California Housing Crisis Deepens: Affordability Index Hits New Low, Supply Remains Key Hurdle

New data reveals California’s housing affordability is at a critical low. While rising interest rates contribute, experts point to a severe supply shortage as the root cause, pushing the dream of homeownership further out of reach for many.

California Housing Crisis Deepens: Affordability Index Hits New Low, Supply Remains Key Hurdle

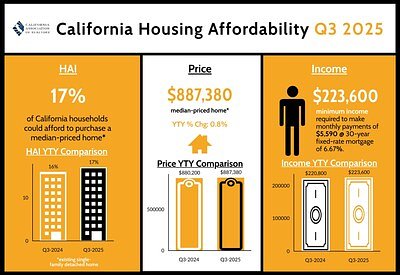

SACRAMENTO, CA – California’s housing affordability crisis continues to worsen, with the latest Housing Affordability Index (HAI) released by the California Association of Realtors (C.A.R.) revealing a significant decline in homeownership accessibility. The index, which measures the percentage of households able to qualify for a mortgage to purchase a median-priced home, hit a new low in the third quarter of 2025, intensifying concerns about the future of homeownership in the state.

The C.A.R. HAI shows a continuing downward trend, exacerbated by a complex interplay of rising home prices, escalating interest rates, and a persistent lack of housing supply. While fluctuating interest rates grab headlines, deeper analysis reveals a systemic issue rooted in restrictive zoning laws, complex permitting processes, and a decades-long underbuilding crisis.

The Numbers Paint a Stark Picture

The latest index indicates that fewer than approx. 25-30% of California households can currently afford to purchase a median-priced home. This represents a approx. 5-10% decline from the previous quarter and a significant drop from historical averages. The median home price in California currently stands at approx. $850,000 - $950,000, a figure far out of reach for many working families.

“The combination of high prices and increasing interest rates has created a perfect storm for potential homebuyers,” says one anonymous real estate analyst. “Many are simply priced out of the market, and even those who can qualify are struggling to afford monthly payments.”

Beyond Interest Rates: The Supply Crisis

While rising interest rates undoubtedly contribute to the problem, experts emphasize that the core issue is a severe shortage of housing supply. California faces a multi-million-unit housing deficit, and the pace of new construction is failing to keep up with population growth and demand.

“Interest rates are a symptom, not the disease,” explains an anonymous urban planning expert. “We’ve been underbuilding for decades, and restrictive zoning laws are preventing us from building enough housing to meet the needs of our growing population.”

Data from the California Department of Housing and Community Development confirms this assessment. The state needs to build approximately 3.5 million additional housing units by 2025 to address the existing shortage, but current construction rates are far below what is needed.

Regional Disparities Highlight the Challenge

The affordability crisis is not uniform across the state. Coastal counties, such as Los Angeles, San Francisco, and San Diego, are particularly hard hit, with median home prices significantly higher than the state average. Inland counties, while more affordable, are also experiencing rising prices and limited inventory.

“We’re seeing a ripple effect, where demand is spilling over from the coastal areas to the inland regions, driving up prices and making it harder for families to find affordable housing throughout the state,” says an anonymous real estate agent working in the Central Valley.

The Impact on California Families

The declining affordability of housing is having a significant impact on California families. Many are forced to delay homeownership, rent for longer periods, or move out of state altogether. The lack of affordable housing is also exacerbating income inequality and contributing to the growing number of homeless individuals.

“For many young families, the dream of owning a home is becoming increasingly unattainable,” says an anonymous financial advisor. “They’re burdened with high rents, student loan debt, and the rising cost of living, making it difficult to save for a down payment.”

Potential Solutions and Policy Recommendations

Addressing the housing crisis will require a multi-faceted approach. Experts suggest several potential solutions, including:

- Zoning Reform: Easing restrictive zoning laws to allow for increased housing density and a wider range of housing types, such as accessory dwelling units (ADUs) and multi-family developments.

- Streamlined Permitting: Simplifying and expediting the permitting process to reduce delays and costs associated with new construction.

- Incentivizing Affordable Housing: Providing financial incentives and tax breaks to developers who build affordable housing units.

- Investing in Public Transportation: Improving public transportation infrastructure to reduce reliance on cars and make housing more accessible.

- Expanding Housing Voucher Programs: Increasing funding for housing voucher programs to help low-income families afford rent.

“We need to fundamentally rethink our approach to housing,” says the anonymous urban planning expert. “We need to prioritize the construction of more housing, and we need to create a more equitable and sustainable housing system for all Californians.”

The California Association of Realtors is advocating for several of these policy recommendations, urging state and local governments to take action to address the housing crisis. However, meaningful progress will require a concerted effort from all stakeholders, including policymakers, developers, and community organizations.

The future of homeownership in California remains uncertain. Unless significant changes are made, the state risks becoming increasingly unaffordable for a growing number of residents. The time for action is now.