CAAP Soars: Airport Group's Growth Outpaces Industry Amidst Economic Shifts

Corporación América Airports reports strong October traffic, exceeding competitor growth. A deep dive into the economic drivers behind the success in Argentina, Brazil, Italy and Armenia, and the impact of currency fluctuations.

CAAP Soars: Airport Group's Growth Outpaces Industry Amidst Economic Shifts

NEW YORK, NY – November 21, 2025

Corporación América Airports (CAAP) is demonstrating strong momentum, reporting a 10.2% year-over-year increase in passenger traffic for October 2025. This growth significantly outpaces that of its major competitors and positions the company as a key indicator of recovery within the global aviation sector. While the broader industry is rebounding, CAAP’s performance highlights a strategic ability to capitalize on regional economic dynamics and evolving travel patterns.

Navigating a Resurgent Travel Landscape

The aviation industry has been steadily recovering from the disruptions of recent years, but growth remains uneven. Data from Fraport and Aena, two of CAAP’s primary competitors, indicate more moderate growth rates of 8.3% and 4.5% respectively for the same period. This suggests CAAP is not merely benefiting from the general uptrend, but is actively gaining market share. “We're seeing a clear rebound in both international and domestic travel,” stated an industry analyst. “The key now is for operators to optimize their infrastructure and services to accommodate the rising demand.” CAAP’s ability to achieve a higher growth rate underscores effective operational management and a strategic focus on key markets.

Regional Engines of Growth: Argentina & Brazil Lead the Way

Much of CAAP’s success is tied to strong performance in Argentina and Brazil. Argentina, experiencing robust economic growth projected at over 5% for 2025, is seeing a surge in both business and leisure travel. This economic buoyancy is directly translating to increased passenger numbers at CAAP-operated airports. Brazil, while experiencing more moderate growth, remains a significant tourism destination, and CAAP’s airports are benefiting from consistent demand. “The South American markets are proving remarkably resilient,” explained a source familiar with CAAP’s operations. “The combination of a growing middle class and increased connectivity is driving sustained growth.”

Italy also contributed meaningfully to CAAP’s positive results, despite slower overall economic growth in the Eurozone. The country’s enduring popularity as a tourist destination continues to fuel demand, with passenger traffic to CAAP-operated Italian airports remaining strong. Armenia, too, is showing promise, with projected GDP growth exceeding 5% in 2025. Despite a mixed tourist performance earlier in the year, Q3 2025 saw a strong rebound in tourism to Armenia, bolstering passenger numbers through CAAP's Armenian airports. “The diversity of CAAP's geographic footprint is a major strength,” noted an industry observer. “It allows the company to offset slower growth in one region with stronger performance in another.”

Currency Fluctuations & Economic Headwinds

While the overall outlook for CAAP is positive, the company faces challenges related to currency fluctuations and regional economic uncertainties. The Argentine Peso is expected to depreciate against the US dollar in 2025, potentially impacting affordability for international travelers. Similarly, the Brazilian Real is facing downward pressure. These currency dynamics could impact revenue streams and require CAAP to carefully manage costs and pricing strategies. “Currency risk is a constant concern for companies operating in emerging markets,” stated a financial analyst. “CAAP has demonstrated a prudent approach to hedging and risk management, but continued vigilance is essential.”

The European economic climate presents different challenges, with Italy experiencing slower growth and potential inflationary pressures. However, Italy’s enduring appeal as a tourism destination provides a degree of resilience, and CAAP’s strategic positioning within the Italian market allows it to capitalize on consistent demand. Armenia’s economy, while growing rapidly, is susceptible to external shocks and geopolitical risks, requiring CAAP to maintain a flexible and adaptive approach. “Navigating these regional economic complexities is crucial for long-term success,” remarked an industry expert. “CAAP’s ability to adapt to changing conditions will be a key differentiator.”

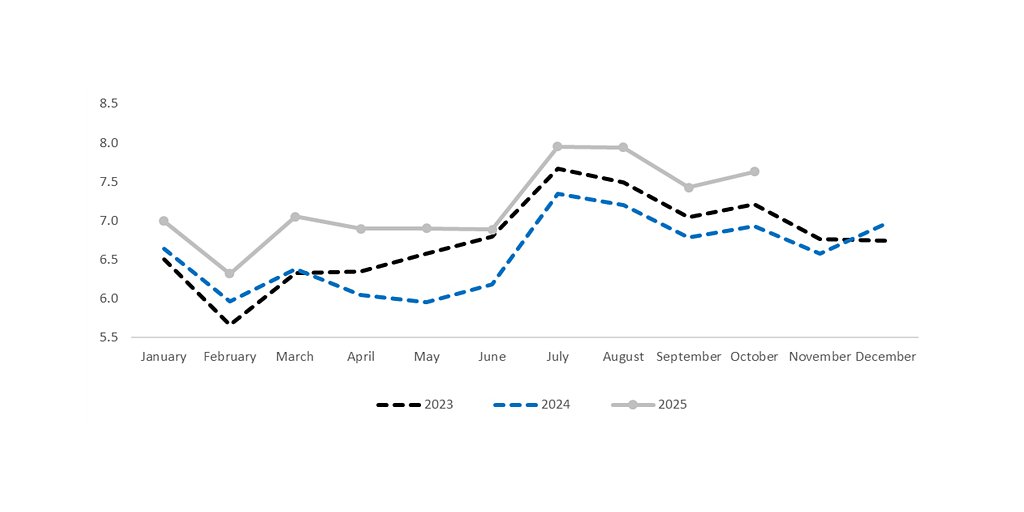

CAAP served 79.0 million passengers in 2024, marking a 2.7% decrease from 2023, excluding the Natal airport. While this represents a downturn, it's important to note the circumstances surrounding the decrease and the robust October 2025 performance clearly indicates a course correction and positive momentum. Investors will be closely watching to see if the strong October numbers continue into the remaining months of the year and beyond.