Beyond the Tap: Navi UPI's Immersive 'Hurrypur' Signals Experiential Future for Fintech

Navi UPI isn't just streamlining payments; it’s building a lifestyle. The company’s 'Hurrypur SOCIAL' takeover exemplifies a growing trend: experiential marketing transforming how fintech connects with consumers.

Beyond the Tap: Navi UPI's Immersive 'Hurrypur' Signals Experiential Future for Fintech

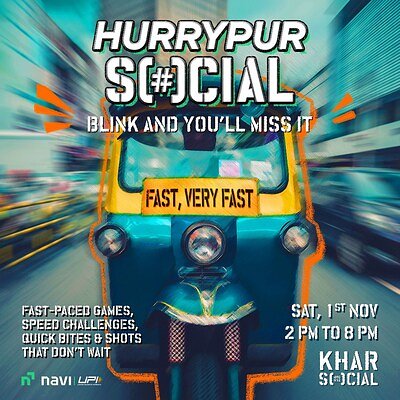

Mumbai, India – In a crowded fintech landscape, simply offering a convenient digital payment solution isn’t enough. Navi UPI is betting on experience. This week, the rapidly growing financial services company transformed Mumbai’s popular Khar SOCIAL into ‘Hurrypur SOCIAL’ – a fully-immersive, themed environment designed to showcase the speed and ease of its UPI platform. While the event is a one-day pop-up, it signals a larger shift: fintech companies are increasingly turning to experiential marketing to forge deeper connections with consumers and differentiate themselves in a saturated market.

For a few hours on November 1st, Khar SOCIAL shed its familiar aesthetic, becoming ‘Hurrypur’ – a fictional town where everything moves at a breakneck pace. From décor to interactive games, the event aimed to embody the seamless, frictionless experience Navi UPI promises. Visitors enjoyed themed cocktails, participated in speed challenges, and explored interactive installations, all while encouraged to utilize the Navi UPI app for transactions.

“We wanted to move beyond just talking about convenience and actually show people what it feels like,” explained a Navi spokesperson. “Hurrypur isn’t just about demonstrating the tech; it's about creating a feeling, an association with speed, fun, and a stress-free lifestyle.”

The Rise of Experiential Fintech

The 'Hurrypur' initiative isn't an isolated incident. Across the fintech sector, companies are recognizing the limitations of traditional advertising. In a world inundated with digital noise, consumers are craving authentic experiences. According to recent reports from Eventbrite and Freeman, experiential marketing campaigns can boost brand recall by 20-30% and generate significantly higher ROI compared to conventional methods.

“Fintech is often seen as complex and impersonal,” notes a marketing analyst specializing in financial technology. “Experiential marketing allows these companies to humanize their brand, demonstrate their value proposition in a tangible way, and build emotional connections with consumers.”

Competitors like PhonePe and Paytm have also invested in similar initiatives, focusing on event sponsorships and interactive activations. Google Pay has partnered with popular brands to create immersive campaigns, recognizing the power of association and co-branding.

Navi's Strategic Play: Targeting Digital Natives

Navi UPI's choice of venue – Khar SOCIAL – is no accident. The popular hangout is a magnet for Mumbai’s young professionals and students – a demographic crucial to Navi’s growth strategy. These “digital natives” are accustomed to seamless digital experiences and are particularly receptive to innovative marketing approaches.

“Navi is very consciously targeting a younger, tech-savvy audience,” says a local retail analyst. “They understand that this generation doesn’t respond to traditional advertising. They want experiences, they want authenticity, and they want brands that align with their values.”

Data supports this strategy. Khar SOCIAL boasts over 50,000 Instagram followers with a strong engagement rate, indicating a highly active and influential online presence. Navi's social media strategy surrounding the event has amplified this reach, generating significant buzz and encouraging user-generated content.

Beyond Transactions: Building a Lifestyle

While convenience remains a key driver of digital payment adoption, Navi appears to be aiming higher – to build a lifestyle around its brand. The ‘Hurrypur’ theme is more than just a marketing gimmick; it’s an attempt to create an aspirational identity, associating Navi UPI with a fast-paced, fulfilling, and stress-free lifestyle.

“We’re not just selling a payment solution; we’re selling a feeling,” explains a Navi representative. “We want people to associate Navi UPI with ease, convenience, and a modern way of life.”

This strategy aligns with a broader trend in marketing – the shift from product-centricity to customer-centricity. Consumers are increasingly seeking brands that understand their needs, share their values, and offer more than just a functional product.

The Future of Fintech Marketing

The success of ‘Hurrypur SOCIAL’ remains to be fully measured, but it offers a glimpse into the future of fintech marketing. In a crowded and competitive landscape, simply offering a better product or lower fees isn’t enough. Companies need to create immersive experiences, forge emotional connections, and build brands that resonate with consumers on a deeper level.

As Navi UPI continues to grow, its investment in experiential marketing could prove to be a key differentiator. By moving beyond transactions and building a lifestyle around its brand, Navi is positioning itself not just as a payment provider, but as a trusted partner in the lives of its customers.

“The future of fintech marketing isn’t about shouting louder; it’s about creating experiences that people will remember,” concludes a marketing consultant. “And Navi UPI is clearly taking that message to heart.”