Asahi Kasei's Pivot: A New Blueprint for Japanese Industrial Strategy

- Joint Venture Ownership: 80% Teijin, 20% Asahi Kasei

- Effective Date: October 2026

- Impact on Earnings: 'Immaterial' (per Asahi Kasei)

Experts view this merger as a strategic masterstroke, enabling Asahi Kasei to streamline operations while gaining exposure to a stronger, specialized entity in high-performance materials.

Asahi Kasei’s Strategic Pivot: A New Blueprint for Japanese Industry

TOKYO, JAPAN – December 01, 2025

In a move that signals a significant strategic realignment among Japan’s industrial titans, Asahi Kasei and Teijin Limited have announced plans to merge their respective materials subsidiaries, Asahi Kasei Advance and Teijin Frontier. While press releases frame such deals in the familiar language of synergy and growth, the real story here is a masterclass in corporate portfolio strategy. Effective October 2026, the integration will create a new joint venture—80% owned by Teijin and 20% by Asahi Kasei—that is far more than the sum of its parts. It represents a calculated pivot by Asahi Kasei to streamline its operations while simultaneously forging a more formidable, specialized entity capable of competing on a fiercely contested global stage. This isn't just a merger; it's a blueprint for how legacy conglomerates can adapt and thrive in the 21st century.

A Calculated Unburdening for Growth

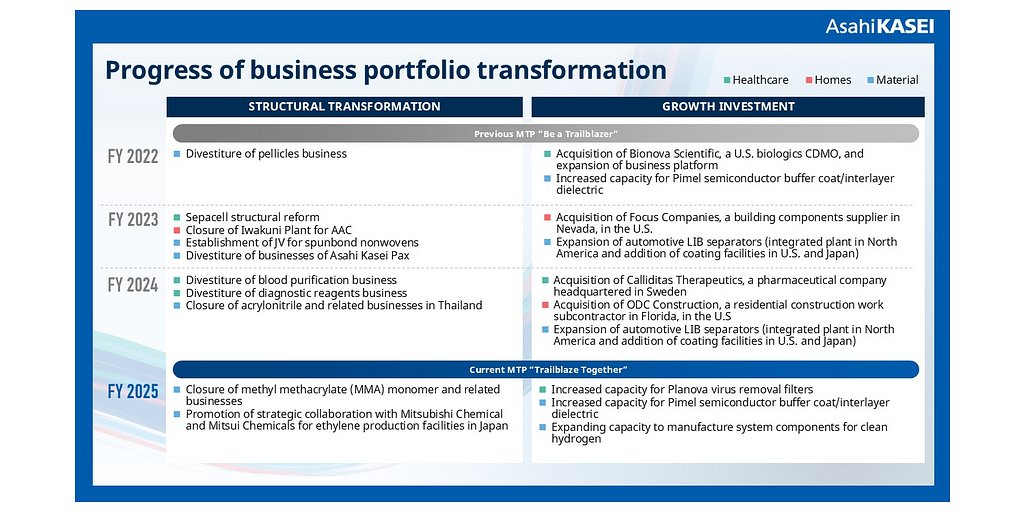

For Asahi Kasei, this integration is a direct and decisive execution of its new medium-term management plan, "Trailblaze Together." The plan is an ambitious road map for improving capital efficiency and channeling resources toward its most promising growth engines: pharmaceuticals, critical care, overseas homes, and high-tech electronics. Within this framework, every business unit must justify its claim on corporate capital and attention.

Asahi Kasei Advance, established in 2015 as the trading arm for the group's fibers, chemicals, and construction materials, found itself at a strategic crossroads. While a functional part of the conglomerate, the question became whether independent growth was the most efficient path forward. The answer, evidently, was no. The company’s leadership determined that folding the unit into Teijin Frontier—a powerhouse that combines a trading company’s global procurement with a manufacturer’s R&D and production muscle—offered a more promising future.

