Crypto's Social License: Bitget's $12M Hong Kong Fire Donation

- $12M HKD ($1.54M USD) donation: Bitget's relief fund for Hong Kong fire victims.

- 150+ deaths, 79+ injuries: Human toll of the Wang Fuk Court fire.

- $57M HKD ($7.3M USD) total: Combined crypto industry donations.

Experts view this coordinated crypto industry response as a strategic effort to build social capital and legitimacy, demonstrating real-world utility and social responsibility critical for long-term adoption.

Crypto's Social License: Bitget's $12M Hong Kong Fire Donation

VICTORIA, Seychelles – November 28, 2025 – In the wake of one of Hong Kong's most devastating residential fires in decades, the global cryptocurrency exchange Bitget has announced a significant $1.54 million USD ($12 million HKD) relief fund to support the victims. The move, executed with remarkable speed, is part of a broader, multi-million dollar philanthropic wave from the digital asset industry, signaling a strategic pivot towards building social capital and a positive public image.

The catastrophic blaze, which engulfed the Wang Fuk Court housing estate in Tai Po on November 26, has left a deep scar on the city. As emergency services concluded their operations, the human cost became tragically clear, with the death toll climbing to over 150 people, including one firefighter, and injuring at least 79 others. The fire, which raged for over 40 hours, displaced more than 900 residents, leaving a community shattered and in immediate need of comprehensive support.

A Structured and Swift Response

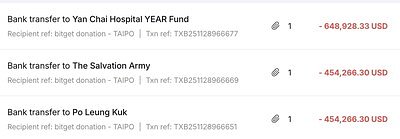

Bitget's response was not only substantial but also strategically structured for immediate impact. The company announced that the entire $12 million HKD donation was executed on the same day as the announcement, funneled through three of Hong Kong’s most established charitable organizations to ensure transparent and targeted aid delivery. This approach bypasses potential delays and ensures funds reach those in dire need without bureaucratic friction.

The allocation of funds demonstrates a multi-faceted relief strategy:

* Yan Chai Hospital received $5 million HKD to bolster emergency medical services, fund treatment for the injured, and support long-term rehabilitation for affected families.

* The Salvation Army Hong Kong was granted $3.5 million HKD to provide immediate financial assistance, secure temporary accommodation, and supply basic necessities for households that lost their homes and livelihoods.

* Po Leung Kuk received $3.5 million HKD to focus on the crucial, long-term psychological recovery, offering counseling, community outreach, and case follow-up for survivors and bereaved families.

This rapid and organized deployment of capital highlights a key advantage of nimble, modern financial entities. While the Hong Kong government mobilized its own substantial relief fund, the swift action from the private sector, particularly from the crypto industry, provided an immediate lifeline. The disaster has also triggered intense scrutiny, with ongoing criminal and anti-corruption investigations into the renovation works at Wang Fuk Court, focusing on the use of highly flammable construction materials that may have tragically accelerated the blaze.

A New Chapter in Corporate Philanthropy

Bitget's contribution, while the largest from a single crypto firm, was part of a powerful collective response from the digital asset sector. Other major exchanges, including Binance, OKX, and HashKey Group, each pledged HK$10 million, bringing the industry's total contribution to over HK$57 million ($7.3 million USD). This coordinated effort marks a significant moment for an industry often viewed through the narrow lens of market speculation and volatility.

This trend extends far beyond a single event. Globally, cryptocurrency donations to non-profits have surged, exceeding $1 billion in 2024 and projected to reach $2.5 billion in 2025. The core technology of blockchain, with its inherent transparency and borderless nature, is proving to be a powerful tool for humanitarian aid, allowing for rapid deployment of funds in crises from the war in Ukraine to earthquake relief in Turkey.

For investors and industry observers, this represents a maturation of the digital asset space. As one analyst noted, "We're seeing a conscious effort to build a 'crypto for good' narrative. It's about demonstrating real-world utility and social responsibility, which is essential for long-term legitimacy and mainstream adoption." This pivot is crucial for an industry seeking to build trust with regulators, institutions, and the general public.

The Strategic Value of a Social License

In today's market, a company's social license to operate—the tacit approval it earns from the public and stakeholders—is as valuable as any physical or intellectual asset. This is a lesson the mining and critical minerals sector has learned through decades of navigating complex environmental and community relations. For emerging technology sectors like cryptocurrency, which face similar, if not greater, public scrutiny and regulatory headwinds, building this social license is not just good PR; it is a core strategic imperative.

Bitget’s philanthropic activities appear to be part of a deliberate, long-term strategy. The company has committed $10 million to its "Blockchain4Youth" initiative to foster Web3 education and another $10 million to its "Blockchain4Her" program to empower women in the space. A recent high-profile partnership with UNICEF aims to leverage blockchain to deliver digital skills training to over a million young people by 2027.

These initiatives, combined with the rapid disaster relief in Hong Kong, paint a picture of a company strategically investing in its own legitimacy. By aligning its brand with positive social outcomes—education, gender equality, and humanitarian aid—Bitget is constructing a narrative that moves beyond financial speculation. This is a playbook familiar to any major player in a sensitive industry. Just as a mining company invests in local infrastructure and environmental remediation to secure its long-term access to resources, a crypto exchange invests in social good to secure its place in the future of finance.

The financial and strategic implications are clear. Strong ESG (Environmental, Social, and Governance) credentials and a robust social license can de-risk a company, attract a wider pool of investors, and foster brand loyalty in a competitive market. For companies operating on the technological frontier, whether extracting lithium for EV batteries or building the infrastructure for digital assets, demonstrating a commitment to the well-being of the global community is no longer optional, but a fundamental component of sustainable growth. The rapid, substantial, and structured aid flowing into Hong Kong from the crypto world suggests this lesson has been well and truly learned.