineups, while simultaneously launching a bold new venture in the energy sector. The recalibration of its 'Ford+' plan, backed by a staggering $19.5 billion in special charges, signals a profound reality check not just for the Dearborn automaker, but for an entire industry grappling with the high costs and wavering consumer demand of the EV transition.

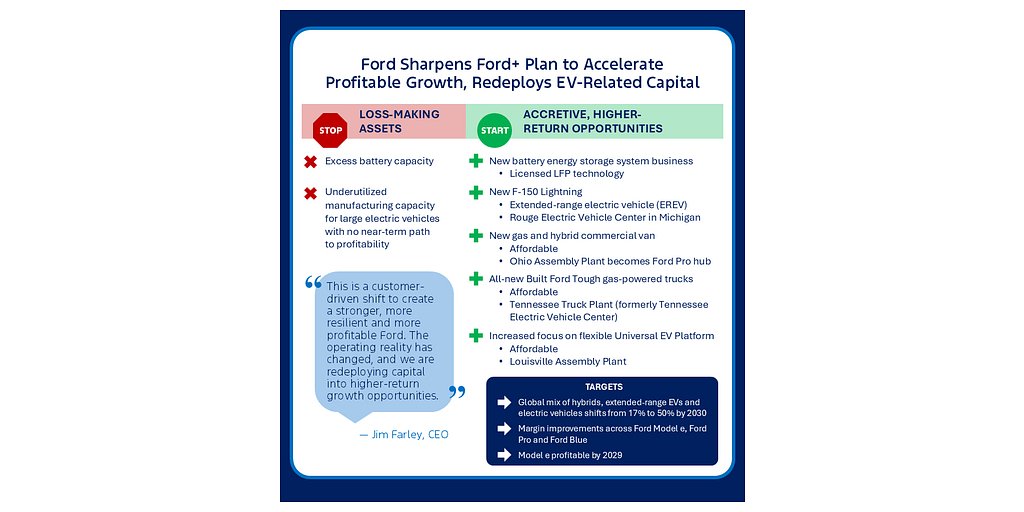

This is not an abandonment of electrification, but a significant course correction. “This is a customer-driven shift to create a stronger, more resilient and more profitable Ford,” stated CEO Jim Farley in the announcement. “The operating reality has changed, and we are redeploying capital into higher-return growth opportunities.” For a legacy giant like Ford, this pivot represents a shift from revolutionary fervor to evolutionary pragmatism, prioritizing profitability and consumer choice over an EV-at-all-costs mandate.

The High Cost of an EV Future

The financial underpinning of Ford's strategic shift is stark. The company will absorb approximately $19.5 billion in special items, a monumental figure that reflects the cost of unwinding its previous, more aggressive EV strategy. Research reveals this charge includes roughly $8.5 billion for canceling planned larger EV models, about $6 billion related to the dissolution of a battery joint venture with SK On, and billions more in asset impairments and program-related expenses.

These write-downs are a direct consequence of a cooling EV market. Data shows a precipitous 40% decline in U.S. EV sales in November after federal tax credits expired, with Ford's own EV sales plummeting over 60% year-over-year. This market reality has savaged the balance sheet of its all-electric division, Model e, which has lost over $12 billion since 2023 and is projected to lose another $5 billion to $5.5 billion in 2025. The goal of profitability for the division has now been pushed back to 2029.

In stark contrast, Ford's traditional business units remain powerhouses. The Ford Blue division, which handles internal combustion and hybrid vehicles, and Ford Pro, its commercial arm, generated a combined profit of over $14 billion in 2024. By reallocating capital to these proven winners, Ford is shoring up its financial foundation while it rethinks the path to an electric future.

A Return to Roots, Reimagined

Ford’s new roadmap is a masterclass in leveraging existing strengths while selectively innovating. The core of the strategy is a renewed focus on customer choice, effectively ending the narrative of a forced march to pure electrics. Hybrids are now central to this plan, with the company projecting that by 2030, 50% of its global sales will come from a mix of hybrids, extended-range EVs, and fully electric models—a massive jump from 17% in 2025.

This pivot is most visible in its manufacturing footprint. The Tennessee Electric Vehicle Center, once destined to build a next-generation electric truck, will be renamed the Tennessee Truck Plant and will instead produce new gas-powered trucks starting in 2029. Similarly, the Ohio Assembly Plant will become a hub for Ford Pro, building new gas and hybrid commercial vans. It's a clear signal that Ford is doubling down on its undisputed dominance in the truck and van markets.

However, EV innovation continues, albeit in a more pragmatic form. The company is shelving plans for large, expensive EVs in favor of a new, flexible “Universal EV Platform” designed to underpin smaller, more affordable models. The first fruit of this labor will be a midsize electric pickup truck slated for a 2027 launch with a target price around $30,000, directly addressing the affordability crisis that has plagued the EV market.

Perhaps the most intriguing product evolution is the next-generation F-150 Lightning. It will shift to an extended-range electric vehicle (EREV) architecture. This technology uses an onboard gas generator to charge the battery, offering the instant torque and electric-drive feel of an EV without the range anxiety. As Doug Field, Ford’s chief EV, digital and design officer, explained, “It keeps everything customers love…and adds an estimated 700+ mile range and tows like a locomotive.”

Beyond the Automobile: Ford's Bet on the Grid

The most forward-looking element of Ford’s announcement is its diversification into a completely new industry: battery energy storage systems (BESS). The company is launching a new business unit and investing $2 billion to repurpose its Kentucky battery manufacturing facilities to produce large-scale stationary batteries for utilities, data centers, and industrial clients.

This is a shrewd move to salvage a massive investment while tapping into a burgeoning market. The insatiable energy demands of AI data centers and the broader transition to renewable energy have created immense demand for grid-scale storage. By leveraging its manufacturing expertise and underutilized EV battery capacity, Ford is positioning itself as a key supplier in the energy infrastructure of the future. The company plans to begin BESS shipments in 2027, targeting an annual capacity of at least 20 GWh. A separate facility in Marshall, Michigan, will produce smaller cells for the residential energy storage market, creating a comprehensive energy solutions portfolio.

Industry Ripples and the Road Ahead

Ford's pivot is not happening in a vacuum. It mirrors a broader industry recalibration, with competitors like General Motors also writing down EV assets and abandoning hard deadlines for an all-electric transition. This trend is amplified by a shifting regulatory landscape in the U.S., where relaxed emissions rules and reduced EV subsidies are encouraging automakers to meet consumer demand for gasoline and hybrid vehicles.

The transition comes with complex implications for the workforce. While Ford touts plans to hire thousands of new U.S. workers, the retooling of its Kentucky battery plant for BESS production will result in approximately 1,600 layoffs. It's a stark reminder that even strategic pivots aimed at long-term growth can have immediate human costs.

Ultimately, Ford’s announcement marks the end of an era of EV evangelism and the dawn of a new age of powertrain pragmatism. The company is betting that the future isn't a single path but a multi-lane highway, offering customers gasoline, hybrid, and electric options tailored to their needs and wallets. For Ford, and perhaps the entire industry, the all-electric future is no longer a sprint but a carefully managed marathon, with profitable detours now part of the planned route.

📝 This article is still being updated

Are you a relevant expert who could contribute your opinion or insights to this article? We'd love to hear from you. We will give you full credit for your contribution.

Contribute Your Expertise →