Asahi Kasei’s disclosure that the deal’s effect on its consolidated earnings is "immaterial" is telling. This isn’t a sign of the deal's unimportance, but rather a reflection of its strategic brilliance. By taking a 20% stake, Asahi Kasei transitions from an operator to a strategic investor. It will account for its holding using the equity method, reflecting its share of the joint venture's profits or losses as a single line item on its income statement. This move effectively outsources the operational heavy lifting and capital demands of the trading business to a more specialized, scaled-up partner. It frees up internal resources and management focus for the core growth areas identified in "Trailblaze Together," all while retaining a financial stake in the upside of a stronger, combined materials business. It's a classic case of having your cake and eating it too—maintaining exposure to a legacy market while sharpening focus on the future.

Forging a High-Performance Powerhouse

The new, yet-to-be-named joint venture is poised to become a dominant force, particularly in the lucrative high-performance materials sector. Teijin Frontier is not merely a trading house; it is an integrated solutions provider with deep technological expertise. Its portfolio boasts innovative materials like SOLOTEX™, a highly stretchable and soft fiber, and DELTAPEAK™, a lightweight performance fabric popular in high-end sportswear. Furthermore, its ECOPET™ line, made from recycled polyester, positions it at the forefront of the critical sustainability trend sweeping through the textile industry.

The company’s strength lies in its ability to manage the entire value chain, from R&D centers in Japan, China, and Thailand to a global network of manufacturing and converting facilities. This integrated model is a significant competitive advantage in the global high-performance textiles market, a sector projected to grow robustly as industries from automotive to aerospace demand lighter, stronger, and more functional materials.

By absorbing Asahi Kasei Advance, Teijin Frontier gains not just scale but also a broader sales network and a complementary customer base. The integration of Hangzhou Asahikasei Textiles Co., Ltd. prior to the merger further bolsters its manufacturing footprint in the critical Chinese market. The combined entity will be better equipped to compete with other Asian giants and global players by leveraging expanded cross-selling opportunities, achieving greater economies of scale in procurement, and building a more resilient global supply chain. This is a strategic consolidation designed to create a specialist with the scale and expertise to win in a market where innovation and vertical integration are paramount.

The Modern Trading House: Consolidation as a New Paradigm

This deal also offers a fascinating glimpse into the evolution of the traditional Japanese trading company, or sogo shosha, model within large industrial groups. For decades, many conglomerates maintained wholly-owned subsidiaries to handle the trading of their own products. While this ensured control, it could also lead to inefficiencies and a lack of specialized focus.

The Asahi Kasei-Teijin venture represents a new paradigm. Rather than nurturing an in-house trading arm, Asahi Kasei is contributing its assets to help build a best-in-class specialist. This model acknowledges that in today's globalized market, a dedicated, scaled-up entity with deep domain expertise can outperform a smaller, captive division. It aligns perfectly with Teijin’s own corporate philosophy of Kumiawase, or the combination of different technologies and resources to create new value.

This strategic partnership allows both parent companies to play to their strengths. Teijin doubles down on its core materials and fibers business, creating a more powerful vehicle for its high-tech products. Asahi Kasei streamlines its portfolio while ensuring its materials have a robust and efficient channel to market. For business leaders and strategists, this move serves as a powerful case study in corporate design: strategic partnerships and joint ventures can be more effective tools for achieving market leadership than rigid, wholly-owned vertical structures, especially in mature or highly competitive industries. It is a shift from owning every piece of the value chain to controlling the most critical parts and partnering for the rest.

The path to October 1, 2026, will be one of careful planning and execution. Integrating two distinct corporate cultures, harmonizing complex IT and supply chain systems, and managing customer relationships through the transition are non-trivial challenges. However, the strategic logic is undeniable. By combining their strengths, Asahi Kasei and Teijin are not just merging two subsidiaries; they are crafting a new, more agile competitor designed for the modern global economy. The success of this venture will depend as much on the careful work of integration over the coming months as it does on the bold vision that set it in motion.